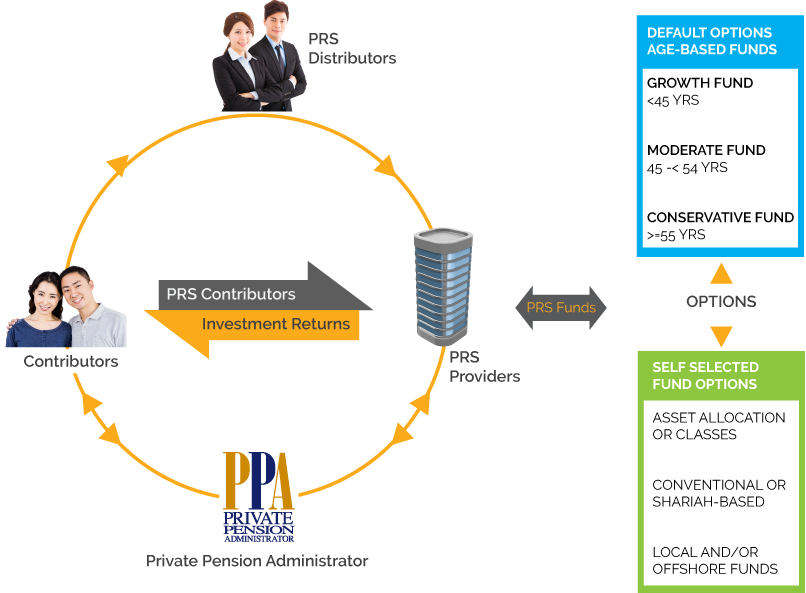

Each PRS offers a choice of retirement funds from which individuals may. Private Retirement Scheme PRS is a voluntary scheme that lets you take the lead on boosting your total retirement savings.

Private Retirement Scheme Prs A T Business Solution Services

Were finding many consumers need help with ensuring they have saved enough to have the retirement lifestyle they dreamed of and these funds are a perfect complement to your Employees Provident Fund EPF member savings.

Private retirement scheme (prs) and deferred annuity. Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. The Private Retirement Scheme is governed under the Security Commission whereas the Deferred Annuity is governed by Bank Negara Malaysia. PRIVATE RETIREMENT SCHEME PRS Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement.

The PRS is a voluntary scheme for all individuals who are 18 years old and above. The total relief for PRS contributions and deferred annuity premiums is restricted to RM3000 for an. For deferred annuity a contributor can surrender the plan in total anytime.

PRS is a voluntary scheme for all individuals who are 18 years old and above. F16 Private retirement scheme and deferred annuity This deduction is effective from the Year of Assessment 2012 until 2021. PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment.

Private Retirement Scheme PRS Vesting Programme for Employers is a scheme that can help employers boost their compensation package by offering to contribute to their employees retirement fund on top of the mandatory Employees Provident Fund EPF contribution. A private retirement scheme PRS contributions by an individual and the employer. If you elect for joint assessment the deduction allowed is restricted to RM3000.

24 December 2014 Page 1 of 15 1. PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment. Objective The objective of this Public Ruling PR is to clarify the tax treatment of.

If you are an EPF member then PRS can complement your EPF savings. Differences Between Private Retirement Scheme and Deferred Annuity Flexibility of withdrawal surrender. The total deduction for PRS contributions and deferred annuity premiums is restricted to RM3000 for an individual and RM3000.

The contents in this website were prepared in good faith and the Private Pension Administrator Malaysia PPA expressly disclaims and accepts no liability whatsoever as to the accuracy relevance completeness or correctness of the. It is an additional way to boost total retirement savings whether you are an Employees Provident Fund EPF member or not. 92014 Date of publication.

PRIVATE RETIREMENT SCHEME Public Ruling No. And b income of the PRS. Private Retirement Scheme or Deferred Annuity.

Private retirement scheme PRS and deferred annuity The total deduction under this relief is restricted to RM3000 for an individual and RM3000 for a spouse who has a source of income. What you should know about the Private Retirement Scheme PRS New way to boost retirement savings. Explained some differences between Private Retirement Scheme provided by unit trust.

The relief is effective from the Year of Assessment 2012 until 2021. It is a new way to boost retirement savings. Up to RM7000 for life insurance public servants.

PRS is offered by Unit Trust Companies whereas Deferred Annuity is offered by Insurance Companies. The tax relief allowed shall not exceed RM3000 in respect of contributions made to Private Retirement Scheme PRS approved by the Securities Commission and paid premiums for deferred annuity. The deduction allowed shall not exceed RM3000 in respect of contributions made to a Private Retirement Scheme PRS approved by the Securities Commission and paid premiums for deferred annuity.

Posted on January 8 2013 by Richard 5 Comments As you are probably aware with effect from the Year of Assessments 2012 to 2021 10 year-period only individual taxpayers are eligible to. Life insurance and EPF. It is an additional way to boost total retirement savings whether you are an Employees Provident Fund EPF member or not.

Tax Penalty on withdrawal amount before payout period. The user should seek personal advice from their PRS Consultant for their own personal situations or circumstances. The private retirement scheme PRS is introduced to encourage retirement savings.

You can invest in Principal PRS funds. With PRS there are No Fixed Amount of intervals or term of contribution.

Tax Filing Guide Tax Guide Tax Debt Relief Filing Taxes

Private Retirement Scheme Principal Asset Management

Differences Between Private Retirement Scheme Prs And Deferred Annuity Malaysian Financial Planning Council

Tax Savings For 2020 3 Things You Must Do Now Before Year End Yau Co

Personal Relief Private Retirement Scheme Or Deferred Annuity Malaysian Taxation 101

Private Retirement Scheme Prs Photos Facebook

Prs Tax Relief Private Pension Administrator

Structure Of Private Retirement Schemes Prs Private Pension Administrator

How To Choose The Best Private Retirement Scheme Malaysia

Structure Of Private Retirement Schemes Prs Private Pension Administrator

Differences Between Private Retirement Scheme Prs And Deferred Annuity Malaysian Financial Planning Council

Tax Savings For 2020 3 Things You Must Do Now Before Year End Yau Co

Structure Of Private Retirement Schemes Prs Private Pension Administrator

How To Choose The Best Private Retirement Scheme Malaysia

Diversify Your Retirement Nest Egg

What S The Difference Of Private Retirement Scheme And Deferred Annuity Plan Kclau Com