Therefore as per provisions found in the Companies act 2013 itself it can be said that the phrase free reserve in situations and contexts entailing cash out flow is used in a manner that any unearned gains are not considered as free reserves because it is intended that a company should not pay dividend or issue bonus shares or make intercorporate investment by way of loans and securities. The statutory reserves required of banks and credit.

It is kept by the entity for reinvesting it in the main business.

Is statutory reserve a free reserve. Another offshoot is the way it affects Sec 63 Bonus Shares. These are what are referred to as statutory reserves because they are controlled by the statute. Reserves are a part of retained earnings that is appropriated for a specific purpose.

Continue reading Section 243Free Reserves. Followig are the examples of statutory reserves. A statutory reserve is an amount of money set aside by a financial institution such as a bank or insurance firm in order to meet unmatured obligations - such as the promise of repayment insurance firms make in exchange for accepting premiums from clients.

Provided that i any amount representing unrealised gains notional gains or revaluation of assets whether shown as a reserve or otherwise or ii any change in carrying amount of an asset or of. The board cannot borrow from the reserves without a vote of the members. A statutory reserve may be kept on deposit with the Federal Reserve Bank.

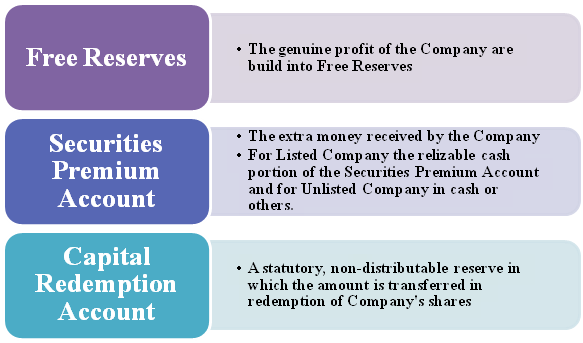

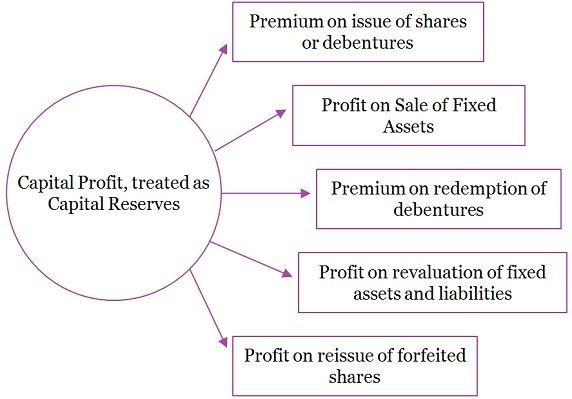

The capital reserves revaluation reserves debenture redemption reserves securities premium and statutory reserves do not form a part of free reserves. 31 December 2013 Yes it is considered. Statutory Reserve is the amount of money securities or assets that need to be set aside as a legal requirement by insurance companies and financial institutions to cover its claims or obligations which are due in the near future.

It is a component of the balance sheet for an insurance firm and can be in the form of anything easily convertible to cash such as. 13 March 2011 Statutory reserves means reservesprofit appropriated for compliance of any lawstatute. Free reserves are the reserves a bank holds in excess of required reserves minus reserves borrowed from the central bank.

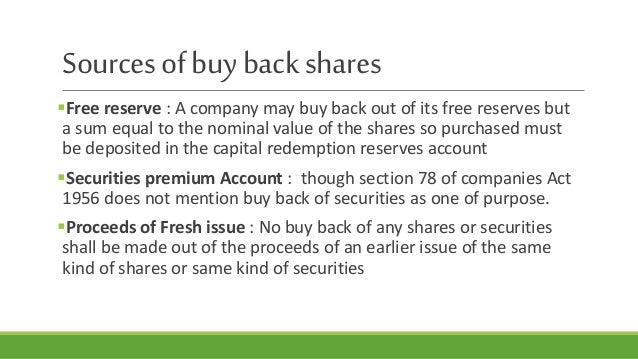

As per Section 63 1 a company may issue fully paid-up bonus shares to its membersshareholders out of its free reserves. Free reserves means such reserves which as per the latest audited balance sheet of a company are available for distribution as dividend. Insurance companies are free to set their statutory reserves above the minimum level using a principles-based approach.

Since Bonus Shares can be issued out of free reserves and the term free reserves is defined as the free reserves as per latest audited balance it is possible that even where there are no or insufficient reserves on the date of Bonus Issue one can still come out with a Bonus issue just because the company had sufficient free. 1 Every non-banking financial company shall create a reserve fund and transfer thereto a sum not less than 200 per cent of its net profit every year as disi in the profit and loss account and before any dividend is declared. Retained Earnings are a part of companys net income which is left after paying out dividends to shareholders.

It is maintained by the company for meeting future losses. Reserve for unexpired risk is a specific statutory revenue reserve. A statutory reserve is an amount of cash a financial institution such as a bank credit union or insurance company must keep on hand to meet the obligations incurred by virtue of accepting deposits and premium payments.

Jump to navigation Jump to search. From Wikipedia the free encyclopedia. In the business of insurance statutory reserves are those assets an insurance company is legally required to maintain on its balance sheet with respect to the unmatured obligations ie expected future claims of.

Statutory reserve of a bank is a free revenue statutory reserve. Means a fraction expressed as a decimal the numerator of which is the number one and the denominator of which is the number one minus the aggregate of the maximum reserve percentages including any marginal special emergency or supplemental reserves expressed as a decimal established by the Board and any other banking authority domestic or foreign to which. Statutory Reserve Rate means a fraction expressed as a decimal the numerator of which is the number one and the denominator of which is the number one minus the aggregate of the maximum reserve liquid asset fees or similar requirements including any marginal special emergency or supplemental reserves or other requirements established by any central bank monetary authority.

As per section 372A b free reserves means those reserves which as per the latest audited balance sheet of the company are free for distribution as dividend and shall include balance to the credit of the securities premium account bat shall not include share application money. A statutory reserve is an amount of money set aside by a financial institution such as bank or insurance firm in order to meet unmatured obligations.

Understanding Balance Sheet Statement Part 1 Varsity By Zerodha

Issue Of Bonus Shares Under Companies Act 2013 Corpbiz

Difference Between Revenue Reserve And Capital Reserve With Comparison Chart Key Differences

Reserve Ratio Formula Calculator Example With Excel Template

General Reserve General Reserve Vs Retained Profit

Free Reserves As Per Companies Act 2013 Meaning Exclusions

What Kinds Of Reserves Are Distributable Lcn Legal

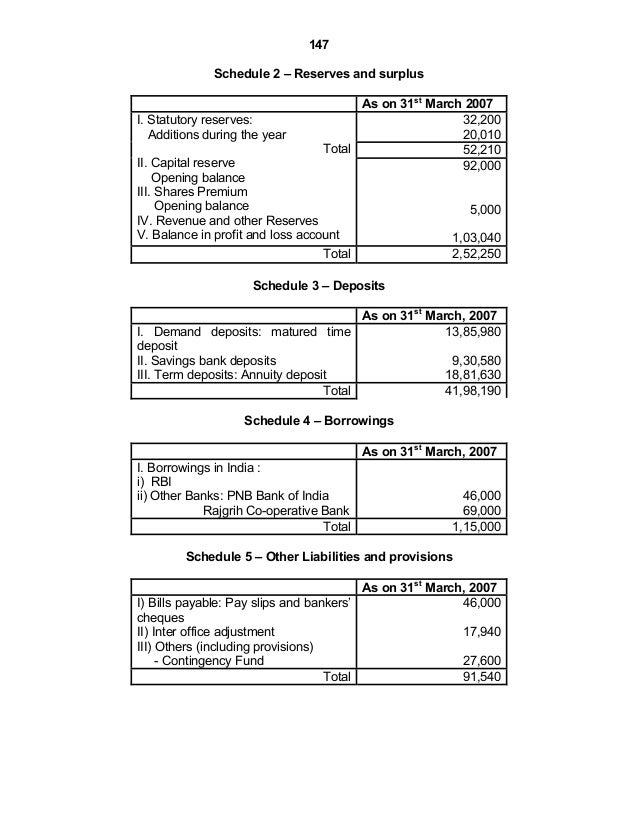

Accounts Of Banking Companies Ppt Download

Excess Reserves Formula Example How To Calculate Excess Reserves

Excess Reserves Formula Example How To Calculate Excess Reserves

Understanding Balance Sheet Statement Part 1 Varsity By Zerodha

Understanding Balance Sheet Statement Part 1 Varsity By Zerodha

Accounts Of Banking Companies 1 90mb