Medical Expenses for Parents. This is a payment made by an employer to his employee as compensation for loss of employment either before or after the date of termination and it is exempted from tax.

Tax Deductions Vs Tax Credits What S The Difference Credit Karma Tax

This relief is applicable for Year Assessment 2013 and 2015 only.

What is self and dependent tax relief malaysia. Medical or dental treatment including a benefit for childcare. Refers to a thorough examination as defined by the Malaysian Medical Council MMC. Life insurance and EPF.

Coming to you this year is the additional lifestyle relief. Companies are not entitled to reliefs and rebates. Complete medical examination for self spouse child RM500 limited.

A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019. 12 rijen The maximum tax relief amount. A recent addition for the year of assessment 2020 where you can make another claim of up to RM2500 for the purchase of laptops personal computers smartphones and.

Basic supporting equipment for disabilities self spouse children or parents Covers equipment to aid with disabilities including wheelchairs and artificial legs. 8 Lifestyle purchases for self spouse or child. Insurance premium for education or medical benefit.

Starting from 1 March 2020 the Inland Revenue Board of Malaysia IRBM has opened the e-Filing portal for the submission of Income Tax Return Form for the Year of Assessment YA 2019 ie. Contribution to the Social Security Organisation SOCSO. Individual and Dependent Relatives.

Tax rebate for self. If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged. Up to RM500 for self spouse or child but the total deduction allowable for this relief as well as the reliefs for medical expenses on serious diseases and fertility treatment above is RM6000.

If so please provide a general definition of these areas. 5000 Limited 3. 27 rijen These are for certain activities or behaviours that the government.

For medical treatments special needs. Medical Expenses For Self Spouse Or Child. This relief is applicable for Year Assessment 2013 only.

Personal Tax Reliefs in Malaysia Reliefs are available to an individual who is a tax resident in Malaysia in that particular YA to reduce the chargeable income and tax liability. This compensation is exempted from tax if compensation received is due to ill health and these other cases. The tax relief for medical expenses expended on yourself spouse or child of up to a maximum of RM6000 is available when seeking treatment for such serious diseases.

Self and dependents Every taxpayer is entitled to a default relief of RM9000. Tax Relief Amount of tax breaks that can reduce your taxable income. Up to RM500 for self spouse or child but the total deduction allowable for both this relief and the relief for medical expenses on serious diseases above is RM6000.

28 rijen Tax Relief Year 2020. Up to RM2500 for yourself your spouse and child. Medical expenses for parents.

One leave passage outside Malaysia is tax-free up to a maximum amount of MYR3000 per year while three trips per year within Malaysia remains tax-free. Tax rebate for spouse. Self and Dependent Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually.

Such illnesses include AIDS Parkinsons disease cancer chronic liver disease leukaemia heart attack major organ transplant etc. Self and DependentSpecial relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability.

Amount RM Self and. RM6000 You can claim tax relief of up to RM6000 for yourself your spouse or children undergoing medical treatments for serious or difficult to treat diseases. Forms E BE B P BT M MT TF and TP.

Individual and dependent relatives. Medical expenses for parents. Individual Relief Types Amount.

Are there any areas of income that are exempt from taxation in Malaysia. Refers to a thorough examination as defined by the Malaysian Medical Council MMC. Deferred annuity and Private Retirement Scheme PRS with effect from year assessment 2012 until year assessment 2021.

Amount RM 1. Lifestyle purchases for self spouse or child. Individual Relief Types Amount RM 1.

Insurance other policies. All tax payers enjoy this tax relief. Does not cover spectacles and optical lenses.

Is Student Loan Forgiveness Taxable It Depends

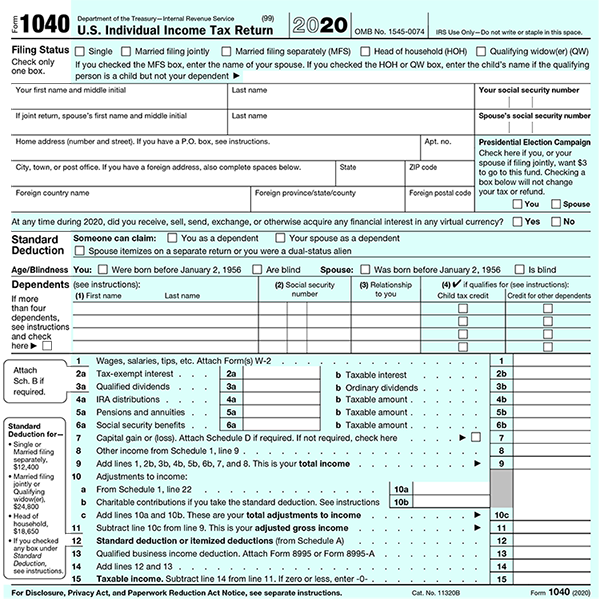

2020 Tax Form 1040 U S Government Bookstore

Income Tax 2020 Everything You Should Claim As Income Tax Relief News Rojak Daily

Income Tax 2020 Everything You Should Claim As Income Tax Relief News Rojak Daily

Income Tax 2020 Everything You Should Claim As Income Tax Relief News Rojak Daily

Malaysia Personal Income Tax Guide 2021 Ya 2020

Individual Income Tax In Malaysia For Expatriates

Income Tax 2020 Everything You Should Claim As Income Tax Relief News Rojak Daily

Malaysia Payroll And Tax Guide Activpayroll Activpayroll

Freelancing In Malaysia Eligiblity Finding Jobs Tax Filing Payments Itr And More

Individual Income Tax In Malaysia For Expatriates

Irs Announces 2016 Tax Rates Standard Deductions Exemption Amounts And More

Malaysia Personal Income Tax Guide 2021 Ya 2020

Loan Interest Calculation Reducing Balance Vs Flat Interest Rate Loan Calculation Calculator Method Inter Interest Calculator Money Math Excel Template

Malaysia Personal Income Tax Guide 2021 Ya 2020

Pin By Arulsothy Ragunathan On Finance Economy Debt Cancellation Mortgage Debt Recovery Model

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018 Money Malay Mail Tax Refund Income Tax Tax

How To Get A Bigger Tax Refund In 2019 Credit Com

Income Tax 2020 Everything You Should Claim As Income Tax Relief News Rojak Daily