The relief has been capped at 5500. Tax Reform Impact What You Should Know For 2019 Turbotax Tax Tips Videos.

Finance Malaysia Blogspot Ya2017 Tax Relief For Personal Income Tax Filing.

Ya2017 tax relief for personal income. Individual income tax bands and resident personal relief. The Earned Income Relief The objective of this relief is to provide individuals who earn an income from hard work with recognition. As the clock ticks for personal income tax deadline in Malaysia 2018 like gainfully employed Malaysians you may have started visiting the LHDN Malaysia website to do your E-Filing as both a proactive and precautionary measure.

We breakdown the new lifestyle tax relief announced in malaysia budget 2017 to find out if its really beneficial to malaysian taxpayers. As the total amount of personal reliefs claimed by Mrs Chua exceeds the overall relief cap of 80000 the total personal reliefs allowed to her is capped at 80000 for YA 2018. 2017 Personal Tax Incentives Relief For Expatriate In Malaysia.

This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019. This guide is for assessment year 2017Please visit our updated income tax guide for assessment year 2019. 6500 as her income exceeded 22000 in YA 2018.

YA2017 Tax Relief for Personal Income Tax Filing April 08 2018 Here are the updated tax relief listings for your reference. In YA 2018 Mrs Lau must claim the relief for course fees incurred in 2016 and 2017 total. Beginning the financial year of 2017 known as YA2017 the following tax reliefs and rebates are in effect in Singapore.

Tax Relief Malaysia Want To Maximise Tax Relief With Your Medical Insurance Read This Ibanding Making Better Decisions. Finance Malaysia Blogspot Ya2017 Tax Relief For Personal Income Tax Filing. Ya2017 tax relief for personal income tax filing.

1st child 2nd child 3rd child. Finance Malaysia Blogspot Ya2017 Tax Relief For Personal Income Tax Filing. Personal reliefs eir wmcr.

Here are the updated tax relief listings for your reference. The tax system will be more progressive under a new measure that caps the amount of personal income tax relief an individual can claim. Finance Malaysia Blogspot 2016 Personal Income Tax Relief Figure Out First Before E Filing.

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018. Personal Tax Relief 2018. Age ya tax computation year without srs salary bonus employment income less.

15 rijen Personal Tax Rebate YA 2017 For the Year of Assessment YA 2017 all tax resident individuals. Tax Relief Malaysia Want To Maximise Tax Relief With Your Medical Insurance Read This Ibanding Making Better Decisions. How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center.

The overall personal income tax relief cap of 80000 takes effect from YA 2018. Finance Malaysia Blogspot Ya2017 Tax Relief For Personal Income Tax Filing. Earned income relief Enter the lower of your earned income or the following values-1000 if you are below 55-6000 55 to 59-800060 and above For handicapped persons the maximum earned income relief will be-4000 if you are below 55-10000 55 to 59-12000 60 and above Spousehandicapped spouse relief.

Progressive scale NR Flat 20 22 from YA2017 R personal relief deducted against from NBS AC2301 at Nanyang Technological University. As Mrs Lau has no assessable income during YA 2020 and YA 2021 she cannot claim the. The Gobear Complete Guide To Lhdn Income Tax Reliefs Gobear Malaysia.

For YA 2019 a Personal Tax Rebate of 50 of tax payable up to maximum of 200 is granted to tax residents. Please take note that item 8 was combined together and only can be entitled up to a maximum of RM2500 relief. Lets max up the relief given to reduce your tax burden.

Malaysian Income Tax Relief For Your Next Year Tax Filing. Although the limit was reduced if compared to the separate limit given. Finance Malaysia Blogspot Ya2017 Tax Relief For Personal Income Tax Filing.

YA2017 Tax Relief for Personal Income Tax Filing. Please take note that item 8 was combined together and only can be entitled up to a maximum of RM2500 relief. Reliefs For Personal Income Tax 2017 Vs 2016 Teh Partners.

Hence the total amount of reliefs claimed by Mrs Chua is not capped for YA 2017. Lets max up the relief given to reduce your tax burden. YA 2017 For YA 2017 a Personal Tax Rebate of 20 of tax payable up to maximum of 500 is granted to tax residents.

Tax Relief Malaysia Want To Maximise Tax Relief With Your Medical Insurance Read This Ibanding Making Better Decisions. Income tax rates for the year of assessment 2020 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia.

Overview Of Singapore Personal Income Tax Jse Office

Singapore Government Pap Should Not Bully Poor People By Increasing Gst In Singapore Politics Forum Org Pofo

Singapore To Impose New Individual Income Tax Rates In 2017 Asean Business News

Sample Format Of Individual Income Tax Return Y A 2017 2018 Income Tax Dividend

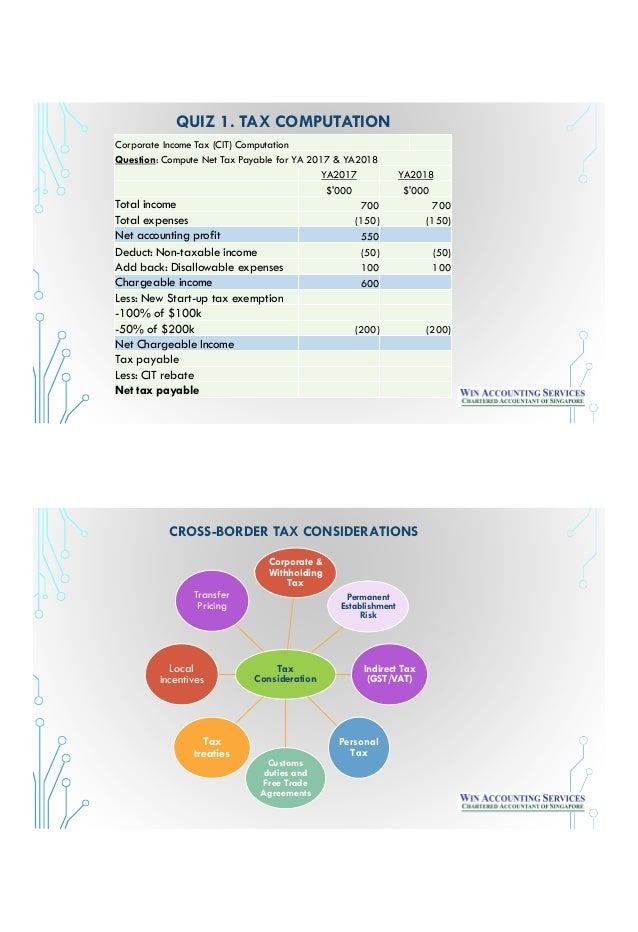

Singapore Corporate Tax Key Features

Malaysia Personal Income Tax Guide 2018 Ya 2017 Ringgitplus Com Tax Guide Income Tax Tax

Your Cheat Sheet Personal Income Tax In Singapore

4 Ways To Reduce Your Income Tax In 2017

Income Tax Filing 2018 Everything You Need To Know About Tax Deductions And E Filing

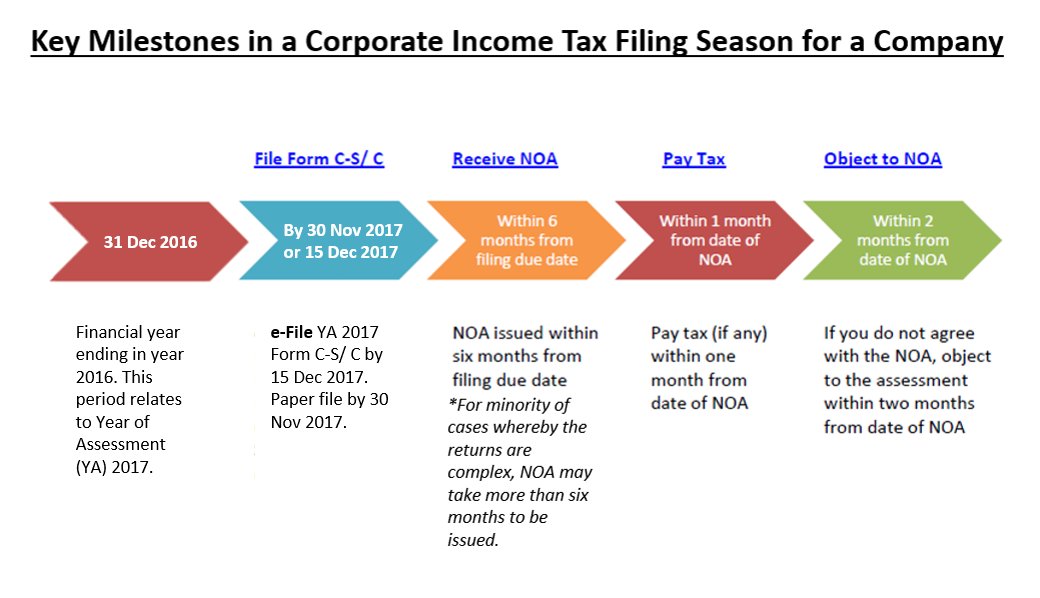

Iras On Twitter Filed Your Company S Income Tax And Not Sure What S Next This Flowchart Illustrates A Typical Filing Cycle Irassg Corporatetax Https T Co Dp5gjrkgrs

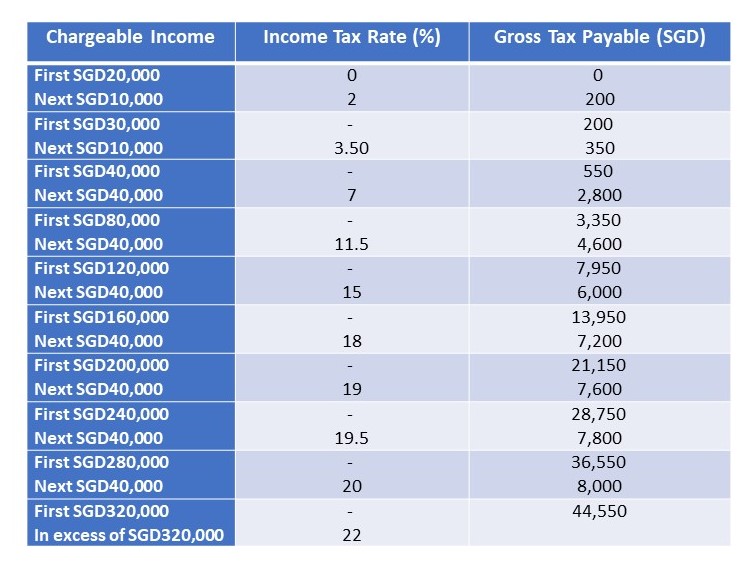

Personal Income Tax Rates For Singapore Tax Residents Ya 2010 2019

Your Cheat Sheet Personal Income Tax In Singapore

Personal Income Tax Rates For Singapore Tax Residents Ya 2010 2019

Cut Off Date For Income Tax Return Tax Walls

Personal Income Tax Rates For Singapore Tax Residents Ya 2010 2019

Finance Malaysia Blogspot Personal Tax Relief For Ya2014

Mofsg On Twitter 2 Increase In Income Tax Rates For Higher Income Earners From Ya2017 Top 5 Earners Affected Sgbudget2015 Http T Co Jcxmdupvhb

Personal Income Tax Rates For Singapore Tax Residents Ya 2010 2019