If youre not living on the premises you should still raise 20 percent of the down payment as you intended. SturtiGetty Images Personal Finance Insider writes about products strategies and tips to.

7 Markets With The Greatest Potential Impact Of Down Payment Assistance Down Payment Resource

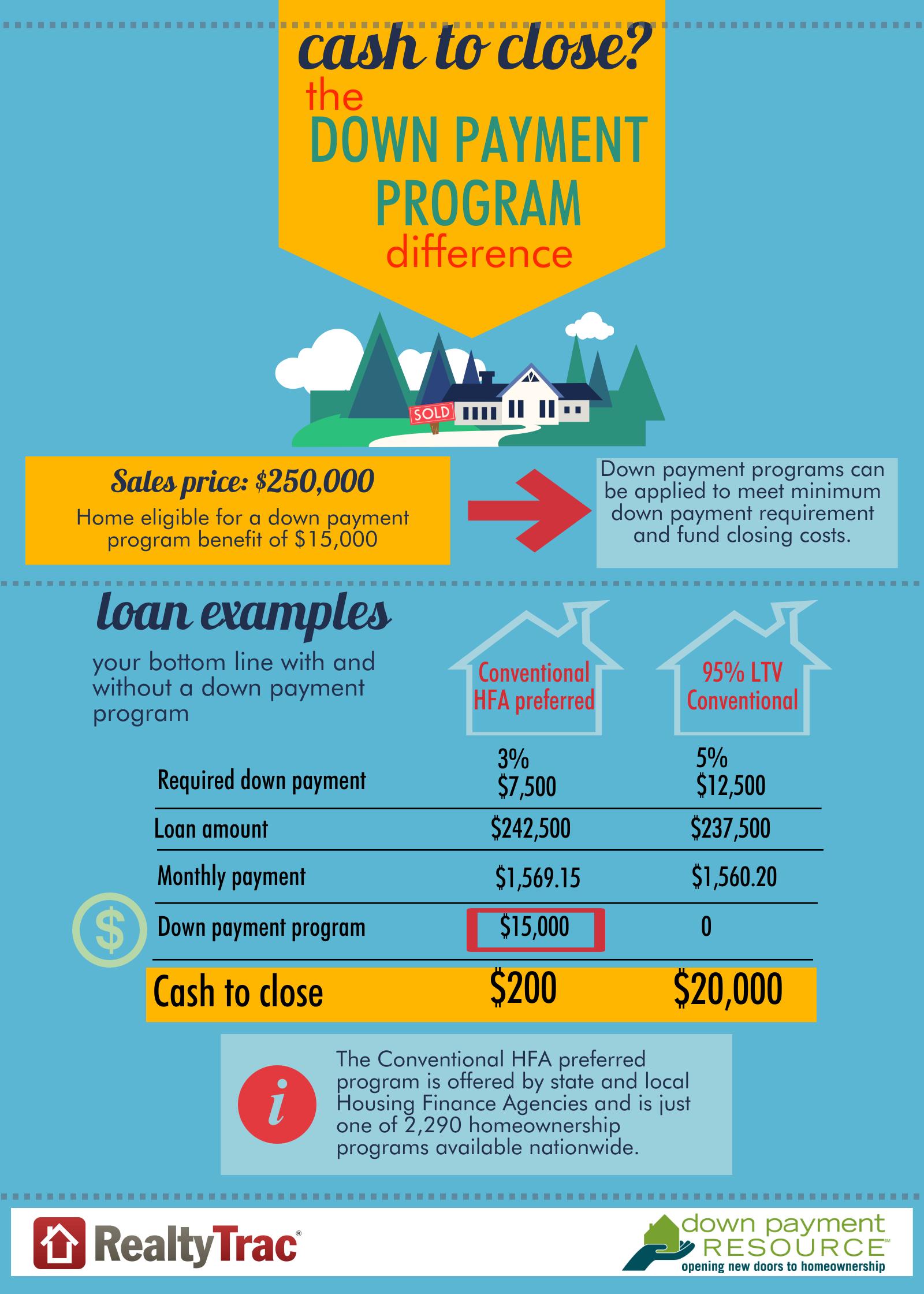

5 Down Payment Conforming 12500 5 Mortgage Amount.

Downpayment to be raised to 20. But in just one year he and his partner Connor were able to save 30K. The down payment often covers a meaningful percentage of the total purchase price such as 20. In other words A LOT of money.

Then with a simple three-step plan it all changed. Heres the thing though. For a home price of 250000 your down payment can range from.

If the down payment is lower than 20 borrowers will be asked to purchase Private Mortgage Insurance PMI to protect the mortgage lenders. That makes a 20 down payment of 77880. If you dont think you can afford that however dont despair.

The 20 Goal Its worth it to strive to come up with as much of a down payment as possibleideally 20. The SBAs small business loan down payment requirement is generally lower than that of traditional banks which can require anywhere from 20-30 of the purchase price. When it comes to putting a down payment on a home the general rule of thumb is to hand over a minimum of 20.

The CMHC announced new mortgage rules that took effect on July 1 2020. The more of an investment you have in it the better. 50000 20 Mortgage Amount.

They will have to liquidate all their existing investments fixed deposits stocks equity funds and even the Provident Fund to raise about Rs 20 lakh for the downpayment. A 20 down payment can give you an edge over other buyers especially if the home you want is in a hot market. These changes tighten CMHC requirements and are aimed at discouraging higher-risk borrowers from taking on a mortgage they cant afford.

Banks and other lenders often require a 20 down payment of the purchase price for the home. Home sellers often prefer to work with buyers who have at least a 20 down payment. A higher risk borrower is a homebuyer with less than 20 home downpayment.

The balance Rs 80 lakh if borrowed at 10 for 20 years will mean an EMI of Rs 77200 which is roughly 60 of their combined monthly income of Rs 13 lakh. Conventional lenders want some assurance that you too have a significant stake in the property and that youll fight tooth and nail to prevent it from going into foreclosure. The average home price in the US.

You pay off the remainder of the loan over time with regular installment payments unless you pay the loan off early with a large payment or by refinancing. Down payment assistance DPA helps homebuyers with grants or low-interest loans that reduce the amount they need to save for a down payment. Conventional loans normally require a down payment of 20 but some lenders may go lower such as 10 5 or 3 at the very least.

New Mortgage Rules 2019-2020. Higher down payments indicate that your finances are more likely to be in order so you might have fewer problems finding a mortgage lender. Also the Home Buying Institute has a down payment estimate range from 0 to 20.

These typically have strict guidelines regarding who qualifies. PMI is insurance that. There are more than 2000 of.

Reached 389400 in 2020. If you pay anything less youll need to buy private mortgage insurance PMI. In many areas of the country you can still buy a nice home for around 250000.

The average amount you can expect to put down on your home is 20 of your homes total value. In my opinion should BNM set new lending rules to cool real-estate industry I suggest increasing minimum down payment to 20 for high-end properties only and exclude first. The down payment amount increases to 20 of the size of the loan for particular use companies.

For car purchases a down payment of 20 or more may make it easier for a buyer to get better loan rates terms or approval for a loan. If however you will be living on the property with your tenants you can apply for an owner-occupied mortgage. This is an average 3-bedroom 2-bath home where a 20 down payment would be around 50000.

They make good money but it never seemed to accumulate into a pile big enough for a down payment. Jacob thought home ownership would never happen. Making a down payment of less than 20 is common.

In this case you will only need to raise 5 to 10 percent of the down payment for your rental property. To curb speculative buying of properties countries such as China Hong Kong and Singapore have already implemented progressively higher down payment ratio for buyers who own more than one property. You may be able to get help through a down payment assistance program.

35 Down Payment FHA 8750 35 Mortgage Amount. How We Saved 30000 for a Down Payment in 1 Year. If youre trying to avoid having to use more expensive private mortgage insurance you may want a.

How To Save For A Down Payment For Your First House Buying Your First Home House Down Payment Take Money

How To Understand The Fi Postings Made In Sd Down Payment Scenario Sap Blogs

Covid 19 Down Payment Resource

Pin By Kaydee Kreitlow On 08 Dream Home Savings Chart Saving Chart Money Saving Plan

Is The 20 Down Payment Rule Dead Realtors Millennials Say Yes

30 Down Payment For 3rd Mortgage

Covid 19 Down Payment Resource

How To Save For Your Mortgage Down Payment

What You Need To Know About Mortgage Down Payments Huffpost Canada Business

Compare Loan Features Not Just Rates The More Flexible The Loan The Higher Interest You Ll Pay A Va No Credit Loans Loans For Bad Credit Loan Application

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Saving For A Downpayment On A House Buying First Home First Home Buyer Home Buying Process

Down Payment Sinking Funds Printable Savings Chart Down Payment

How To Save And Stick To 20 Down Payment For Your Dream Home Step By Step Guide Down Payment Dreaming Of You Step Guide

87 Of Properties Qualify For Down Payment Assistance Housingwire

What You Need To Know About Mortgage Down Payments Huffpost Canada Business

Here S How Long It Will Take To Save For A Down Payment In Major U S Cities Housingwire