For the purposes showing above. During this period the interest will be paid and it will be taxable.

Pf Withdrawal After Leaving Job How To Apply

You have the option to withdraw EPF savings at the age of 50 or 55 either partially or fully or at the age of 60 when you can then withdraw any amount of money at any time.

Can i withdraw my epf at 50. The i-Citra withdrawal facility is open to all EPF members aged 55 years old and below. Yes you can withdraw your PF amount partially only and NOT 100. You can withdraw 90 of EPF balance once you reach the age of 57 years.

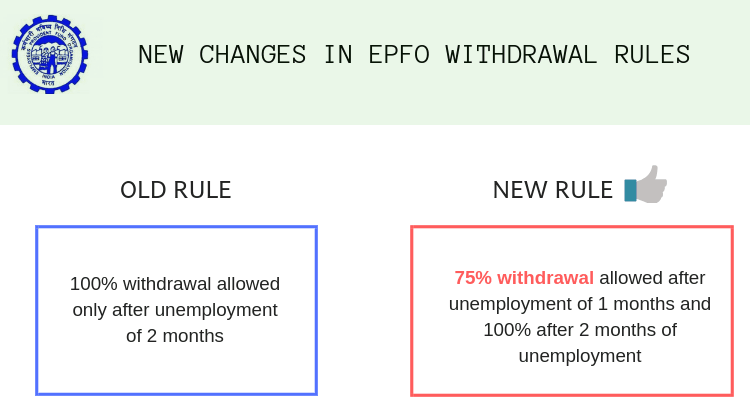

TDS is deducted if the withdrawal amount exceeds 50000. One can withdraw the EPF corpus if heshe faces unemployment before retirement due to lock-down or retrenchment As per the new rule only 75 of the corpus can be withdrawn after 1 month of unemployment. As much as 50 of the employee share with interest can be allowed to withdraw for the said purpose.

You can not withdraw an Employers contribution to EPF before 58 years An individual can not withdraw the EPF contribution by the employer before the retirement age of 58 years. You can withdraw as much as 3 times to meet the expenses of multiple marriages. The withdrawals from the EPF within 5 years of joining are still taxable.

Partial withdrawal is not taxable. So these were the EPF withdrawal rules partial and full withdrawal in 2021. Can I Withdraw for Marriage Only Once or More Than That.

A member can withdraw the full amount from their Akaun 2 when they turn 50. 4 Up to 50 per cent of EPF money can be withdrawn if an employee who has been sacked by his company challenges such sacking in a court. For this Form 10D has to be submitted along with the Composite Claim Form Aadhaar or Non-Aadhaar.

90 of the EPF balance can be withdrawn after the age of 54 years After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of unemployment EPF Withdrawal before 5 years of Service. Yes most of the banks follows the midnight cycles you can withdraw your full limit for a day 10 minutes before midnight and after 15 minutes you can withdraw again your full daily limit. Withdrawal from Account 2.

After you quit your full-time job you get 36 months to withdraw your balance. This clearly says that for anyone quitting job before the age of 55 can withdraw the balance before age of 58 heshe will receive all the interest till withdrawal Takeaway. Please DO NOT refer to the submission information in Employees Provident Fund KWSP website.

07 Dec 2019 You can only make a one-time partial withdrawal of all or part of your savings in Account 2 when you reach age 50 to help you take the necessary steps in planning for retirement. You can make this withdrawal in case you have switched your job and do not want to get yo. Nevertheless it is encouraged that members do not withdraw their savings in Akaun 2 at age 50 because once they withdraw it entirely its gone and they do not earn their annual dividends.

The Employees Provident Fund EPF has enhanced and simplified its policies to enable members aged 55 and 60 to make partial withdrawals of any amount at. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. How to download Form 31 for advance PF withdrawal.

For example for marriage illness education and many other purposes. The EPF rules allow you to withdraw for the marriage of self daughter son or even your siblings. EPF withdrawal is taxable only if it is withdrawn before 5 years of continuous service.

EPFO allows withdrawal of 90 of the EPF corpus 1 year before retirement provided the person is not less than 54 years old. You can withdraw the partial PF in advance before resigning. Although the EPF corpus can be withdrawn only after retirement early retirement is not considered until the person reaches 55 years of age.

Ways to Withdraw PF Amount Although withdrawal of PF isnt allowed while you are still employed there are ways to get this amount in case you need it badly. You can only get pension after turning 50 years of age and have rendered at least 10 years of service. How To Withdraw EPF Money Reaching 50 Years Old When one reaches the age of 50 years old he or she is allowed to withdraw all of ones savings in your Account 2.

To be eligible you must have a minimum of RM150 in your EPF account on the day of application. Last updated. You can apply for withdrawal through i-Akaun.

The maximum withdrawal amount permitted is RM5000 and it will be disbursed up to 5 months. The remaining will be transferred to the new EPF account after gaining employment. For more details on types of withdrawal and how to go about checking their website is highly recommended.

It is available for citizens non-citizens and permanent residents. Age 50 withdrawal. If your service period has been more than 10 years and you are between the age of 50 and 58 you may opt for reduced pension.

How To Withdraw Epf And Eps Online Basunivesh

Epf Withdrawal Rules When And For What You May Withdraw Your Epf

Epf Withdrawal Rules When Can You Partially Withdraw Your Pf Money

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

![]()

Epf Withdrawal Online Epf Withdrawal Procedure Updated You

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Epf Withdrawal Online Epf Withdrawal Procedure

Withdraw Pf Without Leaving Job Of Current Company Planmoneytax

Pf Withdrawal Online Epf Withdrawal Procedure Global Indian Nurses Organization

New Online Epf Withdrawal Facility For Pf Eps Claims

Pf Withdrawal Form Know Epf Withdrawal Procedure

Pf Withdrawal Rule Here S How To Withdraw Money From Your Epf Account Online Utkal Today

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

75 Of Epf Can Be Withdrawn Just After A Month Of Unemployment

Epf Form 15g How To Fill Online For Epf Withdrawal Basunivesh

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Epf Withdrawals New Rules Provisions Related To Tds

Pf Withdrawal Online Epf Withdrawal Procedure Global Indian Nurses Organization

How To Withdraw Money From Epf Emplyee Provident Fund Login Account Withdraw Money From Your Epf Account And All The Details Related To Epf Money Withdrawal