If you are self-employed and purchase individual health insurance then this expense can be deducted directly on your Form 1040 as an adjustment to income. Thus the value of the deduction depends on the taxpayers marginal tax rate which rises with income.

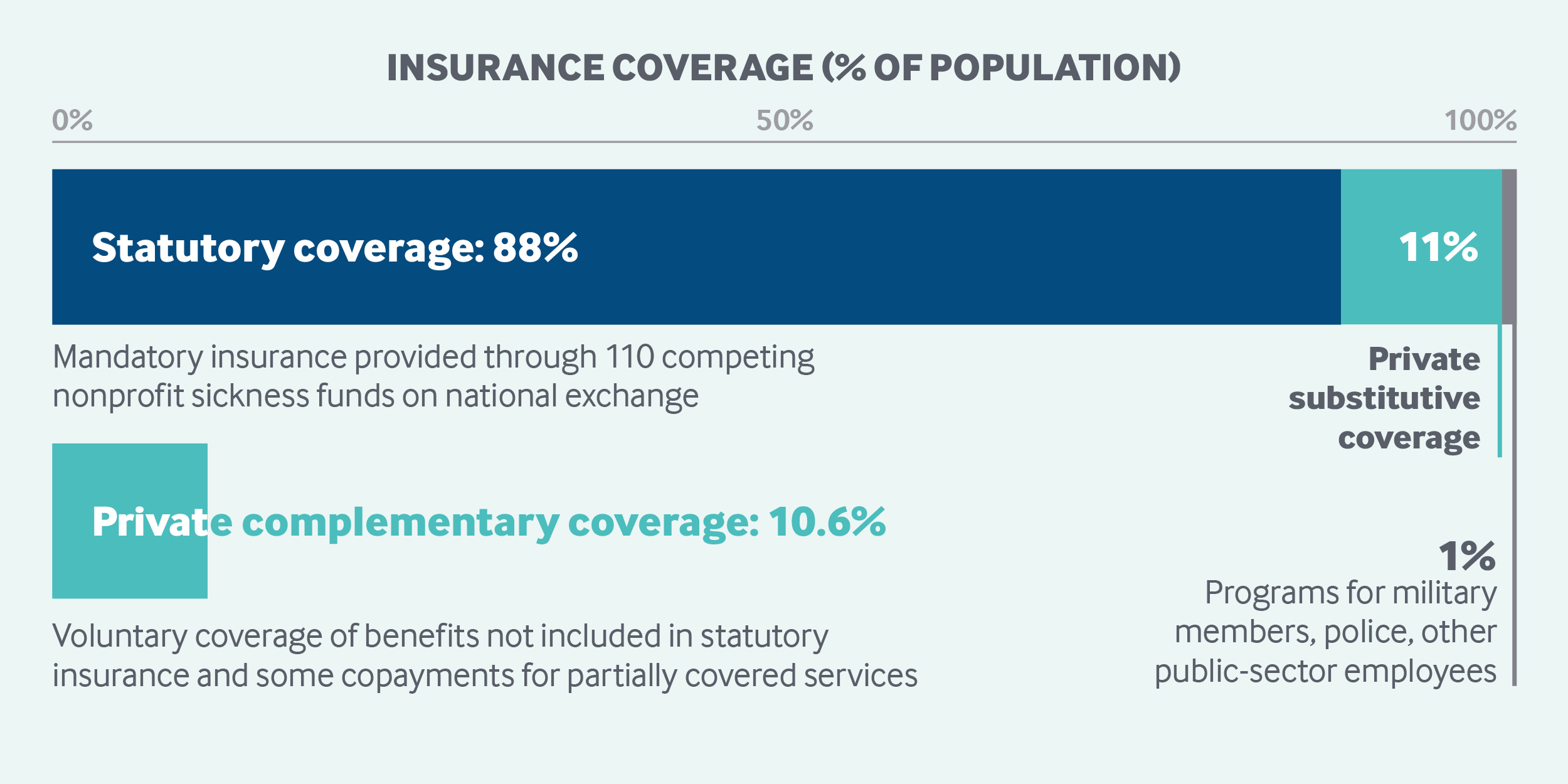

Statutory Health Insurance In Germany A Health System Shaped By 135 Years Of Solidarity Self Governance And Competition The Lancet

This means the amount isnt subject to withholdings for federal or state income tax or Social Security and Medicare taxes.

Does private health insurance reduce tax. Yes though there are significant differences between the treatment of health insurance premiums for tax purposes for persons with individual and group health insurance policies. However if you dont claim the rebate as a premium reduction which lowers the price your insurer charges you you can receive it as a refundable tax offset. In some instances it can even be beneficial from a tax perspective for businesses to take out a business private healthcare plan rather than a personal one.

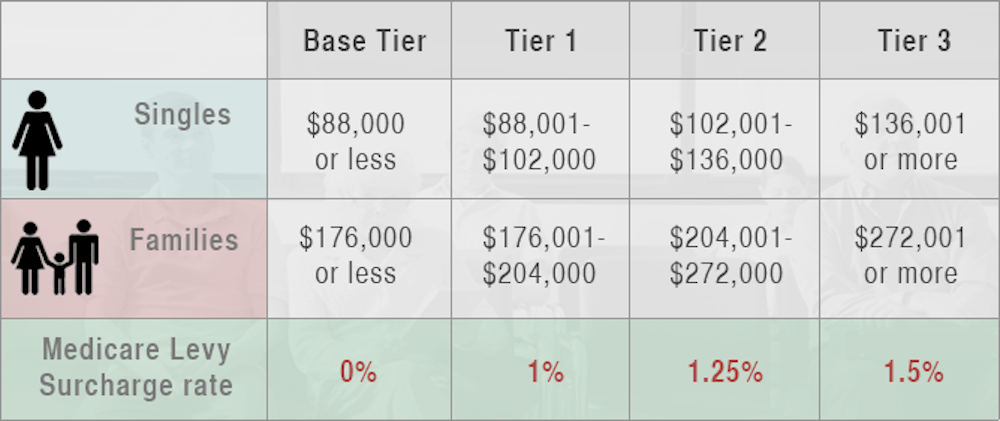

As the rebate is income-tested the size of your rebate will reduce as your income increases and once you earn over the maximum threshold you wont be entitled to any rebate at all. A cafeteria plan is a benefit plan that offers the employee the option to. In some cases the insurer.

There is a significant tax benefit advantage to enjoy from taking out private health insurance as well as several disadvantages for failing to get covered. The private health insurance offset is the same as the private health insurance rebate. On April 1 each year a rebate adjustment is announced based on the Consumer Price Index and the average increase of premiums in the private health insurance sector.

The rebate gives Australians money back in the form of reduced insurance premiums up front or a private health insurance offset at tax time. Self-employed persons can deduct health insurance above the line on their 2020 Schedule 1 which also eliminates the hassle and limitations of itemizing. Because John has private hospital cover he does not have to pay the Medicare Levy Surcharge.

Employees benefit when health insurance premiums are deducted tax-free from their salaries without any of the limitations associated with the itemized deduction. Premium reduction which lowers the policy price charged by your insurer refundable tax offset through your tax return. Without hospital cover John will pay the Medicare Levy Surcharge at 1375 per year.

This can knock as much as 33 off your premiums. From 2008 to 2017 for example the CPI. The Australian Government Rebate.

The remaining portion of the premium would be paid by you. With hospital cover Johns annual tax saving is. However you can reduce the cost of your private health insurance with the private health insurance rebate which is the amount the Australian government contributes towards your premium.

Health insurance isnt tax deductible but there are a bunch of ways you can pay less tax. For instance you may be entitled to the private health insurance rebate or offset. The private health insurance rebate is income tested.

The private health insurance rebate is an amount of money the government may contribute towards the cost of your private health insurance premiums. This is because the business would be eligible for tax relief on the costs so far as they relate to employees. Health coverage tax credits HCTC also lower your health insurance costs but theyre not related to premium tax credits.

You can claim your private health insurance rebate as a. We will calculate the amount of private health insurance rebate you are entitled to receive when you lodge your tax return. If your employer offers health insurance as a benefit and you pay a portion of the plans premium your part of the bill is paid with pre-tax dollars.

Based on age income the government will cover a. You cant claim your private health insurance as a tax deduction. A self-employed health insurance deduction is available for the costs of medical insurance dental insurance and long-term care policies.

Premium costs for people eligible for subsidies will shrink by 50 per month on average according to the federal government but some people will see much larger savings. With basic hospital cover John pays 1138 after the Private Health Rebate. A tax deduction differs from a tax credit in that a deduction reduces your taxable income.

If you meet the eligibility requirements for a private health insurance rebate you can claim your rebate as either. In order for the payroll reductions for health insurance to be tax-free the employer has to establish a cafeteria plan. HCTCs are refundable tax credits that pay 725 of the qualified health insurance premiums for eligible individuals and families.

A premium reduction which lowers the policy price charged by your insurer a refundable tax offset when you lodge your tax return.

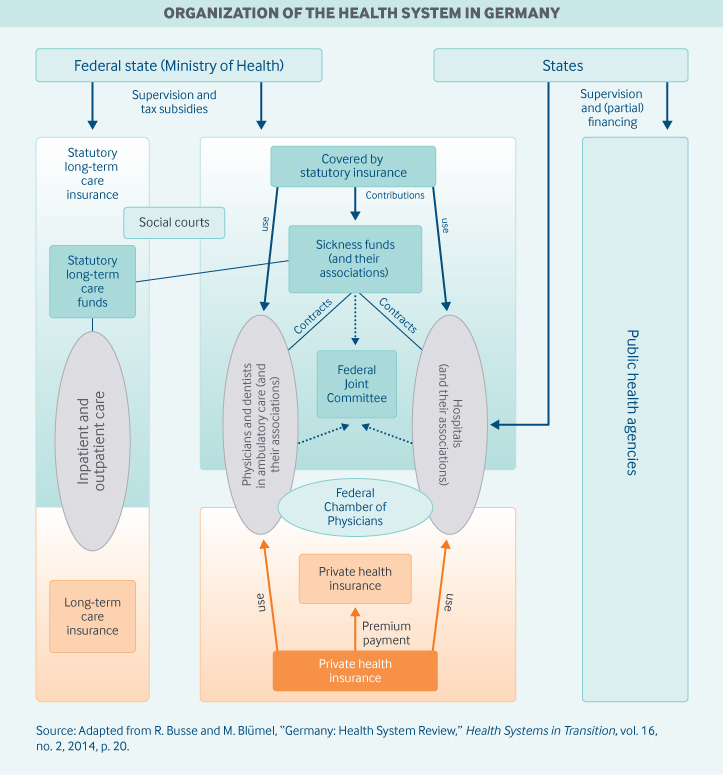

Health Insurance In Germany A Guide For Expats Expatica

Health Insurance In Germany A Guide For Expats Expatica

Health Insurance In Germany A Guide For Expats Expatica

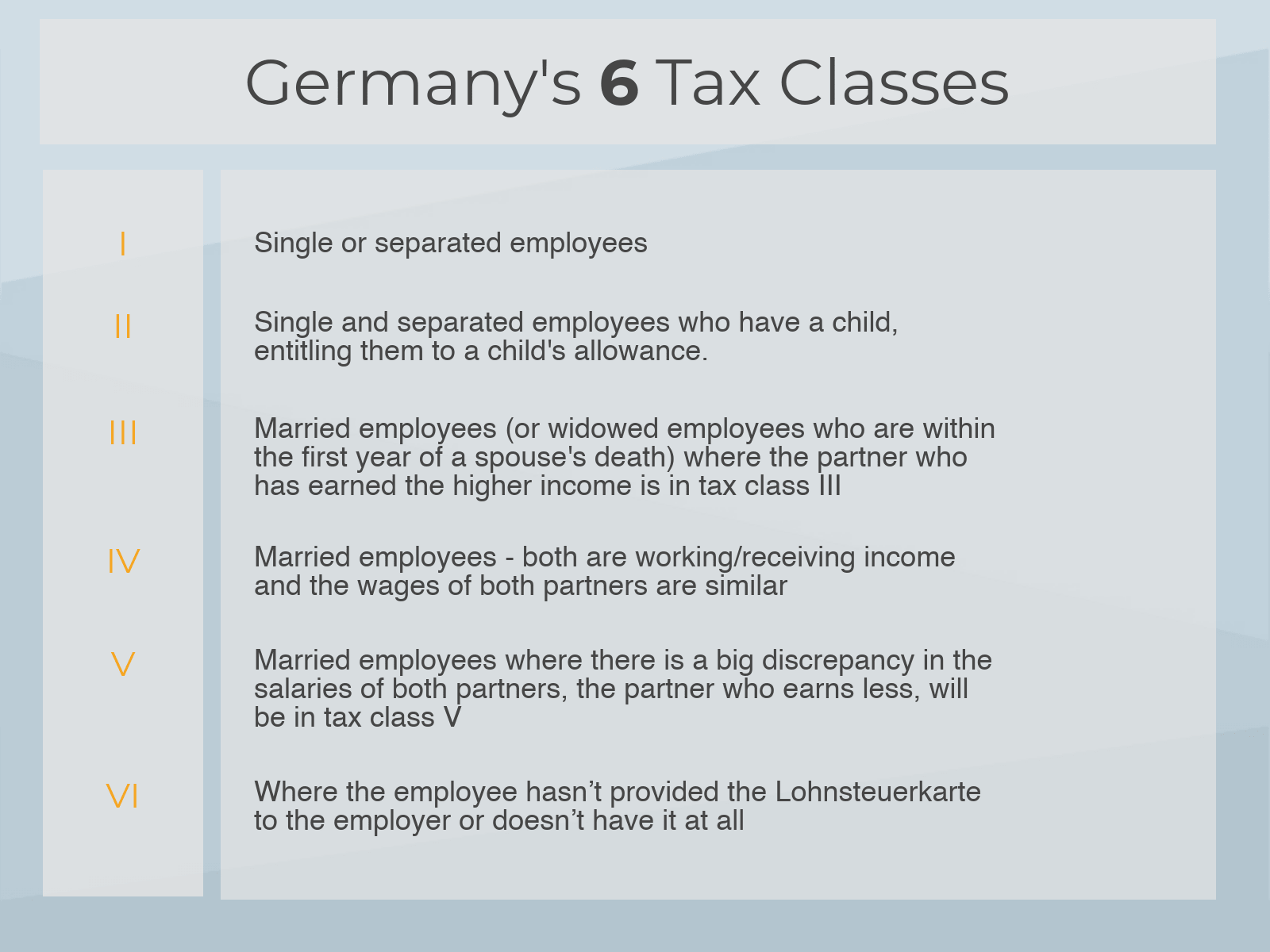

Your Bullsh T Free Guide To Taxes In Germany

Explainer Why Do Australians Have Private Health Insurance

Statutory Health Insurance In Germany A Health System Shaped By 135 Years Of Solidarity Self Governance And Competition The Lancet

Your Bullsh T Free Guide To Taxes In Germany

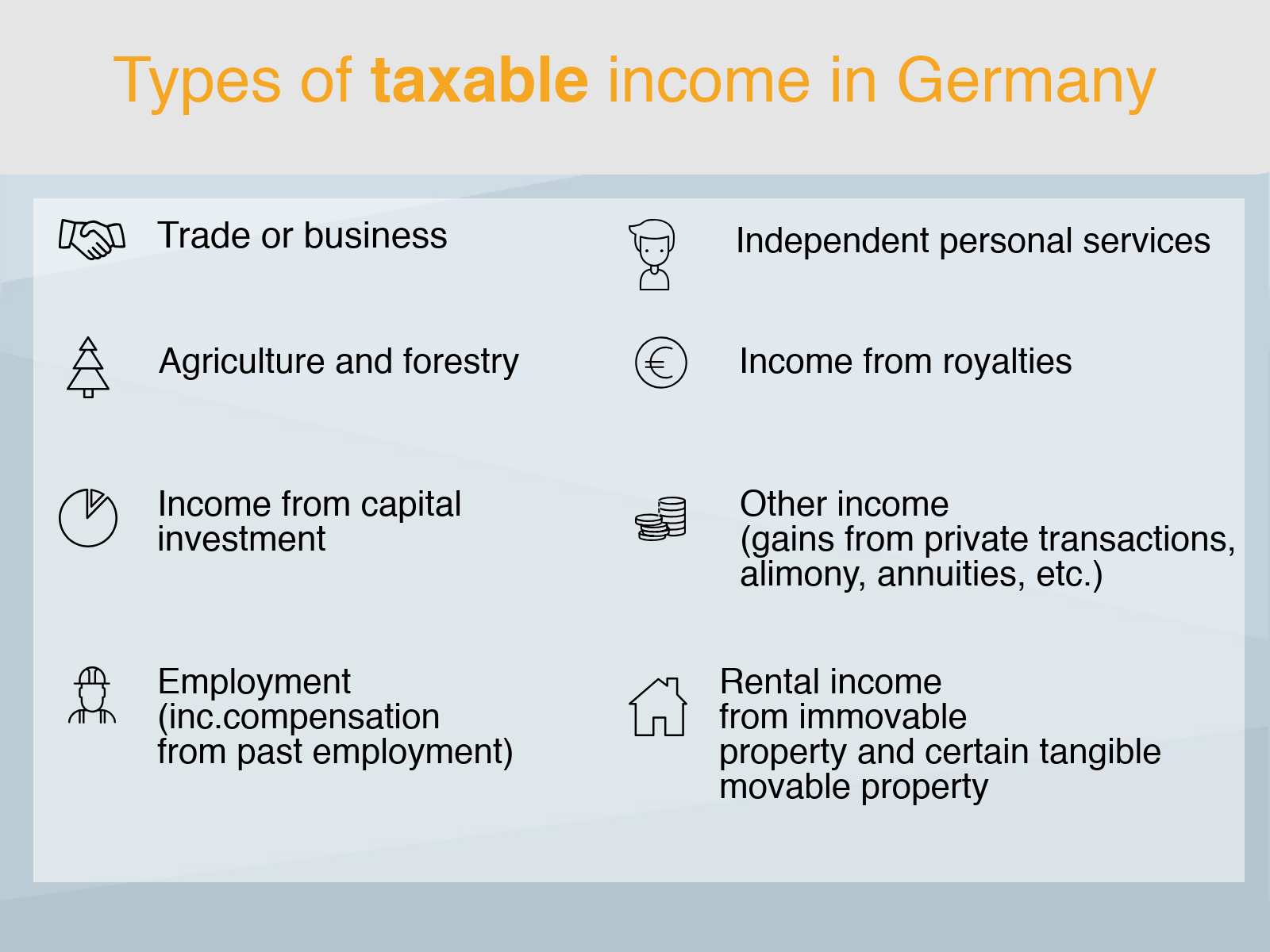

German Tax System Taxes In Germany

Health Insurance In Germany A Guide For Expats Expatica

Statutory Health Insurance In Germany A Health System Shaped By 135 Years Of Solidarity Self Governance And Competition The Lancet

Your Bullsh T Free Guide To Taxes In Germany

Statutory Health Insurance In Germany A Health System Shaped By 135 Years Of Solidarity Self Governance And Competition The Lancet