Market update The stock market is grappling over the potential of a real problem with the swine flu. When the market closes winning bets pay one dollar while losers get nothing.

Going Viral The Cost Of Pandemic Or Panic And The Novel Corona Virus Covid 19

Tysons stock had been doing extremely well heading into 2020 despite the company having to navigate an African swine flu that has caused pork markets to.

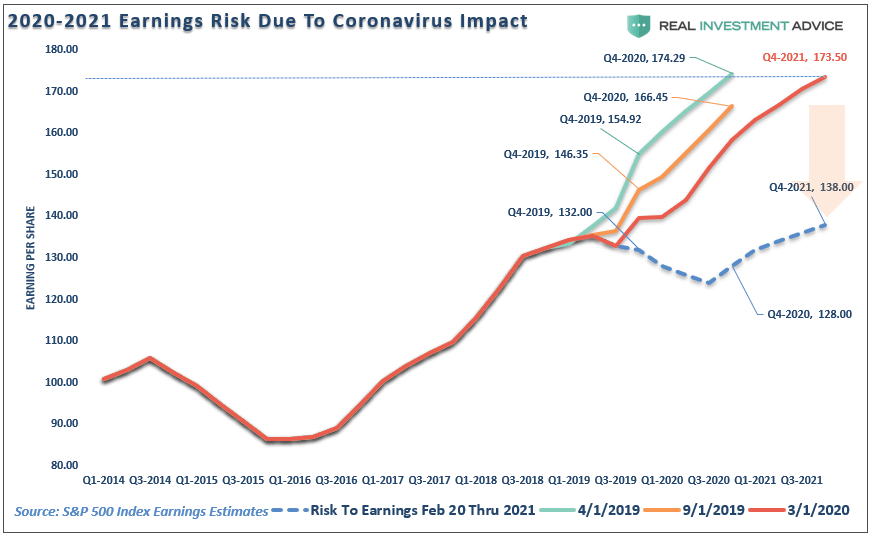

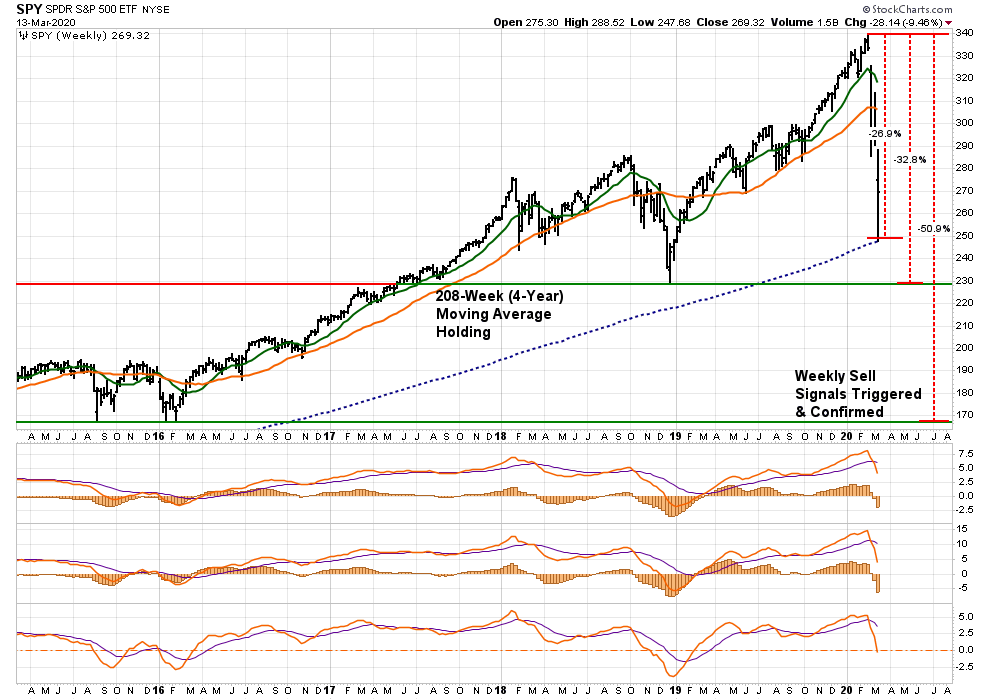

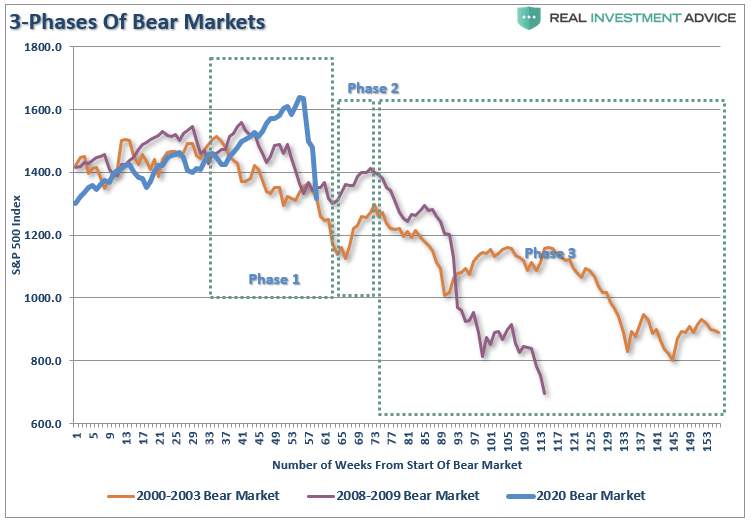

Rally in bear market swine flu. As a result risk for a continuing bear market remains high. In 1976 2 recruits at Fort Dix New Jersey had an influenzalike illness. Is This A Bear Market Rally.

Treasuries collectively were up 9 in that same span. On the Bear Market Rally. Follow the market trend.

This entry was posted on Sunday May 17th 2009 at 1113 pm and is filed under Looking Forward Market ObservationsYou can follow any responses to this entry through the RSS 20 feed. If oil keeps its levels and even swine flu has not triggered sell offs there is a possible rally for another 2-3 weeks if the oil remains or will reach a corridor of 60-65 per barrel Another key driver of the rally has been the reawakening of global investor interest in emerging markets. Slowing growth in China and the return of front-page stories on swine flu may be further catalysts for global equity markets to pause in September.

The bulls want a double bottom with last weeks low. Its a big bounce indeed but that is what it is. Mortality 5 from swine flu were trading at.

Bear market rally. The Emini is in an early bear trend on the daily chart and probably the weekly chart. There is at least a 50 chance of a 20 correction which would be a.

First what constitutes a bear market. Reuters has an article about the economic cause of a flu pandemic. A rally in the context of a bear market that began on February 19th.

The text of the article suggests that the market may go up or it may go down. As long as the ranks of the unemployed continue to increase the damage to the economy will worsen. Isolates of virus taken from them included ANew Jersey76 Hsw1n1 a strain similar to the virus believed at the time to be the cause of the 1918 pandemic commonly known as swine flu.

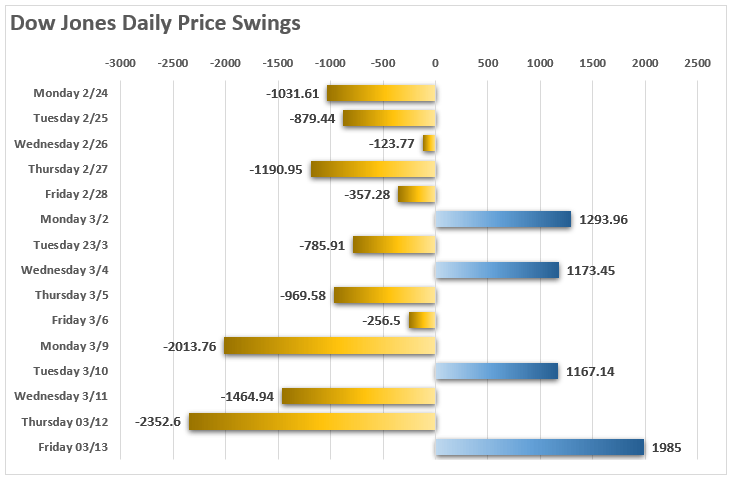

Tomorrow I will go over the second reason. The fact that we are coming off the best two weeks for the Dow 152 since 1938 a huge recession within the Great Depression just about tells you all. Stocks enter a bear market after price drops at least 20 percent according to some market technicians.

In a stock market correction and especially a bear market even leading stocks crumble. For simplicity this study defines bear markets as peri-ods in which price trades below its. The fastest bear market in history then happened and by March 23 the SP index was down 313 year to date.

However the best the bulls can probably get over the next several weeks is a trading range. The World Bank estimated in 2008 that a flu pandemic could cost 3 trillion and result in a nearly 5 percent drop in world gross domestic productThe World Bank has estimated that more than 70 million people could die worldwide in a severe pandemic. Bear market ECB Marc Faber rally Zimbabwe If you enjoyed this article get free updates by email or RSS.

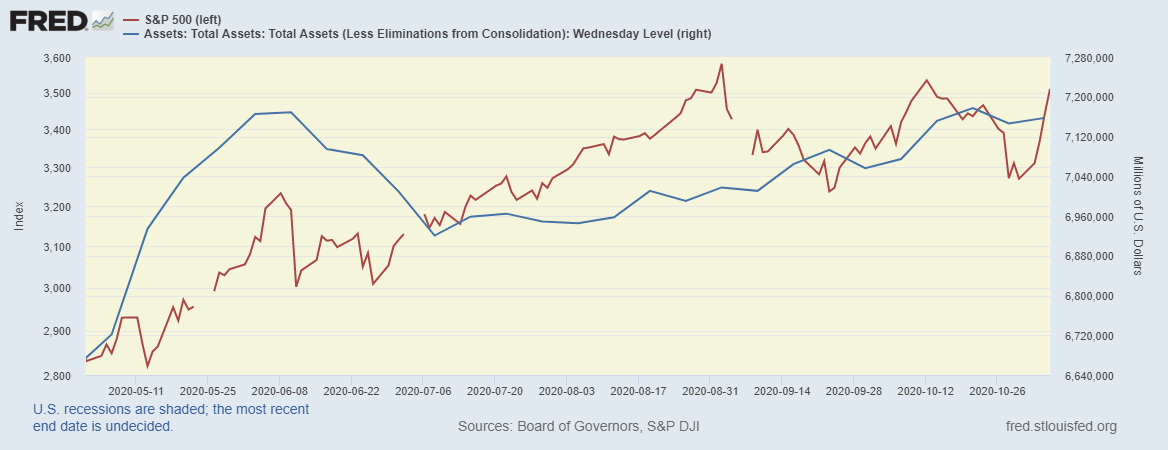

The 6040 ratio was now significantly out of whack relegated to 4852 or roughly 2122 trillion. Will the swine flu in Mexico kill the worldwide equity bear market rally. Within days of opening for instance contracts predicting high US.

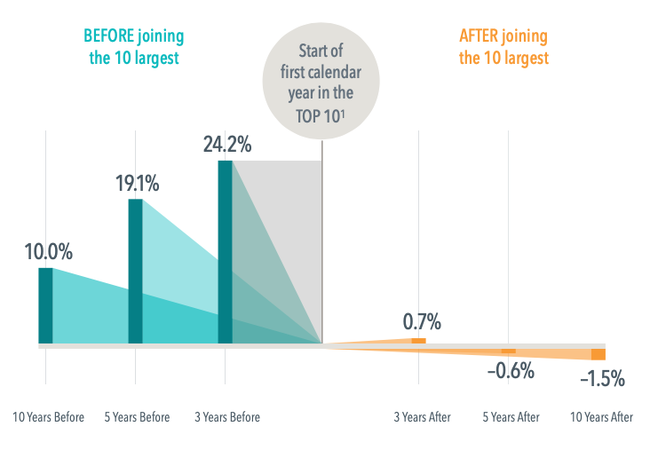

The stealth stock bull market that has soared by 27 on the Dow and 20 on the FTSE these past seven weeks has left the bears battered and bruised after every decline that must signal the proverbial resumption of the bear market was subsequently busted with some of the herd piling in on the tail end of the rally these past few weeks with the bulk still awaiting the retest. Most people define a bear market as a drop of at least 20 in the stock market from the latest high while a 20 recovery from its low puts an index back in a bull market. Defining bear-market rallies Like most chart patterns a bear market rally can be defined count-less ways.

Actually both the charts above of the 29 Bear and Japan suggest the current rally should continue upwards. Look for a follow-through day to confirm a new stock market rally. You can skip to the end and leave a response.

Impressive counter-trend rallies are a feature not an oddity of secular bear markets we are not inclined to aggressively chase the market here. While western stock indexes struggle to rally in an overall bear market their emerging counterparts are set to enjoy the real thing Robin Griffiths technical strategist at Cazenove Capital.

Market Crash Is It Over Or Is It The Revenant Seeking Alpha

The Stock Market Is Delusional Seeking Alpha

Global Seaweed Market Health Benefits Of Seaweed To Drive Growth During 2020 2024 Technavio

What Is Lululemon Athletica S Nasdaq Lulu P E Ratio After Its Share Price Tanked

Pig Outlook Lean Hog Futures Continue To Languish The Pig Site

The State Of The Union Markets Deflation Market Trading Charts Stock Market Union Market

Market Crash Is It Over Or Is It The Revenant Seeking Alpha

What S Going On With The Stock Market By Carter Kilmann Bacon Bits Medium

China S Hog Futures Company Stocks Rally On Disease Outbreaks Successful Farming

Market Crash Is It Over Or Is It The Revenant Seeking Alpha

Market Crash Is It Over Or Is It The Revenant Seeking Alpha

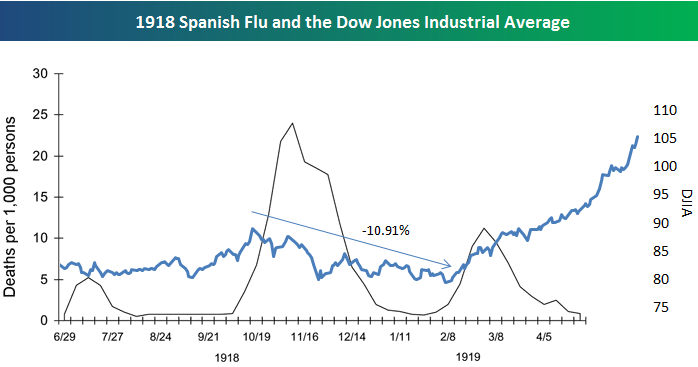

The Spanish Flu And The Stock Market The Pandemic Of 1919 Global Financial Data

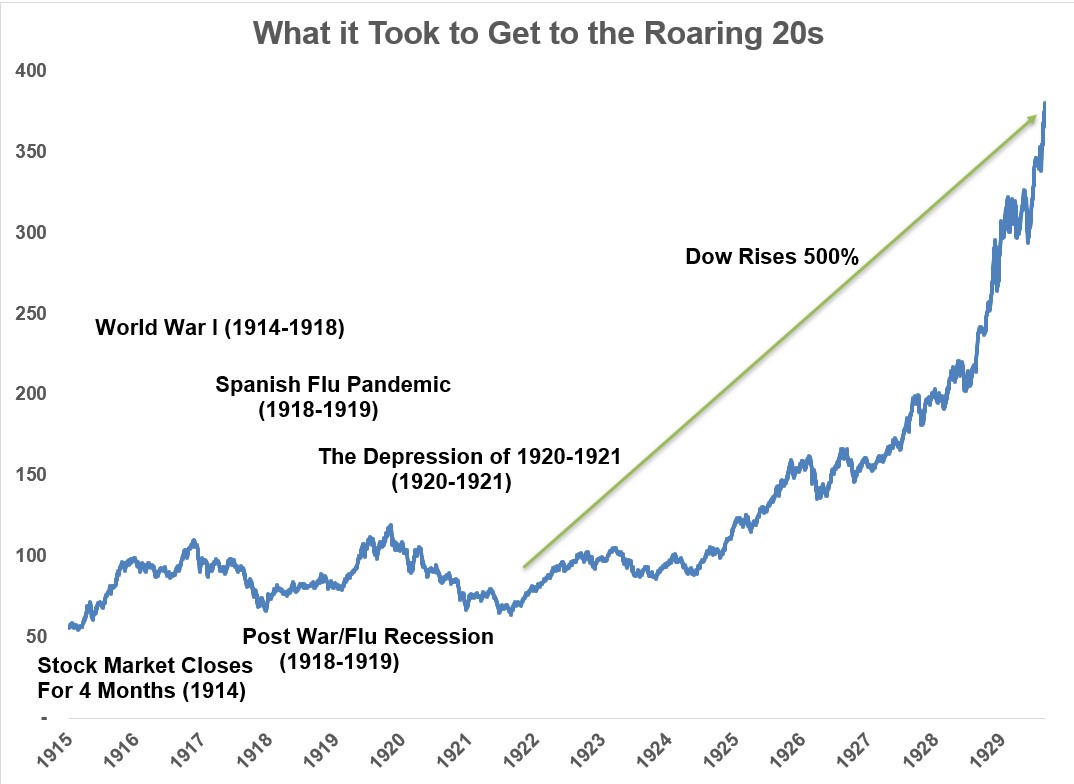

How Did We Ever Get To The Roaring Twenties

1918 Spanish Flu And The Market Seeking Alpha

Pandemics And Gold Part 2 Kitco News

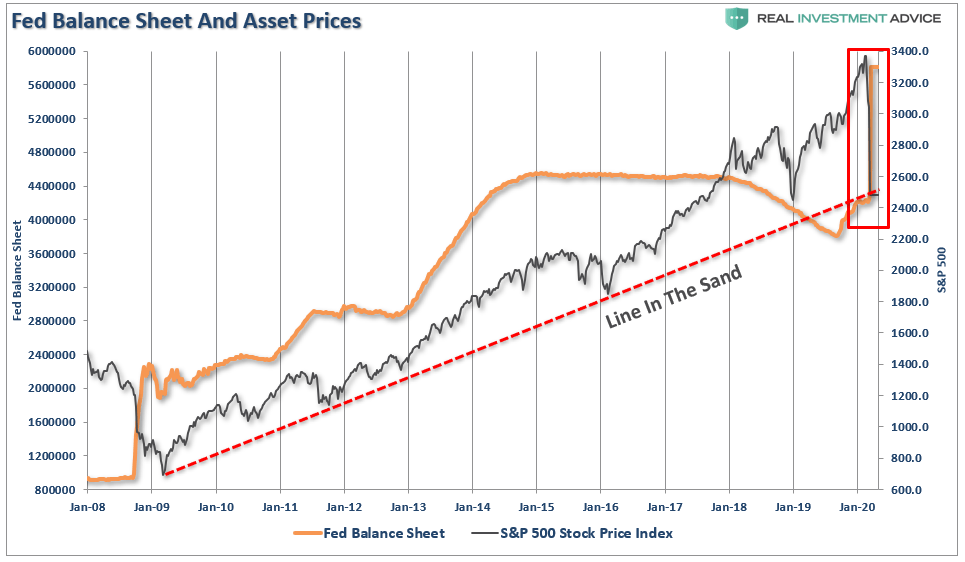

Massive Central Bank Assets Purchases Deflation Market Central Bank Currency War Chart