No theyre not. Trusts can either be revocable or irrevocable essentially meaning that they can either be amended after theyre created or not.

What Is A Balanced Mutual Fund Mutuals Funds Credit Score What Is Credit Score

An individual does get the first R23 800 R34 500 for persons 65 and older interest income exempt from tax which means only the interest received above this.

Tax benefits of unit trusts you must. As discussed above - Non-US. The price of each unit is based on the funds net asset value NAV divided by the number of units outstanding. Basically the income of unit trust may consist of dividends interest or profit and gain from sale of investments and returns on bonds.

Unit trusts are designed for ordinary income earners. Tax Benefits of Unit Trusts YOU Must Know. Unit trusts invest in several instruments that pay out interest.

Basically the income of unit trust may consist of dividends interest or profit and gain from sale of investments and returns on bonds. Returns from unit trusts You invest in a fund by buying units in the fund. The beneficiary has to pay income tax on the proportional profits they derive from the trust.

In the current environment there are a number of benefits to saving for retirement with an RA that invests in unit trusts. Once a unit trust. Transparency and low cost.

Franking credits will generally only pass through a unit trust if it meets the rigid definition of a fixed trust. A unit trust holds a portfolio of securities either bonds or stocks. The income from unit trusts and OEICs is always taxable regardless of the share class or whether the income is actually taken or reinvested.

Monthly investing makes it possible to build a large amount slowly on a limited income. Similarly trusts enjoy a 50 Capital Gains Tax discount regarding disposal of assets that can be passed on to the beneficiaries if the trust is structured accordingly. Some funds pay dividends.

Trusts are not normally taxed at all. At Allan Gray we focus on managing your investments. Any unit trust held within an individual savings account ISA is free of income and capital gains tax.

There is a capital gain when the price of the units rises above the price you paid for the fund. An investor would need 50000 to 100000 to put together a diversified bond portfolio. If units are owned via family trusts the various income tax asset protection and estate planning advantages connected to family trusts are also available to unit holders.

This includes bank accounts and other income assets like bonds and is included in your taxable income. Unit Trusts are PFICs Passive Foreign Investment Companies and require the filing of Form 8621 just like non-US. Due to Malaysian Governments efforts to promote unit trusts most of the income received by unit trusts will be exempt from income tax.

Rather the unitholders are taxed on their share of the trust income. Capital Gain Tax Advantages On disposal of any asset of the trust it is entitled to a 50 discount factor on capital gains if assets are disposed after one year this discount flows throw to unit holders on distribution. For the current tax year youre allowed to invest up to 20000 within a stocks and shares ISA which would offer the option of investing within a range of unit trusts depending upon your personal attitude to risk.

However it may be tax free if it falls within one of the allowances dividend allowance or starting rate for savingspersonal savings allowance. Unit trusts have transparent fees no penalties for surrender or discontinuation and negotiated. Tax Benefits of Unit Trusts YOU Must Know Due to Malaysian Governments efforts to promote unit trusts most of the income received by unit trusts will be exempt from income tax.

Lump sums are often in the region of R50 000. Investors can buy into the diversified portfolio with an investment as low as 1000. Tax on Interest.

You can invest in lump sums or monthly debit orders. Unit trusts can access the 50 CGT discount but the unitholder must be an eligible entity to retain that concession. Benefits of tax-free unit trusts Investors in tax-free unit trusts pay no local taxes including that on income DWT or CGT And when it comes to tax savings holding listed property in a tax-free unit trust is particularly beneficial compared to other assets since there is effectively no corporate or individual tax on the investment returns.

Trusts may provide tax benefits. Basically the income of unit trust may consist of dividends interest or profit. The NAV of a fund is the market value of the funds net assets investments cash and.

Tax Benefits of Unit Trusts YOU Must Know Due to Malaysian Governments efforts to promote unit trusts most of the income received by unit trusts will be exempt from income tax. An actual foreign trust common in New Zealand the UK amongst others would require the filing of Form 3520-A. In this article Rob Formby provides unit trust investors with a simple overview of Capital Gains Tax.

Disbursals from the trust would precipitate the need to file Form 3520. A revocable trust gives you the option to make changes to it after its signed but depending on its terms it may or may not lead to tax advantages further down the line. We acknowledge that there are important aspects of investing - such as tax on your investments - that are not directly related to portfolio management but which can and do affect your investment behaviour and therefore long-term returns.

The latter usually start at around R500month.

The Benefits Of An Offshore Family Trust The Alternative To A Will Infographic Http Www Assetprotectionpackage Family Trust Trust Fund Safe Alternative

Distributable Net Income Tax Rules For Bypass Trusts

Start Investing Money In Mutual Fund And Grow Your Savings Repleteequities Mutualfund Investment Inve Insurance Investments Mutuals Funds Investing Money

S Should I Buy Stocks Bonds Etfs Properties Gold Or Unit Trusts Etc Which Asset Class Makes The Best Investment I Investing Best Investments Stock Market

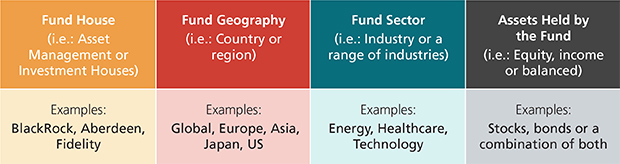

What Is Unit Trust Investment Dbs Singapore

Know About Tax On Mutual Fund And Taxation Rules Mutual Funds Investing Mutuals Funds Investing

Mutual Funds Archives Ezmart4u Real Estate Investment Trust Mutuals Funds Portfolio Professional

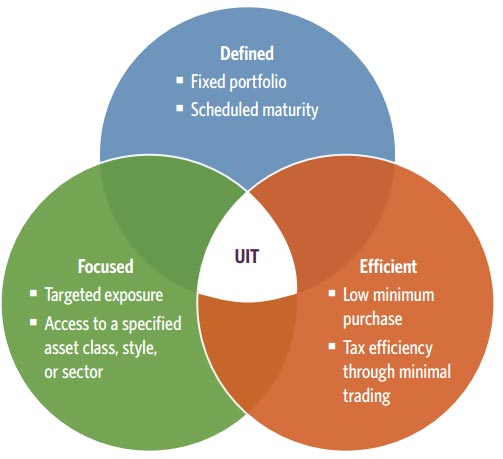

About Unit Investment Trusts Uit Guggenheim Investments

Won T I Need A Large Amount To Invest In Mutual Funds Mutuals Funds Mutual Funds Investing Investing

Pin By Archana Pamnani On Mutuals Funds Investing In Shares Investing Equity

Types Of Mutual Funds In India And Which One Is The Best Mutuals Funds Mutual Funds Investing Finance Investing

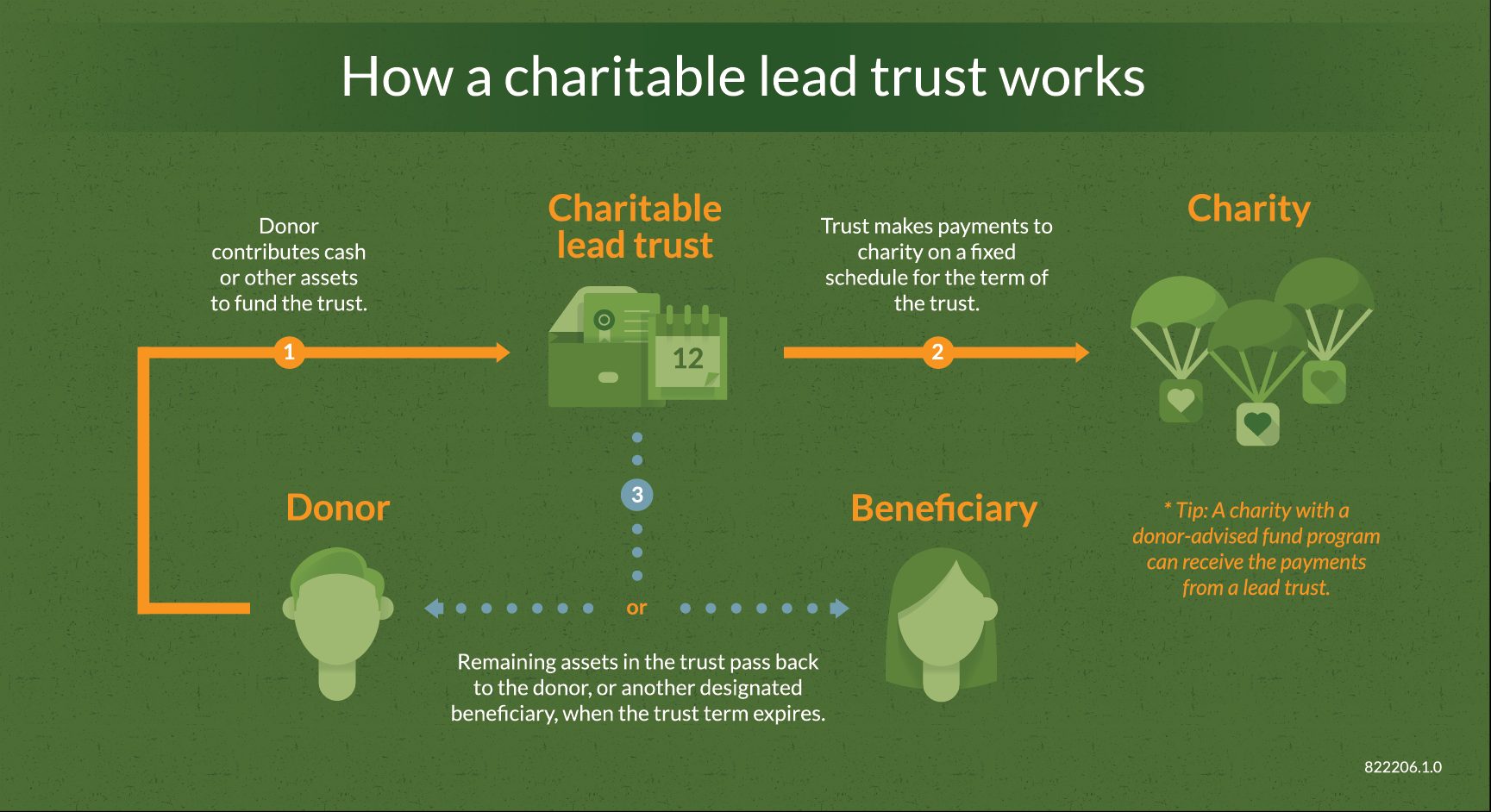

Charitable Lead Trusts Fidelity Charitable

Infograpic 20 20how 20to 20create 20multiple 20sources 20of 20income Sources Of Income Multiple Sources Of Income Income

A Dummies Guide To Unit Trusts Andreyev Lawyers

The 721 Exchange Or Upreit A Simple Introduction Estate Planning Real Estate Investor Capital Gains Tax