PAN Submitted Updated in UAN. Weighing the Pros Cons of Opting for Provident Fund.

Infection Pathway For Metarhizium Spp Infection Is Initiated By A Download Scientific Diagram

This Concerns your EPF Retirement Money Must Read.

Is it viable for epf to support. EPFO KYC process is a one-time activity that links the employees identification details to their EPF account. Theepf file extension is used by a variety of applications. EPF members can call the EPF toll free help desk number 1800118005.

Is EPF deduction mandatory. Employees Provident Fund Organisation India. If Form15G15H is submitted then no TDS Tax PAN is not submitted.

The contributions and dividends will be divided into two accounts. To keep EPFO viable officials give House panel radical idea Sources said officials told the panel that EPFO had over 23 lakh pensioners drawing Rs 1000 per month even when their contributions to the fund corpus had been less than a fourth of the benefits they were drawing. Foreign exchange risk You and I are part of the statistics of 57 million EPF contributors.

EPFO won the Platinum Award the highest award given by Honble Minister Information Technology Govt. Send Email to EPF Help Desk. Even though the Provident Fund may receive tax-deferred treatment in its country of origin that does not mean the United States recognizes that tax-deferred treatment as well.

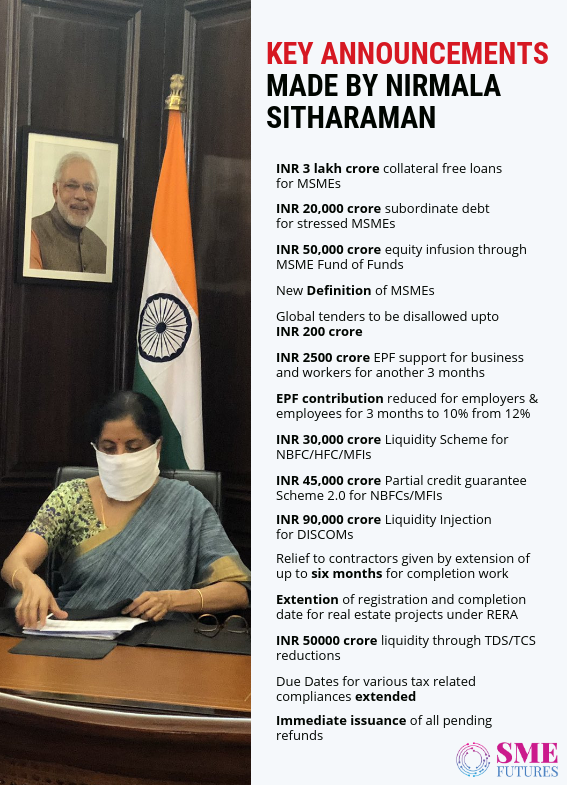

This scheme does not cater to the people living in Jammu and Kashmir. There are two things you ought to know about your retirement money right now. This will increase liquidity for both employers and employees.

Employees also have an option to contribute either 8 or 11 of their monthly wages. 1 Investing larger sum in global markets read. It remains an organisation more fixated on announcing return rates than an.

The scheme allows you and your employer to contribute 12 of your basic salary towards your EPF account. You may also make a call at our toll-free number. Employees Provident Fund Organisation EPFO allows subscribers to withdraw or transfer their PF money in certain conditions.

W ith the recent proposal of the EPFO to increase the wage limit of Provident Fund to a monthly salary of Rs 25000 from the current wage limit of Rs 15000 it aims to bring in a large chunk of workers under Provident Fund scheme. May June and July 2020. One it is used as an Edgecam education part file wherein all the files that are used to educate and train students about Edgecam are all in this file format.

This number works in between morning 915 Am to the evening at 545 Pm. EPF is investing our retirement money for potentially higher return by. In between these timings EPF members can call to this number.

If PAN is Submitted then the TDS will be deducted at 10. The government has cut the Employees Provident Fund EPF contribution by both employer and employee for the next three months ie. EPF Employees Provident Fund Nepal TPF Thailand Provident Fund Thailand MPF Mandatory Provident Fund Hong Kong Example of Provident Fund.

EPF being a retirement benefit scheme ensures that all salaried employees can save a considerable amount of money spend their retirement days. For this entire process to be viable the employee is required to compulsorily complete his EPFO KYC updation. The EPF agency collects contributions from employers at a rate of 13 for employees who receive wages of RM5000 per month and below and 12 for those earning above RM5000 per month.

If your are an employee. Since the day employees join the organization they are eligible for availing insurance benefits Provident Fund including pension benefits. Please send your queries to following e-mail id.

If your are an employer. What is EPF and its withdrawal rules. Thus the total contribution to your EPF account per month is 24 of your basic salary.

How much amount will be deducted from. Of India on the third anniversary of UMANG App EPFO invites Request for Proposals for Appointment of Consultant The EPFiGMS services is available in UMANG Platform Inviting Applications from Retired Officers for empanelment as Inquiry Officer. Top labour ministry officials on Thursday told a parliamentary panel on labour that for pension fund like the EPFO to remain viable it must move from the prevailing system of defined benefits to a system of defined contributions where members draw benefits commensurate with their contributions.

To update my KYC in EPFO I can easily and conveniently use the KYC update EPFO portal and complete my EPFO KYC online. EPFO support team responds to emails in a prior manner. Tax TDS will be deducated at the rate of 346 You will get only 65 of your PF money Tags.

However state PSUs and CPSEs will continue to pay 12 contribution as employer contribution to the EPF. The core function of the EPFO gets defeated if it is unable to help employees in the time of their need adds Kumar. How much pension and interest you will earn on EPF.

As Indias only one stop shop to all things HR Payroll. However sometimes employees face difficulties in transferring their EPF account from the previous organisation to the new organisation after switching their jobs or while withdrawing money from their PF. EPF benefits can be given to the workers in an organisation that employees a minimum of 20 workers.

For organisations that are not eligible for the above support the statutory PF contribution is being reduced from 12 to 10 for the next 3 months. In this file typeepf is used to save data that can prevent users from. Employees need to know that contribution to their EPF accounts can be claimed.

The Pros And Cons Of Taking The Epf I Sinar Withdrawal Facility

Can The Glove Stocks Hold Steady The Star

The Pros And Cons Of Taking The Epf I Sinar Withdrawal Facility

The Many Forms Of A Pleomorphic Bacterial Pathogen The Developmental Network Of Legionella Pneumophila Abstract Europe Pmc

Can The Glove Stocks Hold Steady The Star

Nirmala Sitharaman Announces Relief Measures For Msmes Nbfc S Extends Tax Deadlines Epf Support Sme Futures

Keep Calm Help Is On The Way The Star

Enterprise Development Branch Ppt Video Online Download

The Pros And Cons Of Taking The Epf I Sinar Withdrawal Facility

The Pros And Cons Of Taking The Epf I Sinar Withdrawal Facility

The Many Forms Of A Pleomorphic Bacterial Pathogen The Developmental Network Of Legionella Pneumophila Abstract Europe Pmc

India S Social Security System Download Scientific Diagram

The Pros And Cons Of Taking The Epf I Sinar Withdrawal Facility