The list of institutions included in this section follows the EBA Guidelines on the criteria for the assessment of Other Systemically Important Institutions O-SIIs - pursuant to Article 131 3 of Directive 201336EU. Domestic Systemically Important Banks D-SIBs At the 2011 G20 summit it was proposed that the G-SIFI framework addressing the issue of too-big-to-fail should be extended to cover D-SIBs.

Filmaker Kamala Lopez Equalmeansequal Womens Rights Feminism Activism Quotes Feminism Quotes

The objectives of the guideline are.

What is domestic systemically important. Bank Negara Malaysia the Bank today issued the policy document on Domestic Systemically Important Banks D-SIB Framework which sets out the Banks assessment methodology to identify D-SIBs in Malaysia and the inaugural list of D-SIBs. What is domestic systemically important banks. The additional Common Equity Tier 1 CET1 requirement for D-SIBs was phased-in from April 1 2016 and became fully effective from April 1 2019.

According to the RBI some banks become systemically important due to their size cross-jurisdictional activities complexity and lack of substitute. The D-SIB framework requires the Reserve Bank to disclose the names of banks designated as D-SIBs starting from 2015 and place these banks in appropriate buckets depending upon their Systemic Importance Scores SISs. Thus the Committee is of the view that the appropriate reference system should be the domestic economy ie that banks would be assessed by the national authorities for their systemic importance to that specific.

Correspondingly a process for assessing systemic importance in a domestic context should focus on addressing the externalities that a banks failure generates at a domestic level. According to the RBI some banks become systemically important due to their size cross-jurisdictional activities complexity and lack of substitute and interconnection. The Reserve Bank had issued the Framework for dealing with Domestic Systemically Important Banks D-SIBs on July 22 2014.

What is a domestic systemically important bank and why is it important. What is the list of systemically important banks. SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the 2018 list of D-SIBs.

The conceptual forerunner to systemically important critical infrastructure is Section 9 of Executive Order 13636 which similarly attempted to identify the critical of critical The Obama administration issued this order in 2013 recognizing that the risk of cyberattacks against critical infrastructure continues to grow and represents one of the most serious national security. Being a G-SIB global systemically important bank or a D-SIB tends to come with higher loss absorbency HLA. Hi In this video we have explained what is Domestic Systemically Important Banks The RBI had issued the framework for dealing with D-SIB in 2014.

O-SIIs are institutions that due to their systemic importance are more likely to create risks to financial stability. D-SIB means that the bank is too big to fail. I to put in place a reference system for assessing the systemic importance of banks.

SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the 2018 list of D-SIBs. A framework for dealing with domestic systemically important banks assessment conducted by the local authorities who are best placed to evaluate the impact of failure on the local financial system and the local economy. There are also various national lists of systemically important banks referred to by regulators as domestic systemically important banks D-SIBs.

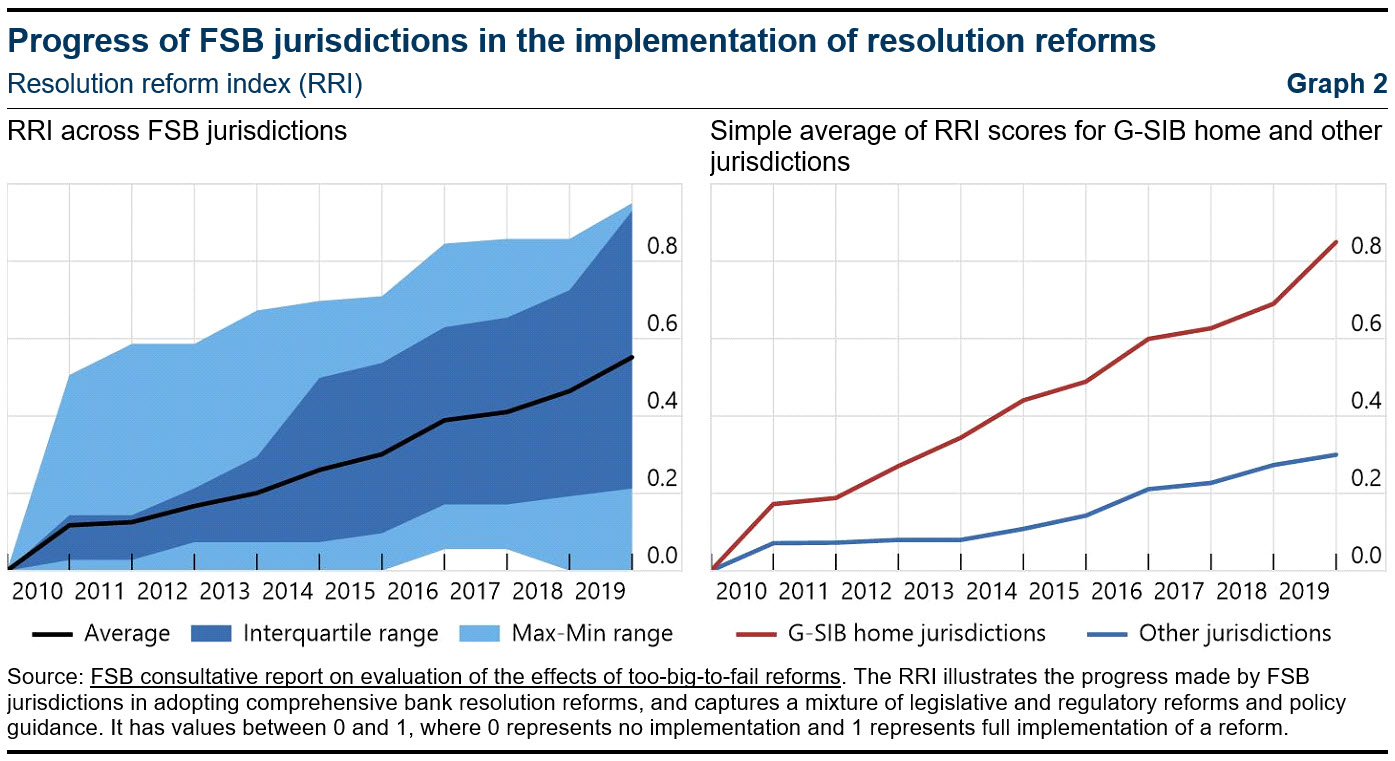

Whereas the G-SIB framework considers the global impact of banking failures by realigning the framework it is hoped that the externalities of. Systemic importance can thus be identified both at the global as well as at the domestic level. The official global list of systemically important banks G-SIBs has been produced each year since 2011 by the Financial Stability Board.

Banks that warrant the systemic importance label the Basel Committee has proposed an assessment methodology based on a set of indicators. D-SIB means that the bank is too big to fail. Guideline for dealing with Domestic-Systemically Important Banks which sets out the assessment methodology to be applied by the Bank for classifying an institution as being systemically important.

Textile Is India S Trump Card With Regards To Exports India Tops The Outline In Jute Creation Of The Worldwide Piece Of The Overall Data Import Business Cybex

Https Www Bis Org Publ Bcbs233 Pdf

Ecb To Directly Regulate Aib And Bank Of Ireland Business Finance Business Marketing Finance

I M Reading Gf Co Executive Summary Jpm Out Of Control On Scribd Cover Letter Format Letter Example Cover Letter Examples

How To Define A Systemically Important Financial Institution A New Perspective Intereconomics

Dermatomyositis Is A Rare Autoimmune Muscle Disease That Involved The Skeletal Muscles Those I Dermatomyositis Awareness Autoimmune Disease Symptoms Myositis

Hong Kong Monetary Authority Systemically Important Authorized Institutions Sibs

Checklist Am I Reinforcing Gender Stereotyping In My Classroom Educate2empower Publishing Gender Stereotyping Teacher Classroom Gender Equality Poster

Addressing Sifis Implementation Financial Stability Board

The Worst Style Etfs 1q18 Question Why Are There So Many Etfs The Post The Worst Style Etfs 1q18 Business Worsts Value Investing Investing Things To Sell

Education Around The World Infographic Educational Infographic Education School Skill

Pin On Natal Ano Novo Christmas New Year

Strategies Involving Student S Interest In Learning Student Infographics Educational Infographic Student Encouragement

Fast Fashion Is Harming The Planet Mps Say Fast Fashion How To Make Light How To Make Clothes