Have obtained a bachelors or equivalent degree or be in the final year of a bachelors degree program. The flagship course offered by the Chartered Financial Analyst Institute is the CFA Programme for aspiring financial analysts.

Step By Step Process To Become A Chartered Financial Analyst Cfa

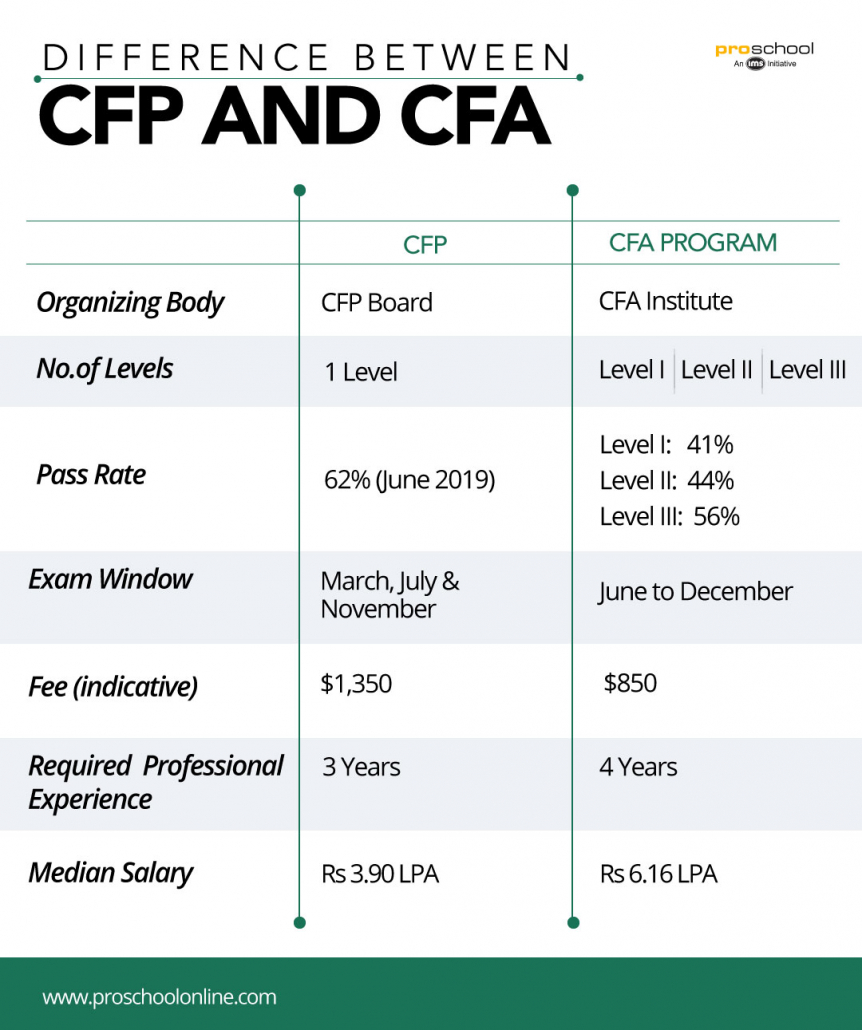

In addition to having a bachelors degree and four years of professional experience in a full-time job that involves making decisions about investments one must pass a series of three exams.

How to become chartered financial analyst in india. One studies topics such as Ethics Economics Equity Fixed Income Bonds Portfolio Management Quants Derivatives Alternative Investments Financial Statement and Analysis. CFA Exam details Chartered Financial Analyst IndiaThe complete information about the Exam CFA is discussed in this complete video000 Introduction of CFA1. You need to have a strong determination and put in consistent hard work to set yourself apart in the robust financial industry.

CFA Institute is a global association of investment professionals. CFA Institute offers Level I II III courses in CFA. Passing the CFA Level 1 exam which has a 42 pass rate over the last decade requires following a solid study plan.

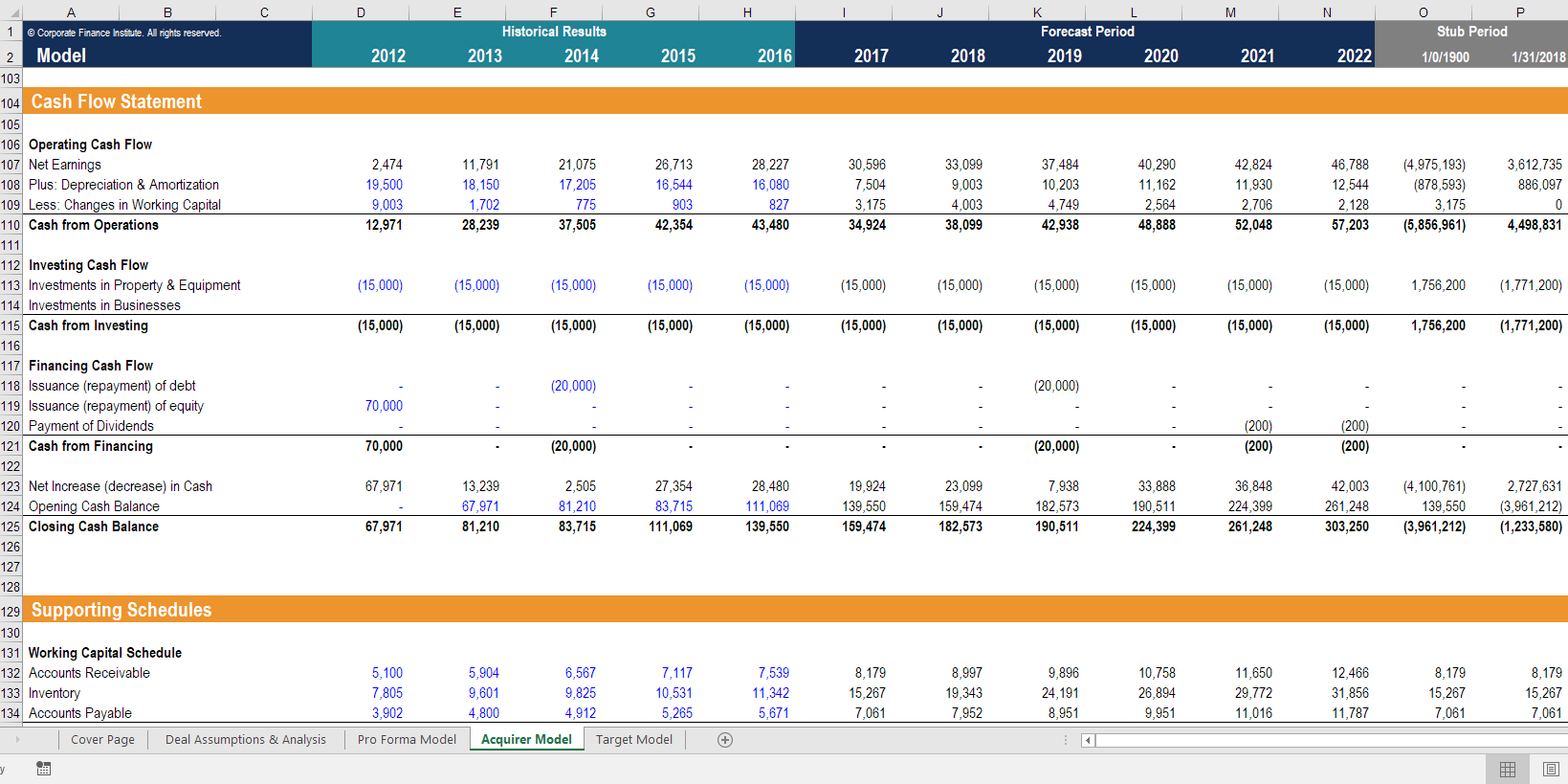

International College of Financial Planning - ICoFP New Delhi. In India there is no such Licensing Requirement as on Date but Certification is often recommended by employers and can improve the chances for advancement. To be prepared as a financial analyst in India you can study with online courses and certifications such as CFIs Financial Modeling and Valuation Analyst FMVA program.

Become an expert in Financial Analyst There is a 3 step process to become a Chartered Financial Analyst. New Delhi Delhi NCR UGC. To become a CFA charter holder one needs to complete the 3 levels of the course and have the required 4 years of work experience.

Enter the CFA Program. CFA which stands for Chartered Financial Analyst is a credential granted by the CFA Institute. Admission 2021 Reviews Courses Fees.

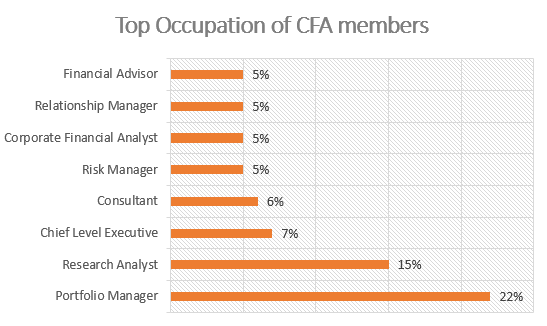

The organization offers the Chartered Financial Analyst CFA designation the Certificate in Investment Performance Measurement CIPM designation and the Investment Foundations Certificate. A good and reliable course like CFA can lay a strong foundation. Salaries Of A Financial Analyst.

45000 Certificate in Commerce - Total Fees Finance. A Chartered Financial Analyst CFA charter is a designation given to those who have completed the CFA Program and completed acceptable work experience requirements. However an accredited degree may not always be a requirement.

Successful Level 1 candidates spend roughly 300. In order to become a financial analyst a candidate must have done graduation with mathematics as one subject. A Chartered Financial Analyst CFA can expect an average starting salary of 392500.

To become a Chartered Financial Analyst you must have followed some processes that mentioned here. An analyst in the US may also acquire certification from the American Academy of Financial Management. The average salary for a Chartered Financial Analyst CFA is 682300 per year 36960 per month which is 294800 76 higher than the national average salary in India.

Analyst Certification FMVA Program Below is a break down of subject weightings in the FMVA financial analyst program. Of course becoming a Chartered Financial Analyst isnt a cakewalk. The CFA Program is a three-part exam that tests the fundamentals of investment tools.

Have a bachelors or equivalent degree Be in the final year of a bachelors degree program Have four years of professional work experience or. Additionally a degree in business administration accounting finance or. The candidates can clear all the three level exams in two years.

If youre in India you can obtain certification from the Telangana-based Institute of Chartered Financial Analysts of India. The highest salaries can exceed 1600000. To become a CFA charterholder candidates must satisfy these requirements.

Traditionally the CA course has been preferred by the candidates in India but since the last few years the CFA course has been able carve a niche amongst the student communities. CFA Chartered Financial Analyst and CA Chartered Accountancy both the courses are excellent courses and are unique in their own way. 79 10 Based on 11 User reviews.

The institute conducts exams for these programs and the candidates are offered Chartered Financial Analyst CFA credential on clearing these exams. An example is the Accredited Financial Analyst AFA certification from the AAFM USA which financial analysts can get if they have a bachelors degree and pass two exams. Eligibility to become Chartered Financial Analyst CFA Primarily the candidates aspiring to become a CFA must have a passport to appear for CFA programme exams.

To become a CFA candidate one must meet one of the following criteria.

Step By Step Process To Become A Chartered Financial Analyst Cfa

Financial Analyst Job Description Skills Education Experience

Cfa Salary And Compensation Statistics Wallstreetmojo

What Is The Scope Of Chartered Financial Analyst Cfa In India

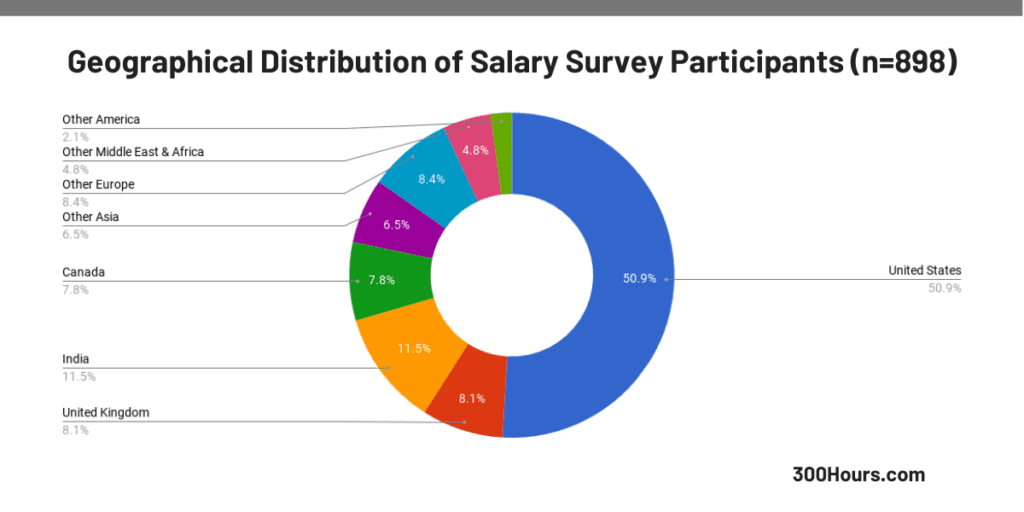

Cfa Salary How Much Does A Cfa Charter Increase Your Pay By 2021 Edition 300hours

Cfa Full Form Chartered Financial Analyst Sbnri

Financial Analyst Certification The Best List In 2021

Cfa Exam Details Chartered Financial Analyst India Cfa Course Youtube

Cfa Usa Training Advanced Learning Online Classroom Management Skills

/dotdash_Final_What_To_Expect_On_The_CFA_Level_III_Exam_Dec_2020-01-e9e42262bd7843d195586d0c66d5832c.jpg)

What To Expect On The Cfa Level Iii Exam

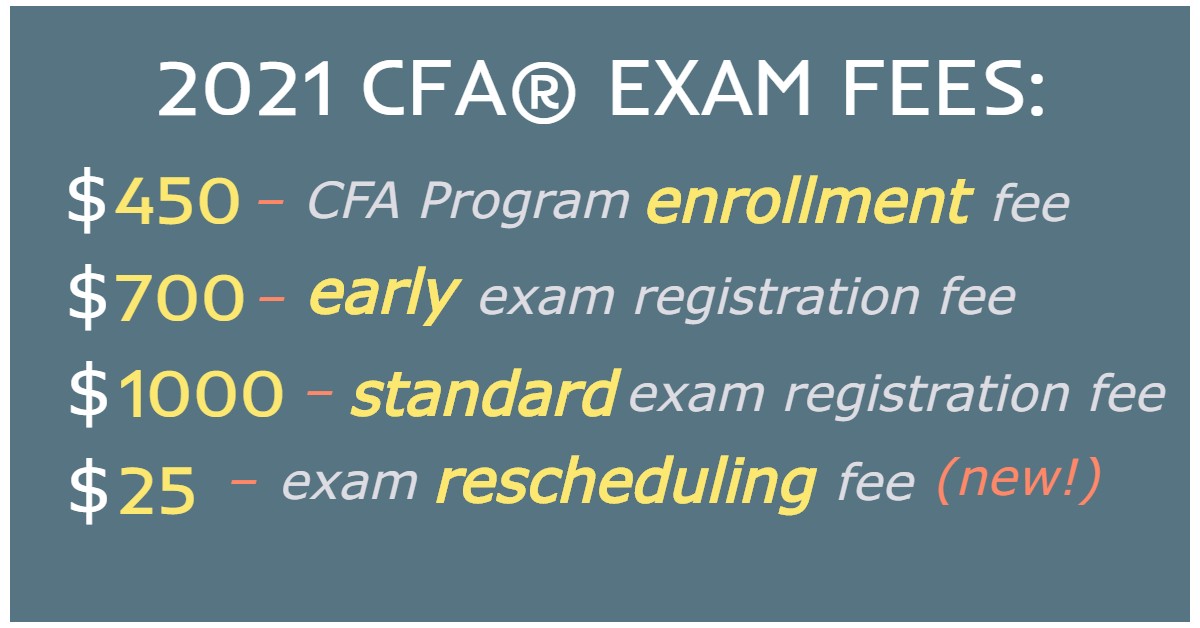

2021 Cfa Exam Cost Standard Fee Is Now 1000 Soleadea

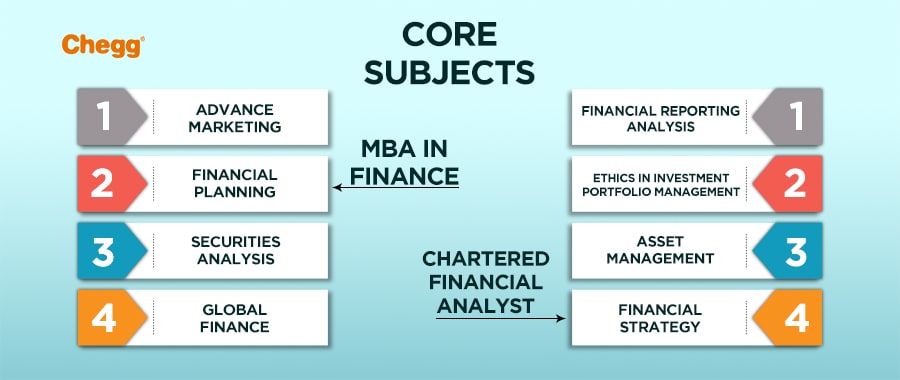

Cfa Vs Mba Confused Between Mba In Finance And Cfa

Chartered Financial Analyst Cfa In India Icici Direct

A Day In The Life Of A Financial Analyst

What Is The Scope Of Chartered Financial Analyst Cfa In India

9 Top Skills For Financial Analyst

Importance Of Certified Financial Planner Financial Planner Certified Financial Planner Financial