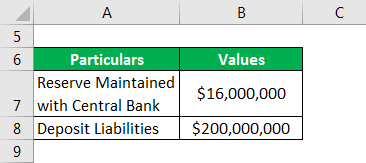

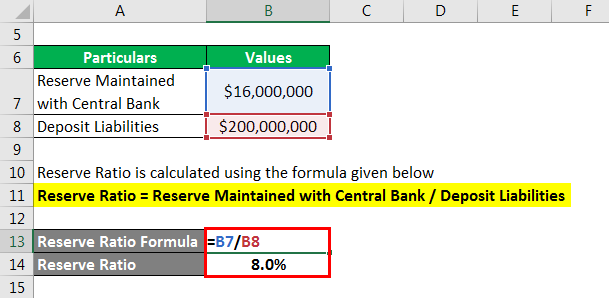

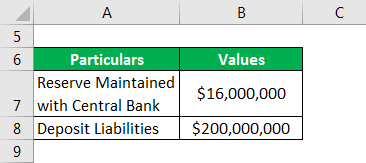

On March 15 2020 the Fed announced it had reduced the reserve requirement ratio to zero effective March 26 2020. The formula for reserve ratio is expressed as the dollar amount of reserve maintained with Central bank divided by the dollar amount of deposit liabilities owed by the bank to the customers.

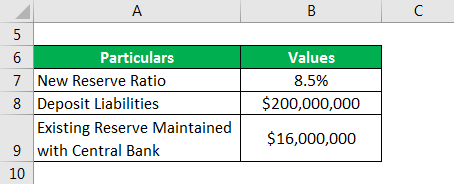

If the result is negative then the bank has a reserve requirement of zero and a reserve balance requirement of zero.

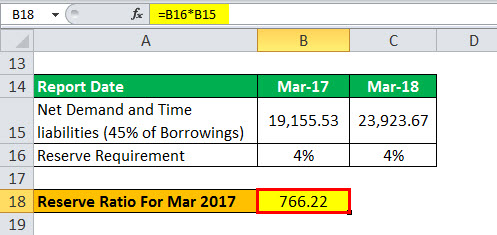

How to calculate the reserve requirement ratio. A more detailed description of the system can be found in the ECB publication entitled The single monetary policy in the. How to calculate the minimum reserve requirements. The central bank requires a reserve ratio to be 5 for 2017 and 55 for 2018.

Determine the bank deposits Next determine the bank deposits borrowed by. Reserve requirements are calculated by applying reserve ratios specified in Regulation D to an institutions reservable liabilities See Reserve Ratios as reported on the Report of Transaction Accounts Other Deposits and Vault Cash FR 2900 during the reserve computation period. This page provides summary information on how to determine the reserve requirements of an individual credit institution subject to the ECBs minimum reserve requirements.

If the reserve ratio requirement is 10 in the country the ABC Bank must reserve at least 100 million in central bank and may not use that cash for lending or any other purpose. The reserve ratio is. This means if a bank has deposits of 1 billion it is required to have 110 million on reserve 1.

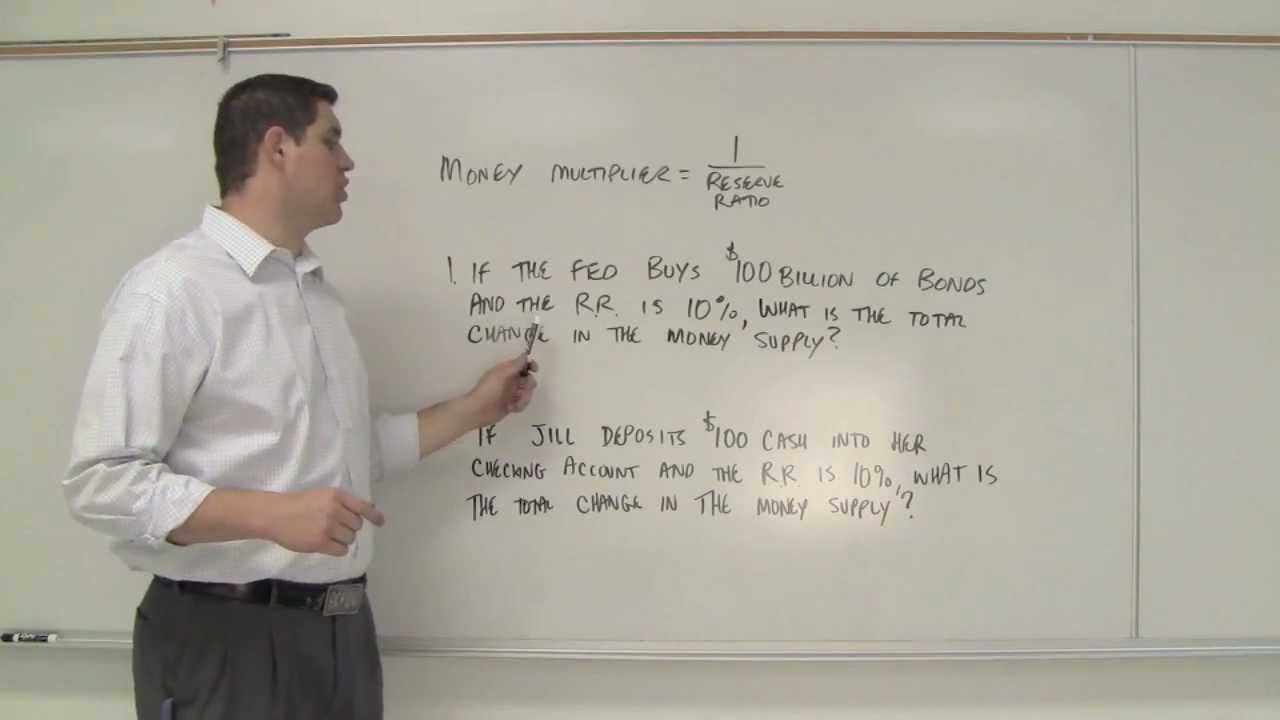

Reserve Requirement Ratio. A required reserve ratio is the fraction of deposits that regulators require a bank to hold in reserves and not loan out. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

Required reserves 01 1000 100 The required reserves in this case are 100 and the bank is able to lend out the remaining 900. The calculation of reserve ratio can be done by using the following steps. As of July 2021 this reserve requirement is.

While the required reserve ratio is set by an outside controlling financing board the actual reserve ratio on hand can be calculated by dividing the amount of deposited money retained on hand by the bank by the total amount of deposited money that the bank has. First determine the total reserve. In this video I explain the reserve requirement the money multiplier and how money is created.

Bank Deposits fo Mar 2017 10356188 85 8802760. As a simplistic example assume the Federal Reserve determined the reserve ratio to be 11. If the required reserve ratio is 1 to 10 that means that a bank must hold.

Mathematically it is represented as Reserve Ratio Reserve Maintained with Central Bank. Reserve Ratio Example. Check out the Ultim.

Reserve ratios are set by the Federal Reserve the central bank of the US. Bank Deposits for Mar 2018 12352599 90 13853314. Calculate the total cash reserve.

Next determine the total liabilities. And banks Net deposit is 85 and 90 for 2017 and 2018 respectively of total borrowings. Determine the reserve amount Firstly determine the reserve amount maintained by the bank with the central bank and it.

If the Federal Reserves reserve ratio requirement is 10 Bank XYZ must keep at least 40 million in an account at a Federal Reserve bank and may not use that cash for lending or any other purpose. Calculate Adjusted Net Transaction Accounts Subtract the exemption amount from the net transaction amount accounts to get the adjusted net transaction accounts. How to calculate reserve ratio.

Standard levels include 8 to 12 of the insurers total revenue but the actual amount. This is telling us that the commercial bank needs to keep 10 of its deposits as required reserves therefore. Most reserve requirements are established at the state level.

It did so to encourage banks to lend out all of their funds during the COVID-19 coronavirus pandemic. Calculate the Required reserves. For example suppose ABC Bank has 1000 million in deposits.

For example lets assume that Bank XYZ has 400 million in deposits. If the result is not negative calculate the reserve requirement. Try it on your own.

Reserve Ratio Formula Calculator Example With Excel Template

Reserve Ratio Formula Calculator Example With Excel Template

Cash Reserve Ratio Formula Example Calculate Crr

Reserve Ratio Formula Calculator Example With Excel Template

Reserve Ratio Formula Calculator Example With Excel Template

24 2 The Banking System And Money Creation Principles Of Economics

Determinants Of The Money Supply The Money Multiplier Ppt Video Online Download

Money Creation Yellow Page Worksheet

Reserve Ratio Formula Calculator Example With Excel Template

Money Creation Yellow Page Worksheet

Cash Reserve Ratio Formula Example Calculate Crr

The Money Multiplier And Reserve Requirement Youtube

Cash Reserve Ratio Examples Of Crr With Step By Step Calculation

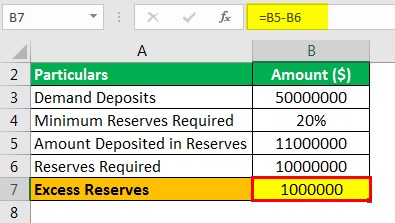

Excess Reserves Formula Example How To Calculate Excess Reserves

Education What Effect Does A Change In The Reserve Requirement Ratio Have On The Money Supply

/dotdash_final_Deposit_Multiplier_Dec_2020-01-12355ee057a74ef1887bb1066444b606.jpg)

/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)