However EPFO permits 90 withdrawal of EPF amount one year before retirement on condition that the person should not be less than 54 years of age. You can withdraw up to 50 of your share with interest.

Epf Withdrawal Process How To Withdraw Pf Online Updated

2 If the EPFO subscriber.

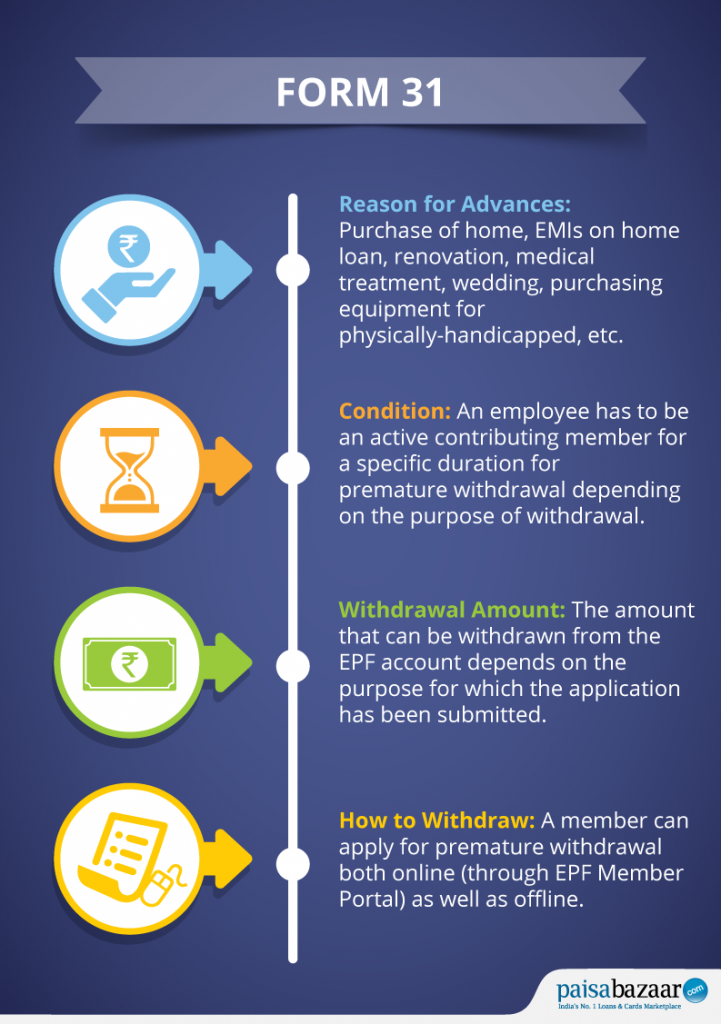

Lesser amount can be withdrawn for epf. EPF members can apply for partial withdrawal or advance both offline and offline. You can avail this partial withdrawal facility only once in your life for housing purposes. 1 According to current rules an EPFO subscriber can withdraw his or her EPF balance after remaining unemployed for two months.

EPF can also be withdrawn for the purpose of self siblings brother and sister and childrens marriage. This will affect all of YOU who withdrawn certain. You can withdraw fron your EPF for your marriage if you have held your EPF account for 7 years.

Increasing the Age Limit For 90 EPF Amount Withdrawal. The other good thing you need not attach any proof for any withdrawals. Through this rule an employee can get the opportunity to plan the early retirement before the actual age of retirement.

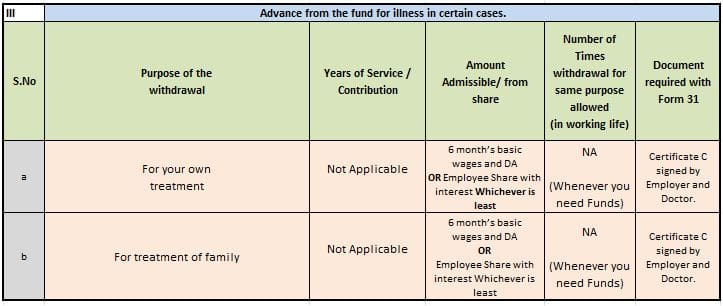

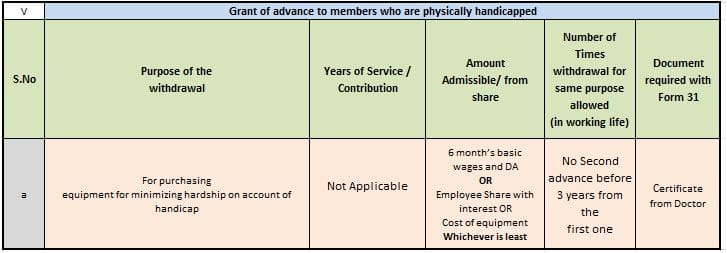

The decision has been taken by the labour ministry due to the second wave of the Covid-19 pandemicAdded to this mucormycosis or. Taxation on EPF withdrawal. Post matriculation After 10 th Marriage SelfSiblingsChildren.

Effective January 2014 the minimum basic savings required in Account 1 was revised upward. Since the withdrawal is considered as income of the investor the funds withdrawn from the EPF account before 5 years of continuous service are fully taxable as per the investors applicable tax slab TDS will be deducted if the amount withdrawn is more than Rs50000. Youemployee can withdraw the full PF amount on retirement from service 55 years or on cessation of employment and not being employed for at least 60 days.

In such case you need to declare that you are unemployed in order to withdraw your EPF amount. The amount can only be withdrawn for childrens higher education ie. Though the EPF amount can be withdrawn only after retirement that is at the age of 55 early retirement is not taken for consideration.

However members can apply for lesser amounts as well. Lesser Amount can be Withdrawn for EPF Members Investment Scheme effective January 2014. However there are certain terms and conditions under which you can opt for the advance.

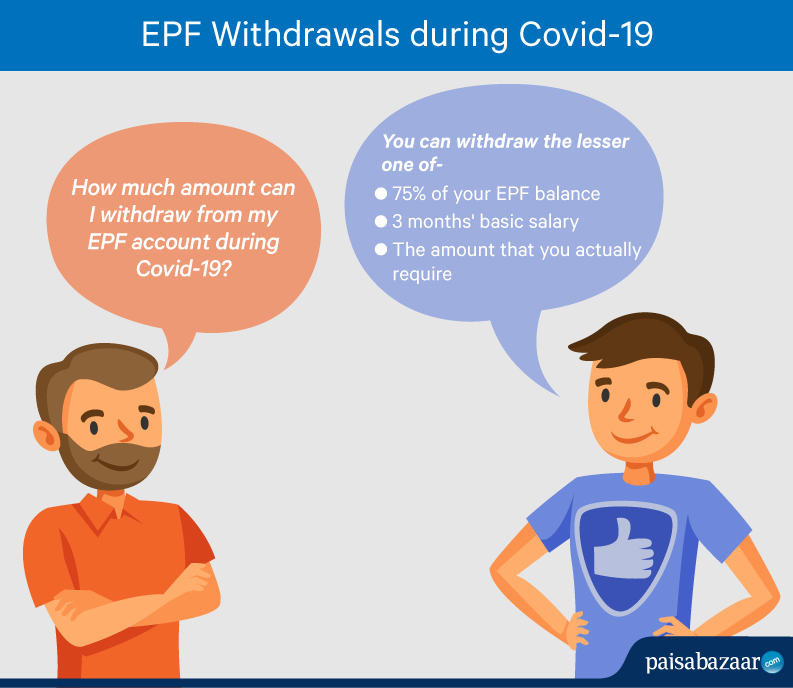

The EPF rules were then amended to reflect the new guidelines whereby an individual who is a member of the Employees Provident Fund Organization EPFO would be allowed to withdraw an amount that is equivalent to three months of their basic and dearness allowance DA or be able to withdraw 75 of the credit balance in their account whichever is the lesser amount of the two. Lesser Amount can be Withdrawn for EPF Members Investment Scheme effective January 2014 Are you an EPF member who withdraw money out for investment scheme. In case of unemployment due to retrenchment or lockdown you will be allowed to withdraw your EPF amount.

EPFO allows its members to withdraw non-refundable withdrawal of up to three months of basic wages and dearness allowance or 75 of the amount available in the EPF account whichever is less. 90 of the EPF balance can be withdrawn after the age of 54 years. The good news is the EPF Composite Claim Form is one-pager and one of the simplest form I have seen.

The maximum amount that can be withdrawn to purchase a site or plot is 24 times the salary. The maximum amount that can be withdrawn is 36 times the salary. EPF Withdrawal provisions Existing rule.

Employee provident fund organization allows premature withdrawal and also provides loan facility to its subscribers. If you want to withdraw from EPF for repayment of housing loan you must have completed 10 years of service. Till today 90 EPF corpus amount can be withdrawn at the age of 54.

Then this is a very important news to you. Here are the main amendments to EPF withdrawal rules-. Are you an EPF member who withdraw money out for investment scheme.

This will affect all of YOU who withdrawn certain amount from EPF account 1 for eligible investment purpose. 10 Things To Know About EPF Withdrawal. Repairs or alterations to an existing home The home should be in the name of the EPF member spouse or should be jointly owned by both.

Higher limit means lesser money you can withdraw from EPF in the future. After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of. Effective January 2014 the minimum basic savings required in Account 1 was revised upward.

Again a minimum 7. Effective January 2014 the minimum basic savings required in Account 1 was revised upward. You can withdraw up to 90 of the accumulated corpus for purchase of house or house site.

But as per new updated rules your age must be at least 57 to withdraw 90 EPF corpus amount. Almost all salaried people contribute a certain percentage of their salary towards their Employee Provident Fund EPF account every month. Then this is a very important news to you.

As per latest rules 90 of the EPF balance can also be withdrawn for the down payment of new house and the EPF account can be used to pay EMIs as well if the employee is a member of a housing society of at least 10 members and have continued the EPF account for at least 3 years. You wont be eligible for this withdrawal facility before 57 and the main purpose of this withdrawal. This will affect all of YOU who withdrawn certain.

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Epf Form 31 Instructions Filing Procedure How To Download

Epf Withdrawal Process How To Withdraw Pf Online Updated

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Online Epf Claim Facility Procedure Process Flow Conditions

Epf Withdrawals New Rules Provisions Related To Tds

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Covid 19 Know How Much You Can Withdraw From Your Epf

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

How To Withdraw From Epf For Coronavirus

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Changes In Epf Withdrawal Rules From 10 Feb 2016

Epf Partial Withdrawal Or Advance Process Form How Much

Pf Withdrawal Rule Change Your Epf Claims Will Be Settled In 3 Days How To Apply