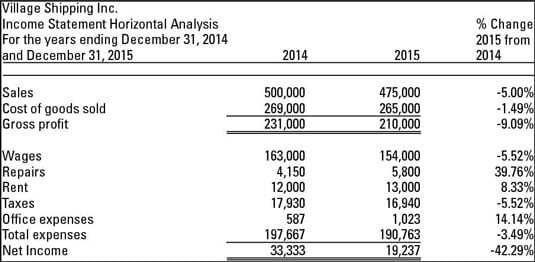

Horizontal analysis can also be compared with vertical analysis. The statements for two or more periods are used in horizontal analysis.

Types Of Financial Analysis List Of Top 10 Types Of Financial Analysis

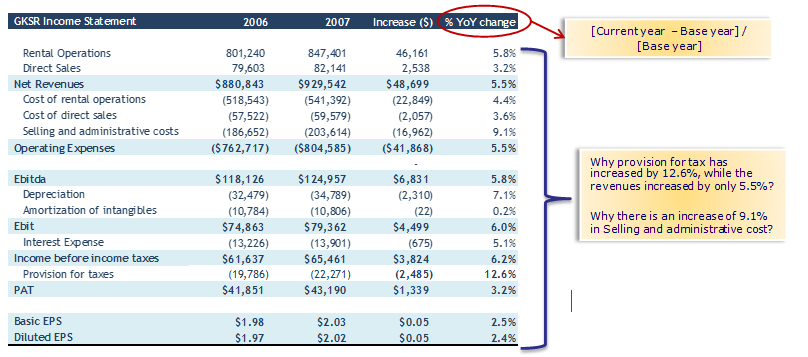

Horizontal analysis also known as trend analysis is a financial statement analysis technique that shows changes in the amounts of corresponding financial statement items over a period of timeIt is a useful tool to evaluate the trend situations.

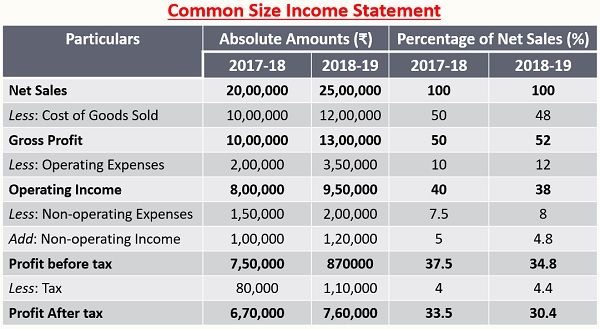

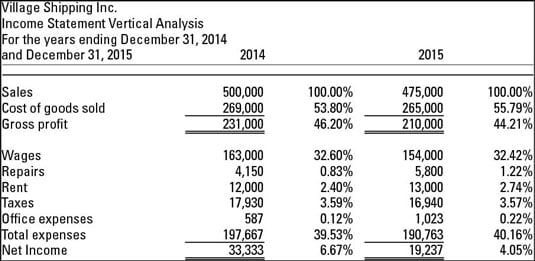

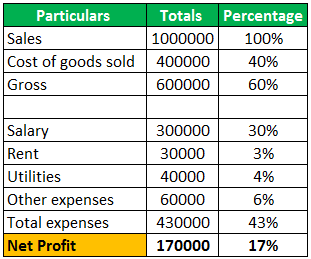

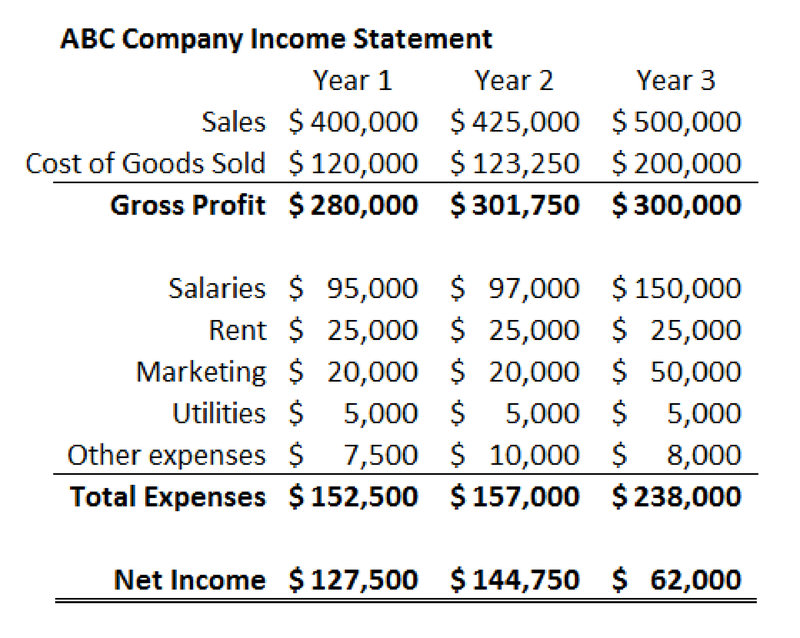

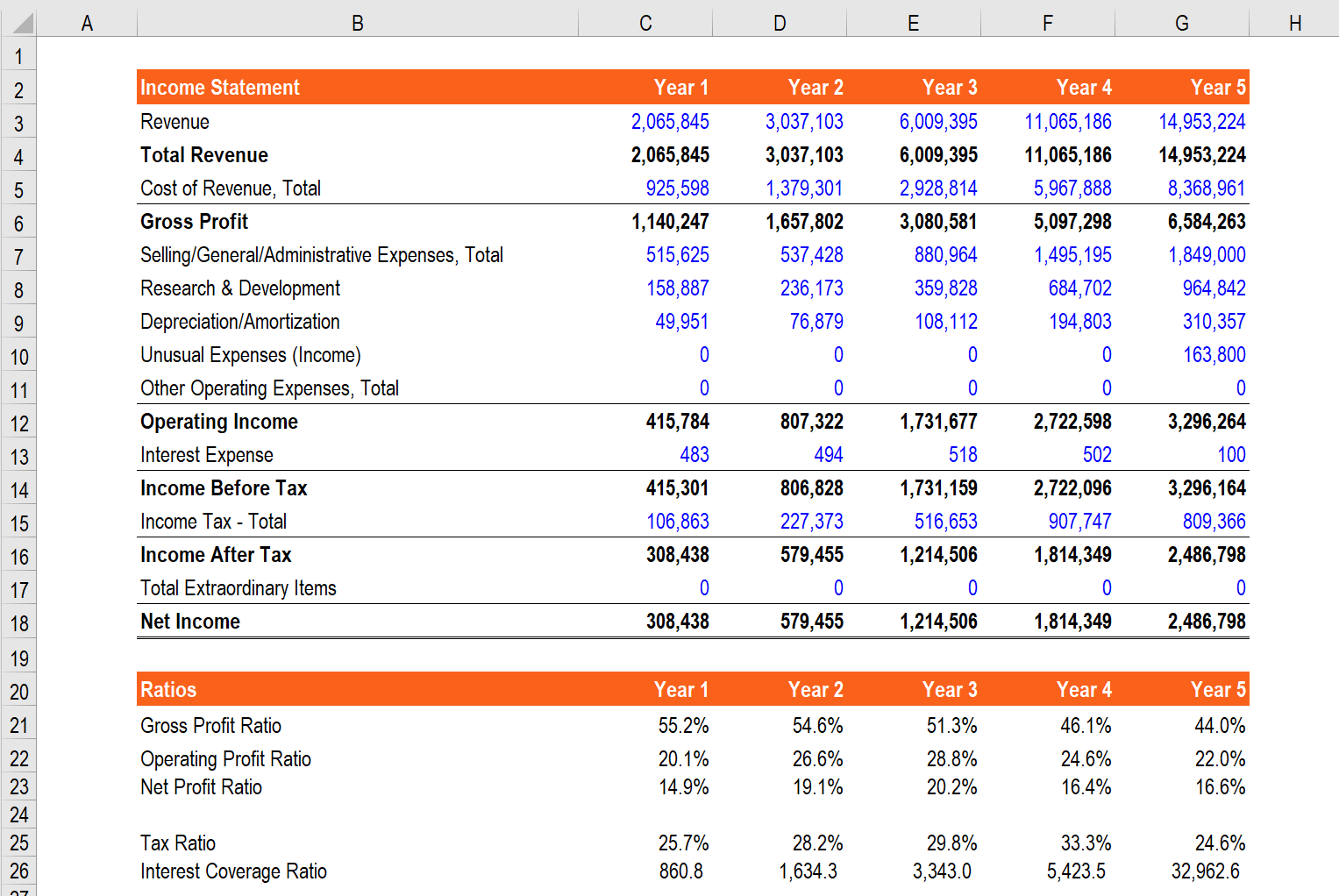

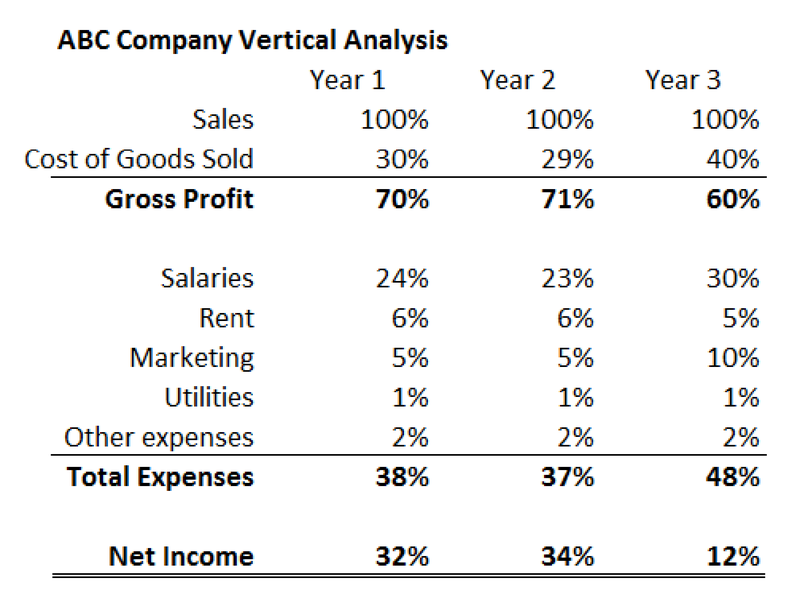

What do you understand by horizontal and vertical financial analysis. In the above vertical analysis example we can see that the income decreases from 1 st year to 2 nd year and the income increases to 18 in the 3 rd year. Horizontal Analysis is very useful for Financial Modeling and Forecasting. Vertical analysis makes it easier to understand the correlation between single items on a balance sheet and the bottom line expressed in a percentage.

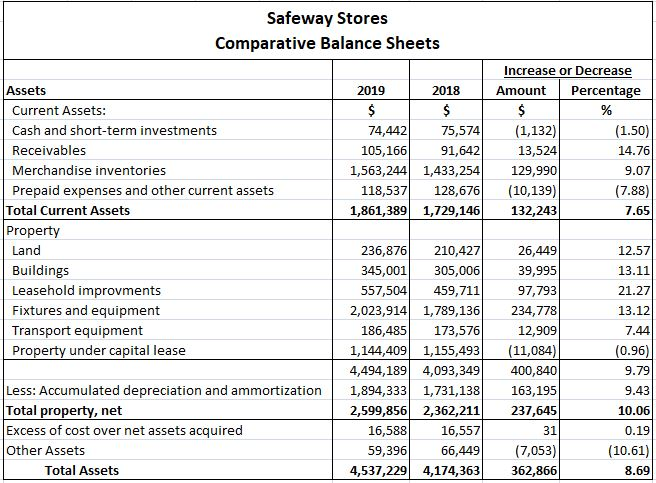

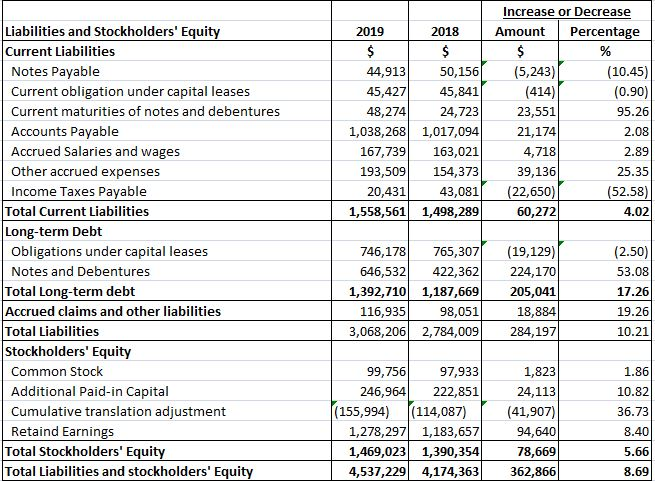

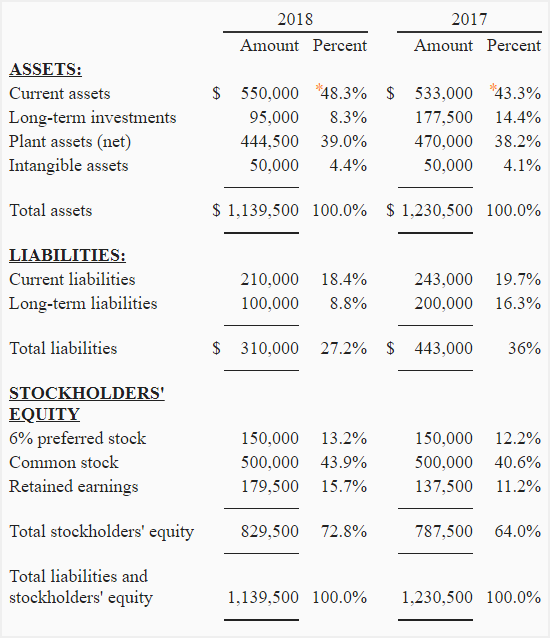

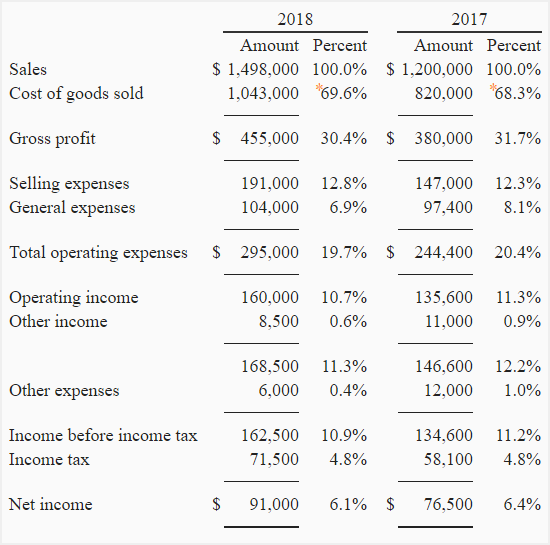

A horizontal analysis typically looks at a number of years. What is the difference between vertical analysis and horizontal analysis. The vertical analysis of a balance sheet results in every balance sheet amount being restated as a percent of total assets.

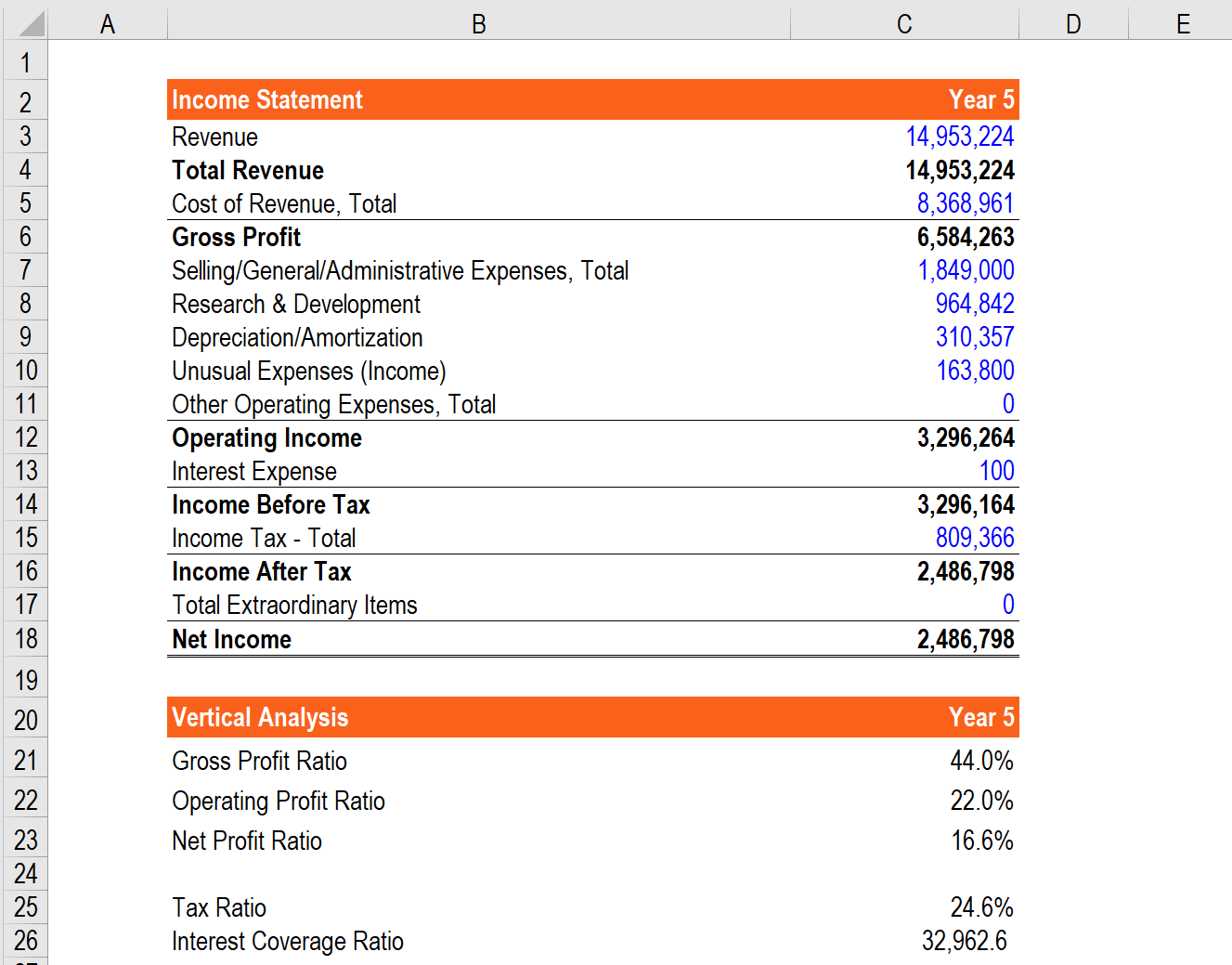

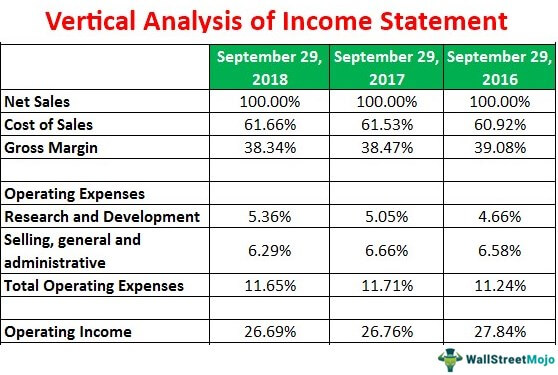

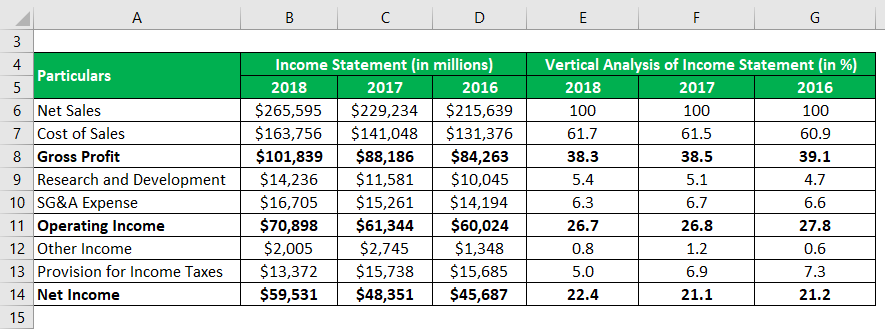

The vertical analysis of an income statement results in every. Vertical analysis expresses each amount on a financial statement as a percentage of another amount. Learn to use this analysis to monitor change over time.

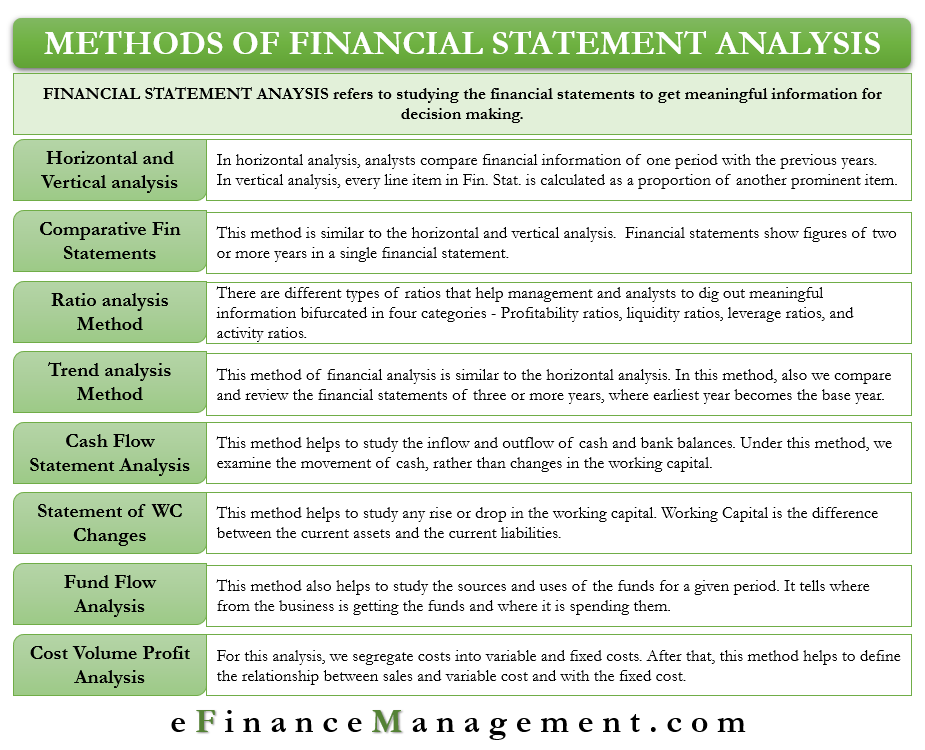

Both are part of ratio analysis Horizontal analysis is used to compare items of the different periods ie. The main difference is that while horizontal analysis compares the figures under different heads in the income statement and the balance sheet vertical analysis represents each figure as a percentage of the total along with the change in both over the past year. Like horizontal analysis vertical analysis is used to mine useful insights from your financial statements.

Whereas vertical analysis analyzes a particular financial statement using only one base financial statement of the reporting period horizontal analysis compares a specific financial statement with other periods or the cross-sectional analysis of a company against another company. So we have to do some calculations. Horizontal Analysis Whereas vertical analysis focuses on each line item as a percentage of a base figure within a current period horizontal analysis reviews and compares changes in the dollar amounts in a companys financial statements over multiple reporting periods.

By contrast a vertical analysis looks only at one year. To conduct a vertical analysis of balance sheet the total of assets and the total of liabilities and stockholders equity are generally used as base figures. Horizontal analysis is useful because it helps a company identify trends and predict future performance.

Vertical analysis shows the relative size of accounts on a financial statement with each item as a percentage of another. Vertical analysis can become a more potent. Definition of Vertical Analysis.

We can perform horizontal analysis on the income statement by simply taking the percentage change for each line item year-over-year. By using horizontal analysis we can now clearly see that Googles revenue gross profit and EBITDA grew faster than Apples in every year except for 2015 and one EBITA. Also external users will be interested in debt service coverage ratio.

For vertical analysis the firm compares the financial. So by using this method it is easy to understand the net profit as it is easy to compare between the years. HORIZONTAL AND VERTICAL ANALYSIS OF THE BALANCE SHEET Just like we performed horizontal and vertical analysis on the income statement we can also run these calculations on the balance sheet when.

It can be applied to the same documents but is exclusively percentile-based and travels as the name implies vertically within each period across periods rather than horizontally across periods. Vertical analysis also known as common-size analysis is a popular method of financial statement analysis that shows each item on a statement as a percentage of a base figure within the statement. Step 2 Based on the YoY or QoQ growth rates you can make an assumption about future growth rates.

You are moving horizontally in the financial statements of different periods usually a year and vertical analysis means comparing items of the same period like GP ratio of a particular year. Step 1 Perform the horizontal analysis of income statement and balance sheet historical data. The primary difference between vertical analysis and horizontal analysis is that vertical analysis is focused on the relationships between the numbers in a.

Horizontal analysis compares financial information for one company with the same types of financial income for the same company in one or more previous years. The approach used here is fairly simple.

Financial Statement Analysis Fsa Ratios Process Tools Uses Users Limitation Types

Difference Between Horizontal And Vertical Analysis With Comparison Chart Key Differences

Financial Analysis Overview Guide Types Of Financial Analysis

Difference Between Horizontal And Vertical Analysis Compare The Difference Between Similar Terms

Horizontal And Vertical Analysis Dummies

Vertical Analysis Of Income Statement Example Interpretation Limitation

Vertical Analysis Of Income Statement Advantages And Disadvantages

Horizontal And Vertical Analysis Dummies

Difference Between Horizontal And Vertical Analysis With Comparison Chart Key Differences

Vertical Analysis Formula Example Financial Statement Vertical Analysis

A Beginner S Guide To Horizontal Analysis The Blueprint

A Beginner S Guide To Vertical Analysis In 2021 The Blueprint

Vertical Common Size Analysis Of Financial Statements Explanation Example Accounting For Management

Financial Analysis Overview Guide Types Of Financial Analysis

Horizontal Analysis Definition

Methods Of Financial Statement Analysis All You Need To Know

A Beginner S Guide To Vertical Analysis In 2021 The Blueprint

Vertical Common Size Analysis Of Financial Statements Explanation Example Accounting For Management