Gold tends to do poorly in bull markets but investors consider it a safe fallback in times of strife. Few people have the cash on hand to buy a rental property but you can invest in REITs real estate investment trusts that.

Investing In Gold Rules And Myth Gold Investments Investing Buying Gold

May 21 2021 at 417 pm.

Best investments during high inflation. Real estate performs well because landlords and property owners see the values of their. Normal inflation is between 23 percent and 33 percent. Investing for inflation involves picking assets that appreciate are tangible or pay variable interest.

To understand how certain investment classes performed during inflationary periods those periods need to be defined along with what is considered above-average inflation. If you feel compelled to tweak your stock market investments real estate is traditionally a smart bet during high inflation says Latham. The stocks that perform best and worst when prices rise Last Updated.

Arnott found that real estate investment trusts have also fared pretty well during prior inflationary periods. Other hedges to inflation include investing in real estate gold and even cryptocurrencies advisors say. Another smart way to invest during period of high interest rates is to look towards economically sensitive sectors such as consumer-discretionary companies which sell items such as automobiles energy and financial stocks.

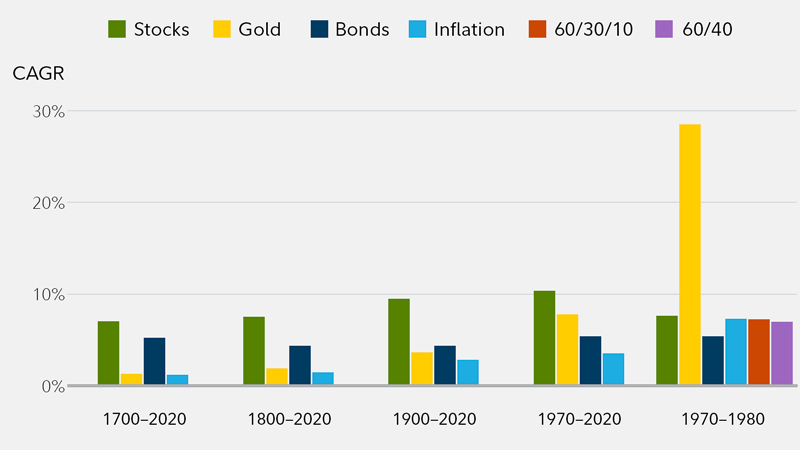

In some parts of the US residential real estate as an asset class performed very well in the 1970s. 3 Best Investments for Inflation More Since gold prices coincide with inflation by investing in gold you have a better chance of strengthening your purchasing power on potential investment. Even after adjusting for inflation agricultural commodities and real estate produced very strong returns and were among the best performing assets of the decade.

Here are eight inflation investments for investors looking to protect their portfolios. The Tell Inflation scare. The average inflation rate from 1913 to 2013 was 322.

When inflation looms investors flock to gold sending prices skyrocketing. Residential real estate however was a mixed bag. High rates of inflation create a tax on capital that makes much corporate investment unwise at least if measured by the criterion of a positive real investment return to.

Precious metals also make for a relatively recession-proof investment as market turmoil leaves paper assets in freefall while gold retains its value. May 24 2021 at 842 am. MOS Mosaic produces concentrated phosphate and potash crop nutrients for the.

The following are recent years that had above-average inflation. Inflation below 23 percent is considered low while inflation between 33 percent and 49 percent is extremely high. These include real estate commodities and certain types of stocks and bonds.

Anything above 322 can be considered high inflation. By its very nature real estate is an inflation hedge as property owners typically. Many investments have been historically viewed as hedgesor protectionagainst inflation.

This is especially true because as rents rise people become increasingly interested in owning as a way of getting the tax benefits that help offset the general level of inflation. In the late 1970s and early 1980s he devoted significant portions of the Berkshire Hathaway annual letter to investing in stocks during inflationary periods. Good inflation-hedging investments include stocks TIPS and tangibles like gold or real.

But like any strong portfolio diversification is key and if you are considering investing in gold the SPDR. There are better assets to invest in when aiming to protect yourself against inflation. Real estate is actually the ultimate hard asset and often sees its greatest price appreciation during periods of high inflation.

Over the long term real estate is also usually an excellent investment response to inflation. Aside having the potential to provide good profit even in periods on inflation such sectors also have the added.

My Investment Portfolio Investment Portfolio Investing Equity Crowdfunding

How To Prepare For Inflation 8 Actionable Tips

What Really Causes Inflation Deflation Economics General Knowledge Facts Business And Economics

The Investment Clock Investing Trading Charts Investing Money

Saving Money Vs Inflation Saving Money Investing Saving

These Countries Offer The Highest Interest Rates Today Interest Rates Loan Interest Rates Best Interest Rates

Pin Von Annika Pilzer Auf Finanz Planung Finanzplanung Geldplaner Finanzen

Secular Bull And Bear Markets Bear Market Secularism Bull And Bear Market

Investing How Do You Beat Inflation

We Are Entering Into A New Era Of Inflation Are You Prepared Commodity Prices Financial Asset New Era

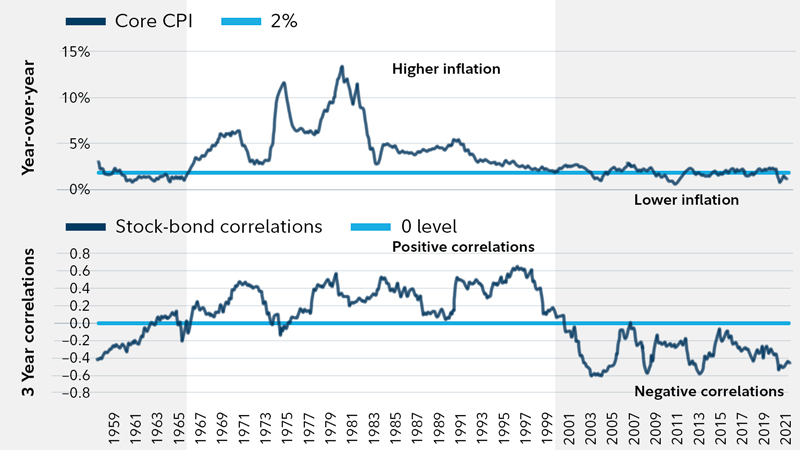

How To Protect Your Money From Inflation Portfolio Plan Fidelity

How Inflaction Affects Your Income Investment And Savings Infographic Savings Infographic Investing Charts And Graphs

Investment Opportunity Comparisons Investing Savings Bonds Farmland

How To Protect Your Money From Inflation Portfolio Plan Fidelity

Business Cycle Investing Fidelity Investments Finance Investing Forex Trading Stock Market