Edited Dec 28 2016 at 0626 When your father reaches 55 years of age he can withdraw in cash his EPF funds with the Insolvency Department by submitting a bankruptcy declaration letter. At the counter the staff will use the thumbprint.

Epf Withdrawal Taxation New Tds Tax Deducted At Source Rules Tax Deducted At Source Tax Help Financial Management

When you reach a certain age the EPF allows you to withdraw partially or in full the savings in Account 2.

How to withdraw epf at age 50. A physically handicapped member can withdraw from his EPF kitty for purchasing equipment required to minimize his hardships. In such cases the pension value is reduced to a rate of 4 per year until the employee reaches the age of 58 years. Your Bank Account Book.

The staff needs only these two items from you. Age 50 withdrawal. Pension is to be paid from age 58 while a reduced pension can be paid from age 50.

A member can withdraw the full amount from their Akaun 2 when they turn 50. Age 505560 Withdrawal. At the age of 54 years.

All you need to submit your application for Age 50 Years Withdrawal are. Withdraw via i-Akaun plan ahead for your retirement. Your Identity Card IC 2.

The EPF has a list of approved banks for you to bank in. After the age of 58 you can withdraw full EPF amount as well as pension. The Employees Provident Fund EPF today announced that effective 1 January 2017 Akaun Emas will be introduced as a second retirement nest egg for members working beyond age 55.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current. 8 KUALA LUMPUR 3 November 2016. The withdrawals from the EPF within 5 years of joining are still taxable.

For more details on types of withdrawal and how to go about checking their website is highly recommended. When you request to withdraw your EPF money you need to give EPF your bank account no which you need to verify first with the bank to get a confirmation letter that your account is active and then submit to the EPF. An EPF pension scheme member can withdraw early pension if he or she has attained the age of 50 but is less than 58 years old and if they have made an active pension contribution in EPF for 10 years or more.

Under the EPF scheme a member has the option to withdraw the full corpus and close the account in the event of job loss. However bear in mind that the EPF savings especially Account 1 is basically meant for retirement or when one reaches the age of 50 where part of the Account 1 money can be withdraw. You can withdraw 90 of EPF balance once you reach the age of 57 years Earlier a withdrawal was allowed up to 90 of the EPF balance one year prior to retirement ie.

You need to fill and submit Form 10D to claim your full pension. Withdrawal of pension between ages 50-58 with at least 10 years of service Even if you have completed 10 years of service the EPS amount cannot be withdrawn before the age of 58. HttpsyoutubeQHfz3-8Jz-8 Pf Exit date httpsyoutubeWg5aRggkIvk.

The Akaun Emas is one of the initiatives under the enhancement to the EPF schemes as. How to Withdraw EPF Advance or Full settlement in 2020 see below links PF transfer. You can apply for withdrawal through i-Akaun.

An EPFO member can withdraw upto 90 of the EPF amount at any time after attaining of the age of 54 years or within one year of his actual retirement on superannuation whichever is later. This is the most common form of EPF withdrawal. You have the option to withdraw EPF savings at the age of 50 or 55 either partially or fully or at the age of 60 when you can then withdraw any amount of money at any time.

Nevertheless it is encouraged that members do not withdraw their savings in Akaun 2 at age 50 because once they withdraw it entirely its gone and they do not earn their annual dividends. KUALA LUMPUR 26 June 2020. You can make a one-time withdrawal of all or part of your savings in EPF Account 2 when you reach age 50.

The Employees Provident Fund EPF takes note of the World Banks suggestion to gradually raise the age when members can make full withdrawal of Accounts 1 and 2 of their EPF retirement savings from 55 to 65. If you have already completed 10 years of service the EPS amount cannot be withdrawn and only the scheme certificate is to be issued by filling Form 10C along with the Composite Claim Form Aadhaar or Non-Aadhaar. FULL WITHDRAWAL AT AGE 55 REMAINS.

There is no change to the current Age 55 Withdrawal. The EPF assures members that no such steps on raising the. You have the option to withdraw EPF savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time.

Epf Withdrawal For Covid 19 Online Have Rs 2 00 000 In Pf Account Check How Much You Can Withdraw For Coronavirus Covid Pf Withdrawal Status Timeline Process The Financial Express

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Pf Withdrawal Form Know Epf Withdrawal Procedure

Epf Withdrawals New Rules Provisions Related To Tds

Epf Withdrawals New Rules Provisions Related To Tds

Pf How To Withdraw Pf Online Without Employer Signature Youtube

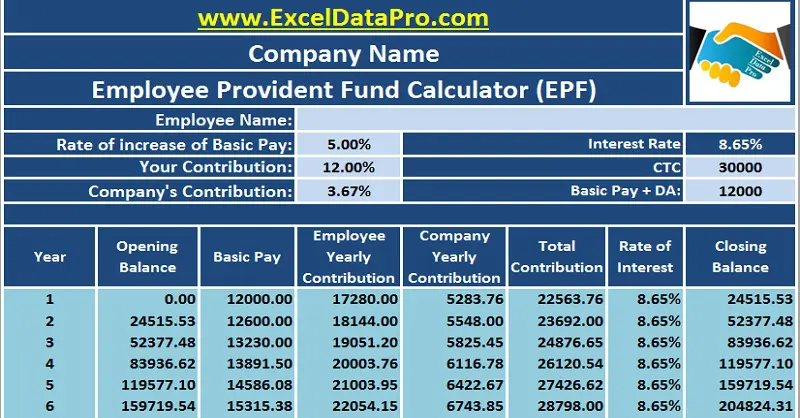

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Epf Withdrawal Process How To Withdraw Pf Online Updated

Eps Employee Pension Scheme Eligibility Calculation Withdrawal

Epf Withdrawal Process How To Withdraw Pf Online Updated

Tax On Epf Withdrawal Rule Tax Flow Chart Paying Taxes

Sample Filled Epf Transfer Form 13 Formal Letter Template Card Template Transfer

Is There A Way To Withdraw Pf Money While Changing Company Quora

Employee Provident Fund Is For Keeps Don 8217 T Withdraw It Midway

Kwsp Epf Partial Withdrawal Age 50

Health Insurance Sec 80d Tax Deduction Fy 2020 21 Ay 2021 22 Income Tax Tax Forms Cash Management

National Pension Scheme And Atal Pension Yojana Main Differences Pensions National Schemes