Reserve Requirement Ratio On January 16 2020 the Fed updated its reserve requirement table. Statutory Liquidity Ratio SLR refers to the proportion of deposits the commercial bank is required to maintain with them in the form of liquid assets government bonds gold cash and other securities in addition to the cash reserve ratio.

Statutory Reserve is the amount of money securities or assets that need to be set aside as a legal requirement by insurance companies and financial institutions to cover its claims or obligations which are due in the near future.

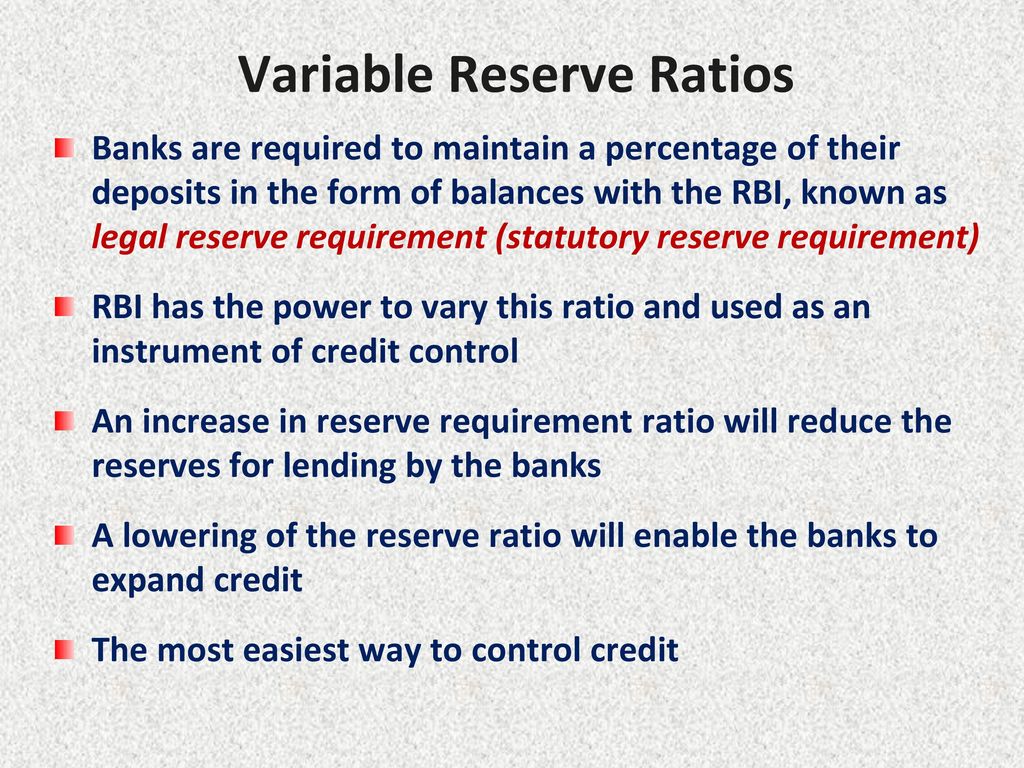

What is statutory reserve requirement ratio. This is a requirement determined by the countrys central bank. Definition of Reserve Ratio Definition. Effectively banking institutions namely commercial banks merchantinvestment banks and Islamic banks are required to maintain balances in their Statutory Reserve Accounts SRA equivalent to a certain proportion of their eligible liabilities EL this proportion being the SRR rate.

4 Reserve requirements are the percentage of deposits that depository institutions must hold in reserve and not lend out. Purpose and Functions 1994 describes how a change in the reserve requirement ratio affects bank credit and the money stock. Why SLR is maintained.

It required that all banks with more than 1275 million on deposit maintain a reserve of 10 of deposits. Besides what is the current statutory reserve rate. The low reserve tranche will be set at 1829 million up from 1275 million in 2020 and is the amount of a depository institutions net transaction accounts that may be subject to a reserve requirement ratio of not greater than three percent and which may be zero.

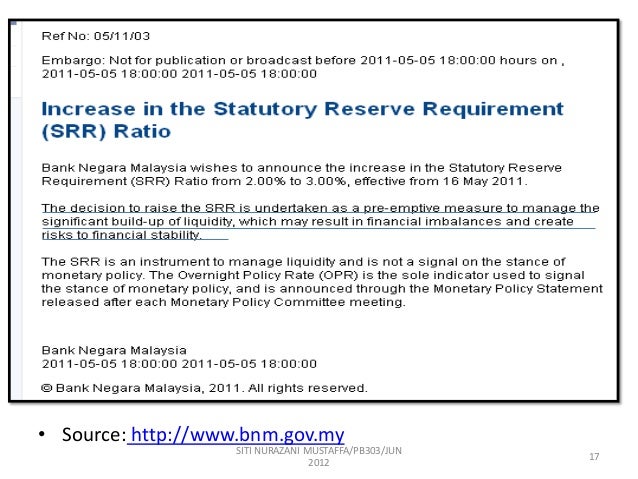

Why BNM uses the SRR as its tool. Effectively banking institutions are required to. Statutory Reserve Requirement 1 of 11 Issued on.

Consider the case of XYZ Insurance. This measure is part of Bank Negara Malaysias continuous efforts to ensure sufficient liquidity to support financial intermediation activity. The Statutory Reserve Requirement SRR ratio remains unchanged at 200.

Banks with more than 169 million up to 1275 million must reserve 3 of all deposits. Also known as Cash Reserve Ratio it is the percentage of deposits which commercial banks are required to keep as. BOZ increases minimum statutory reserve ratio by 4 The Bank of Zambia BOZ has increased minimum statutory reserve ratio by 4 percentage points to 9 from the current 5 in a bid to safeguard the stability of the market in order to rein in the adverse impact of the recent exchange rate developments on inflation.

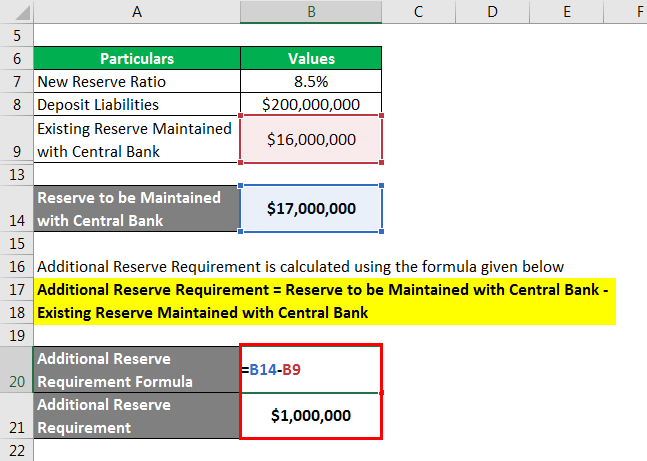

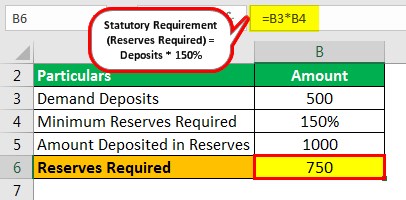

The Statutory Reserve Requirement SRR is a monetary policy instrument available to Bank Negara Malaysia the Bank for purposes of liquidity management. The reserve ratio is the portion of reservable liabilities that commercial banks must hold onto rather than lend out or invest. Example of Statutory Reserves.

19 Mar 2020 Bank Negara Malaysia wishes to announce that the Statutory Reserve Requirement SRR Ratio will be lowered by 100 basis points from 300 to 200 effective 20 March 2020. The Statutory Liquidity Ratio SLR refers to the proportion of deposits the commercial bank is required to maintain with them in the form of liquid assets in addition to the cash reserve ratio. According to the statutory reserve requirements of its state insurance regulator XYZ would be required to keep 50 million in.

It is basically the reserve requirement that banks are expected to keep before offering credit to customers. Statutory Liquidity Ratio or SLR is the minimum percentage of deposits that a commercial bank has to maintain in the form of liquid cash gold or other securities. In addition each Principal Dealer is able to recognise MGS and MGII of up to RM1 billion as part of the SRR compliance.

The SRR is an instrument to manage liquidity and is. 15 May 2020 PART A OVERVIEW 1.

Education What Effect Does A Change In The Reserve Requirement Ratio Have On The Money Supply

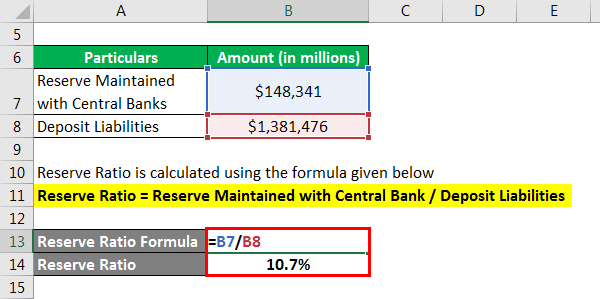

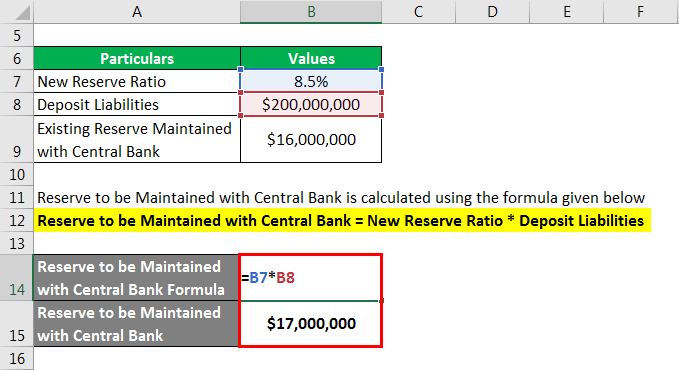

Reserve Ratio Formula Calculator Example With Excel Template

What Do You Know About Srr Daily Ft

Reserve Ratio Formula Calculator Example With Excel Template

Statutory Reserve Methods And Purpose Of Statutory Reserve

Reserve Ratio Formula Calculator Example With Excel Template

Sri Lanka Reserve Requirement Ratio 1997 2021 Ceic Data

Statutory Reserve Meaning Types What Is Statutory Reserve

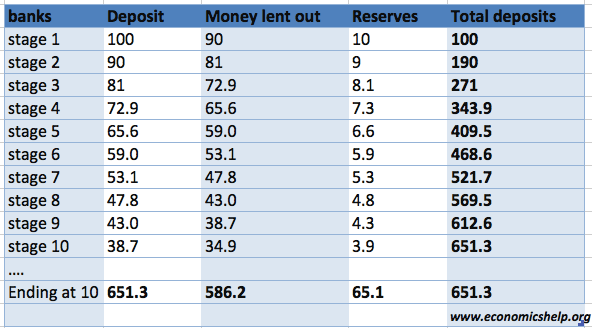

Reading Money Creation Macroeconomics

L6 The Money Supply The Federal Reserve System Ppt Video Online Download

Reserve Requirements Advantages And Disadvantages

Money Multiplier And Reserve Ratio Economics Help

The Federal Reserve System Boundless Business

Excess Reserves Formula Example How To Calculate Excess Reserves

Excess Reserves Formula Example How To Calculate Excess Reserves

Reserve Ratio Formula Calculator Example With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)