As announced in an EPF media statement dated 3 November 2016 effective 1 January 2017 members will. Will still be subject to the annual EPF dividend but it will flow to your Account 2.

What No One Is Telling You Epf Is Not Enough The Rojak Pot

When you reach a certain age the EPF allows you to withdraw partially or in full the savings in Account 2.

Epf will stop dividend payments to. The Employees Provident Fund EPF wishes to clarify that an old statement regarding the maximum age of 75 years for EPF dividend payment which is currently circulating via WhatsApp and other online platforms is outdated and no longer applicable. Even though that rate sounds low bear in mind that for the last decade or so the rate has been at a healthy average of 5-6 per annum. No Change To Age 55 Withdrawal And Introducing Akaun Emas For Age 60 Withdrawal.

A Government-guaranteed minimum rate of 25 will be paid out to each and every contribution to the EPF. However the maximum total amount withdrawal allowed is RM60000. Progressive Corporation PGR Ex-Dividend Date Scheduled for July 06 2021.

KUALA LUMPUR 12 October 2019. You have the option to withdraw EPF savings at age 50 or 55 either partially or fully. EPF Responds To Budget 2020 Announcement.

This is the most common form of EPF withdrawal. The EPF could serve as your primary retirement vehicle and unnecessary withdrawals might leave you with inadequate fuel to see you through your post-retirement journey. Your Account 2 can still be used for Housing Education Health and Age 50 Withdrawal.

The removal of the i-Sinar criteria will also mean that the interim payment of RM1000 implemented last month will be effectively stopped. EPF Chief Executive Officer Tunku Alizakri Alias said. KUALA LUMPUR 3 November 2016.

INFO CONTINUED CLOSURE OF EPF BRANCHES NATIONWIDE FROM 15 JUNE 2021. The Employees Provident Fund EPF notes that Budget 2020 takes into account fast-changing demographics the changing definitions of work and the work environment and the issues surrounding social well-being generally. The Employees Provident Fund EPF today announced that effective 1 January 2017 Akaun Emas will be introduced as a second retirement nest egg for members working beyond age 55.

The deferred contribution for the respective months can then be settled over a maximum period of 3 months. Imprisonment term not exceeding 6 years or a fine not exceeding RM20000 or both. If this happens and if theyre found guilty of it they can be jailed for up to 6 years andor fined up to RM20000 under Section 483 of the EPF Act In addition to that employers would also be liable to pay late payment charges.

As an example for SMEs who apply to defer their April contributions their restructured payments will start from July 2020 up to a maximum of 3 months ending September 2020. In the absence of wages Employer no recovery can be affected. 8 - The contribution has been recovered from the wages of the employee but the employer had not paid to the EPF.

Deducts the employees share of contributions from the wages and fails to pay to EPF. China Life Insurance Company Limited LFC Ex-Dividend Date. Money youve set aside into Flexible Housing Withdrawal account still belongs to you and will not be assigned to banks.

There is no change to the current Age 55 Withdrawal. Any contribution by the member must be matched with employers share of contribution. INFO EPF RECORDS HEALTHY RETURNS OF RM1929 BILLION IN GROSS INVESTMENT INCOME FOR Q1 2021.

The payments will be staggered over a period of six 6 months with the first payment of up to RM10000. INFO TEMPORARY CLOSURE OF KLUANG AND KUALA TERENGGANU BRANCH. The companys annual payout was.

However unless really squeezed for money one should not withdraw from the EPF especially when between jobs. BP canceled its dividend payment - totaling about 26 billion - scheduled for June 21 and that it wont declare a dividend for the second and third quarters. EPF is tax-free and the rewards on maturity are an added advantage.

For most Malaysians there are several types of EPF withdrawals to highlight.

Is Your Employer Depositing Pf Money To Epfo Or Trust If Not Then What To Do

Pdf Case Study On The Employee Provident Fund Of Malaysia Semantic Scholar

Epf 10 Things You Must Know About Epf Scheme Telugu Youtube

Basic Salary More Than 15000 Eps Contribution Rejection Of Transfer Or Epf Claim

Epf Withdrawals New Rules Provisions Related To Tds

When You Don T Get Your Epf Withdrawal Money Though It Shows Settled Incorrect Bank Details Etc

Epf Trust Exempted Epf Uan Transfer Passbook

What No One Is Telling You Epf Is Not Enough The Rojak Pot

What No One Is Telling You Epf Is Not Enough The Rojak Pot

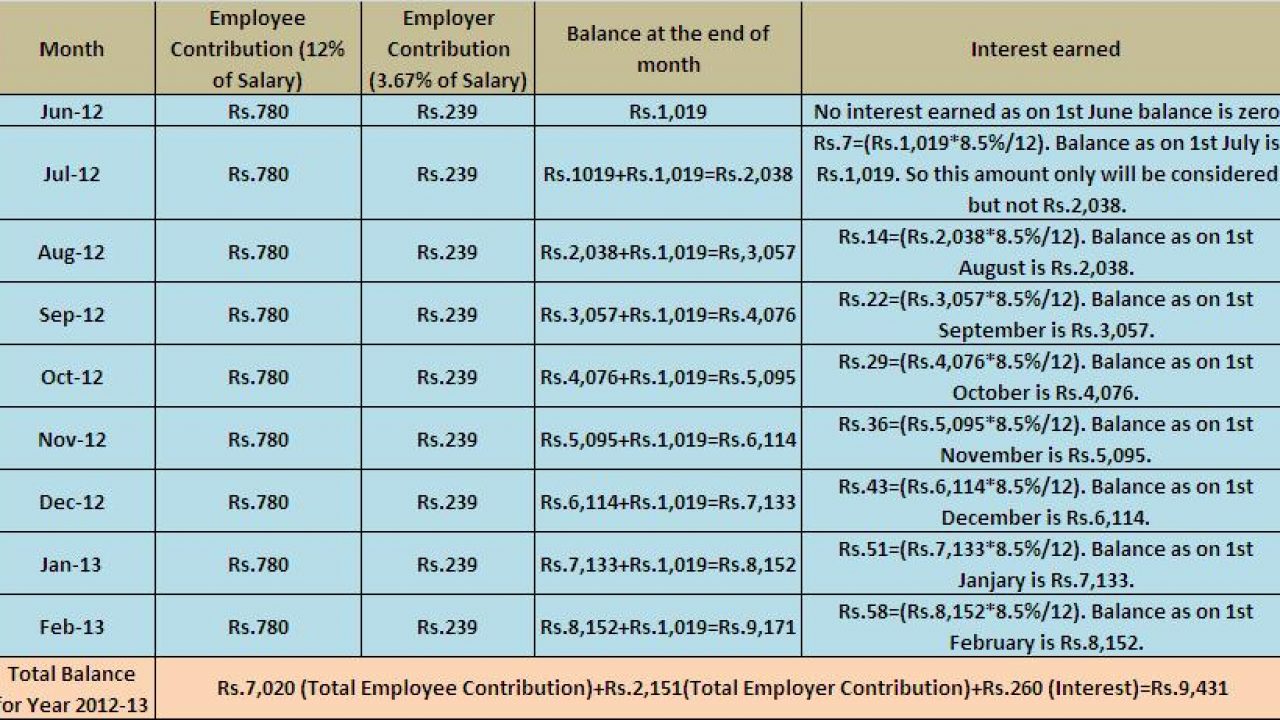

How Epf Employees Provident Fund Interest Is Calculated

Old Inactive Epf Account Should You Withdraw Or Continue Basunivesh

Epf Withdrawals New Rules Provisions Related To Tds

What No One Is Telling You Epf Is Not Enough The Rojak Pot

Pdf Case Study On The Employee Provident Fund Of Malaysia Semantic Scholar

Your Epf Account Will Earn Interest Even After Quitting Job Here S How Goodreturns

Epf Form 15g How To Fill Online For Epf Withdrawal Basunivesh

How To Make Epf Claim Online Upon Death Of The Account Holder Goodreturns