20 of first 6m npw plus 10 of amounts in excess of 6m Or 10 of loss reserves MUST BE MET AT ALL TIMES Greater of. A statutory reserve is an amount of money set aside by a financial institution such as a bank or insurance firm in order to meet unmatured obligations - such as the promise of repayment insurance firms make in exchange for accepting premiums from clients.

Pin On 7th Pay Commission Staff News

1000000 capital surplus Or Net Premiums Written npw test.

What is statutory minimum reserve. Reserves MUST BE MET AT ALL TIMES Greater of. The primary advantage of. Capital Adequacy aka Regulatory Capital Requirement.

The level is calculated on the basis of the banks balance sheet prior to the start of the maintenance period. Key Takeaways Statutory reserves are the minimum amounts of cash and readily marketable securities that insurance companies must hold. Types of Statutory Reserve.

The Bank of Zambia BOZ has increased minimum statutory reserve ratio by 4 percentage points to 9 from the current 5 in a bid to safeguard the stability of the market in order to rein in the adverse impact of the recent exchange rate developments on inflation. The Bank has announced to all commercial banks that with effect from Monday December 9 2019 the minimum statutory reserve. Statutory Reserve Rate means a fraction expressed as a decimal the numerator of which is the number one and the denominator of which is the number one minus the aggregate of the maximum reserve percentages including any marginal special emergency or supplemental reserves expressed as a decimal established by the Board to which the Administrative Agent is subject for eurocurrency.

A statutory reserve is a pool of funds that insurance companies are required by law to hold as a guarantor of liquidity in order to remain solvent and financially stable. Capital Adequacy is therefore the statutory minimum capital reserve that a financial institution or investment firm must have available and regulatory capital adequacy provisions thus require relevant firms to maintain these minimum levels of capital calculated as a percentage of its risk. The regulatory authority granted to states by the McCarran-Ferguson Act has imposed measures for licensure and reserve requirements of insurance companies.

Minimum Statutory Tax Withholding Obligation means with respect to an Award the amount the Company or an Affiliate is required to withhold for federal state local and foreign taxes based upon the applicable minimum statutory withholding rates required by the relevant tax authorities. Take into account the condition of the reserve and the assets on site to determine an appropriate market. Statutory Reserve Rate means a fraction expressed as a decimal the numerator of which is the number one and the denominator of which is the number one minus the aggregate of the maximum reserve percentage including any marginal special emergency or supplemental reserves established by the Federal Reserve Board to which the Administrative Agent is subject with respect to the.

These are called minimum reserves. 250000 capital surplus Or Net Premiums Written npw test. Undertake a public competition process where usersbusinesses are allowed to submit rent amounts above the statutory minimum rent threshold.

The amount of statutory reserve that needs to be maintained is calculated either by a. It is a component of the balance sheet for an insurance firm and can be in the form of anything easily convertible to cash such as. Statutory reserve is the amount of cash a financial institution must keep on hand by virtue of accepting deposits and premium payments.

A banks minimum reserve requirement is set for six-week periods called maintenance periods. Insurance companies are free to set their statutory reserves above. Financial institutions like banks credit unions and insurance companies derive their profits from the loans and investments they make with the funds that have been deposited with them.

20 of first 6m npw plus 15 of amounts in. Seek and use accurate information about fees and charges for similar sites by contacting other sites directly or contacting a real estate agent. In the US where the rule-based approach is used to calculate statutory reserves the.

Euro area banks are required to hold a certain amount of funds as reserves in their current accounts at their national central bank. What is Statutory Reserve. They are mandated under state insurance regulations.

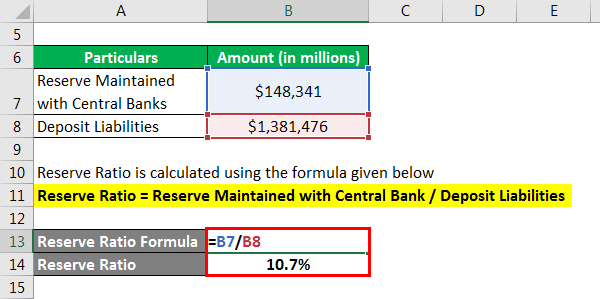

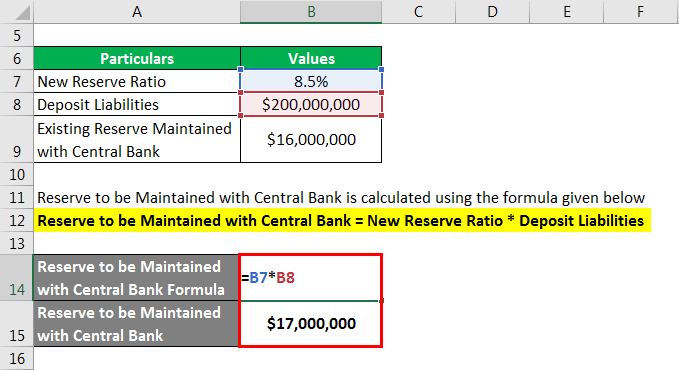

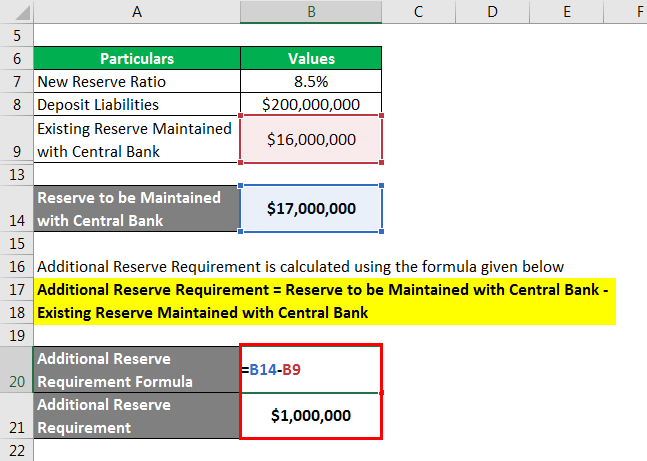

Reserve Ratio Formula Calculator Example With Excel Template

Reserve Ratio Formula Calculator Example With Excel Template

Cait Condemns Zomato For Bringing Recent Incident In Light With A Detailed Statement Bring It On Statement Food Safety Standards

Pin On Mlm Consultancy Strategy India

What Is Statutory Reserve What Does Statutory Reserve Mean Statutory Reserve Meaning Explanation Youtube

Product Liability Insurance Protects Businesses In The Event That Some Defect In Their Product Causes Bo Liability Insurance Business Risk Car Insurance Online

Reserve Requirements Advantages And Disadvantages

Employees Compensation Insurance Is Mandatory Under The Hong Kong Employee S Compensation Ordinance Any Hong Kong Business Insurance Insurance Health Business

Brazil Reserve Requirement Ratio 1994 2021 Ceic Data

Common Law And Statute Law Common Law Quotations Stock Broker

Statutory Reserve Methods And Purpose Of Statutory Reserve

Reserve Ratio Formula Calculator Example With Excel Template

Reserve Ratio Formula Calculator Example With Excel Template

2018 Madaraka Express Trails In The Wild Courtesy Of The Sarova Taita Hills And Salt Lick Lodges Book Today Game Lodge Excursions Hill Games

Statutory Reserve Meaning Types What Is Statutory Reserve

Apply Fixed Deposit Compare Fd Calculator New Set Of Rules From Rbi For Small Finance And Payment Banks Rbi Finance Fixeddepos New Set Finance Settings

Tally Erp 9 Profit And Loss Reserve And Surplus Transfer To Capital Acco Accounting Classes Capital Account Business Expansion

/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)

/GettyImages-1141794014-43b2241017694328a0a104a92ca37193.jpg)