I think Sunway REIT the largest REIT right now is by far sitting there very lonely without anyone closer to it. Pavilion REIT Are you bored of the current small market capitalization of REITs in Malaysia.

14 Things To Know About Pavilion Reit Before You Invest Updated 2020

Out of these 755 million units are offered to Malaysian and foreign.

New ipo pavilion reit. Pavilion REIT Are you bored of the current small market capitalization of REITs in Malaysia. Come 7th December 2011 we will witnessed a new contender - Pavilion REIT to challenge the title. Pavilion REIT Real Estate Investment Trust is scheduled to be listed in Main Market of Bursa Malaysia on the 7th December 2011.

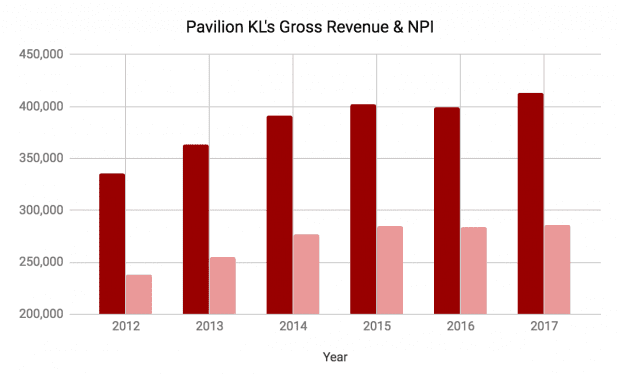

As at Q2 2018 the mall recorded 962 in occupancy rate with main tenants such as JD Sports King of Trainer Muji Mango and Mango Man Toys R Us and COS. On 27 April 2018 Pavilion REIT completed the acquisition of Elite Pavilion Mall and its related assets for RM580 million. It will distribute 100 of its income from the period from its debut to Dec 31 2012 its IPO prospectus read.

I think Sunway REIT the largest REIT right now is by far sitting there very lonely without anyone closer to it. Pavilion REIT Are you bored of the current small market capitalization of REITs in Malaysia. Following closely behind IGB REIT in terms of market capitalization size is Pavilion REIT RM408b Sunway REIT RM402b and CMMT RM302b.

Pavilion REIT Are you bored of the current small market capitalization of REITs in Malaysia. Come 7th December 2011 we will witnessed a new contender - Pavilion REIT to challenge the title. En route to a listing on Dec 7 Pavilion REIT is issuing 790 million new shares or 263 of its total issued units upon listing.

Come 7th December 2011 we will witnessed a new contender - Pavilion REIT to challenge the title. Sifusssss any comment on this new ipo got kang tau Can huat ar. Pavilion Real Estate Investment Trust Pavilion Reit a Malaysian shopping mall trust is seeking a listing in Malaysia by December this year.

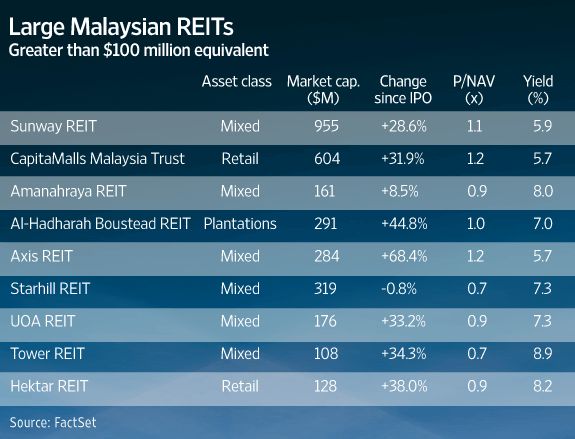

These instruments currently trade around their net asset values and at an average distribution yield of around 7. It intends to raise approximately 700m ringgit RM700m by offering 790m new shares at an indicative price of between 88-90 sen per share. Come 7th December 2011 we will witnessed a new contender - Pavilion REIT to challenge the title.

Our assets are strategically located in the heart of the golden triangle of Kuala Lumpur and benefit from growth in Malaysias economy. The IPO is expected to raise RM710mil. I think Sunway REIT the largest REIT right now is by far sitting there very lonely without anyone closer to it.

This comprises 755 million shares offered to institutional investors and the rest came under the retail offering. Based on the IPO price of RM125 IGB REITs market capitalization would be RM43bn making it the largest pure retail M-REIT. Pavilion REIT Real Estate Investment Trust IPO.

Based on the IPO price of RM125 IGB REITs market capitalization would be RM43bn making it the largest pure retail M-REIT. I think Sunway REIT the largest REIT right now is by far sitting there very lonely without anyone closer to it. Following closely behind IGB REIT in terms of market capitalization size is Pavilion REIT RM408b Sunway REIT RM402b and CMMT RM302b.

The positive sentiment from news that Pavilion REIT may debut on Bursa Malaysia as early as next month appears to have rubbed off on Mal. I think Sunway REIT the largest REIT right now is by far sitting there very lonely without anyone closer to it. The UK Residential REIT URES announced its intention to proceed with an initial public offering IPO of new Ordinary Shares and to apply for the admission of its shares to the premium listing segment of the Official List of the FCA and to trading on the Main Market for listed securities of the London Stock Exchange.

Pavilion Real Estate Investment Trust Pavilion REIT is one of the largest retail concentrated REIT in Malaysia. Pavilion REIT Are you bored of the current small market capitalization of REITs in Malaysia. The principal investment policy of Pavilion REIT is to invest in income producing real estate used.

The Initial Public Offering IPO consists of 790 million units at an IPO price of RM088 per unit. It is the REITs largest acquisition since IPO. Come 7th December 2011 we will witnessed a new contender - Pavilion REIT to challenge the title.

M-REITs have done well with the largest ones having posted increases in unit prices of almost 32 on average since IPO. If successful Pavilion REIT would be the 15th M-REIT and perhaps also the second largest. Ii 35000000 new units made available for application by the malaysian public the eligible tenants of the subject properties as defined herein the directors of pavilion reit management sdn bhd and the eligible employees of pavilion reit management sdn bhd urusharta cemerlang sdn bhd capital flagship sdn bhd and kuala lumpur pavilion sdn bhd at the retail price being the initial price payable by.

The UK Residential REIT will invest in a diversified portfolio. Pavilion REIT whose portfolio consists of the Pavilion Kuala Lumpur Mall and the 20-storey Pavilion Tower office block plans to pay out at least 90 of its distributable income on a half-yearly basis from FY12.

12 Things To Know About Pavilion Reit Before You Invest

Finance Malaysia Blogspot New Ipo Pavilion Reit

12 Things To Know About Pavilion Reit Before You Invest

5212 Share Price And News Pavilion Real Estate Investment Trust Share Price Quote And News Fintel Io

Pdf Accounting Project Pavilion Reit Its Comparison With Sunway Reit Syed Salman Academia Edu

Pavilion Reit To Add To M Reit Offering Ipo Books Philippe Espinasse

12 Things To Know About Pavilion Reit Before You Invest

Pavreit 5212 Pavilion Real Estate Investment Trust Overview I3investor

6 Things I Learned From The 2021 Pavilion Reit Agm

Qatar Investment Sells 74m Pavilion Reit Units For Rm125 8m The Star

Returning Footfall Better Earnings For Pavilion Reit The Star

Pavilion Reit Archives The Fifth Person

Financial Management Solutions Fortune My Investing Reit Financial Management

Cornerstones To Buy 33 5 Of Pavilion Reit S Malaysia Ipo Ipo Property Real Estate Reit Shopping Malls Retail Properties Cimb Credit Suisse Maybank Qnb Capital Financeasia

Footfall Rebound To Boost Pavilion Reit Earnings The Star

Financial Management Solutions Fortune My Investing Reit Financial Management

Pavilion Real Estate Investment Trust Crunchbase Company Profile Funding