Heres when you should and shouldnt close it. Interest fees charged to cardholders and transaction fees paid by businesses that accept credit cards.

Best Checking Accounts And Rates July 2021 Us News Money

How to Avoid Paying Interest on a Credit Card.

Do credit card companies benefit from higher interest rates. While most investors fret the onset of higher interest rates heres why bank investors can breathe easy. There are a few ways you can achieve this goal. They guarantee that the reduced rates they offer will save you thousands of dollars in interest and finance charges and will allow you to pay off your credit card debt three to five times faster.

Using a credit card with a high interest rate can become costly if you dont pay off your balance. Because store credit cards on average have a higher APR than most other credit cards store cards can be more costly in the long run. Credit card companies make the bulk of their money from three things.

You may ask the card company what your interest rate will be before applying. That could allay some investors concerns. Similarly credit cards aimed at those with fair or poor credit and retail credit cards often have higher rates.

If you have a limited credit history or a record of missed payments youll likely be approved for a bad credit credit card with a higher interest rate. Cards can stretch your dollar a little further too if you take advantage of rewards or cash back cards. The credit card company may decide which interest rate to charge you based on your application and your credit history.

3 Stocks That Benefit From Higher Interest Rates. Savers seeking safety The least-risky types of accounts bank savings credit union savings and money market to name a few offer better yields when interest rates rise. If you have a high interest rate on your credit card you may be looking to negotiate a lower interest rate.

Those benefits however can be acutely undermined by a high interest rate. With profit margins that actually expand as rates climb entities like banks insurance companies. Credit cards are great tools that can help you leverage your cash flow since you can make purchases now and pay later.

Why rising interest rates will help. The financial sector has historically been among the most sensitive to changes in interest rates. Updated Thu Jul 8 2021.

They claim that the lower interest rates are available for a limited time and that you need to act now. That amount is then added to your bill. However the card company might not be able to answer until it has your credit information.

Here are 5 kinds of people who benefit from higher interest rates. Your cards interest rates wont affect you if you pay off each cards balance in. It works as a daily rate calculated by dividing your annual percentage rate by 365 and then multiplying your current balance by the daily rate.

Credit card companies typically offer their best rates to customers who have the highest. While credit cards typically carry higher interest rates than mortgage student auto and personal loans one of the benefits of having a credit card is that you can get away with never paying interest at all. Additionally credit card companies make money by charging high interest rates on balances that.

Credit card interest is what you are charged when you dont pay your credit card bill in full each month. Vacationers abroad When interest rates. Keep in mind too that rewards credit cards will likely charge higher rates than cards that dont offer airline miles or cash back.

Higher market rates should give Capital One more flexibility in raising rates on its credit cards and other loans. The more a consumer uses a credit card the more merchant fees the credit card company can earn.

Debt Snowball Vs Debt Avalanche Paying Credit Card Debt In 2021 Forbes Advisor

Best Low Interest Credit Cards July 2021 Compare Low Aprs Credit Karma

What Is The Average Credit Card Interest Rate

Best High Yield Online Savings Accounts In July 2021 Magnifymoney

What Is The Average Credit Card Interest Rate

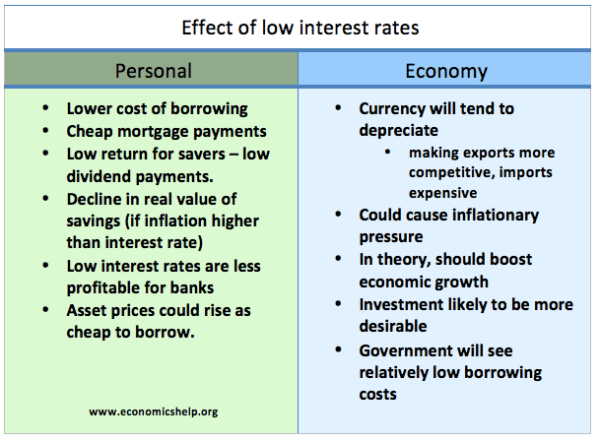

Effect Of Raising Interest Rates Economics Help

:max_bytes(150000):strip_icc()/GettyImages-1215119911-77a3dedeb90e4236aa84d08ffaeaffb7.jpg)

These Sectors Benefit From Rising Interest Rates

Why Are Credit Card Interest Rates So High Nerdwallet

The Average Credit Card Interest Rate By Credit Score And Card

How Do Interest Rates Affect The Stock Market

Should You Use One Credit Card To Pay Off Another Forbes Advisor

Effect Of Raising Interest Rates Economics Help

What Are Interest Rates How Does Interest Work Credit Org

How Do Interest Rates Affect The Stock Market

:max_bytes(150000):strip_icc()/interest_rate_istock496445100-5bfc47a6c9e77c002636cbdc.jpg)

How Do Interest Rates Affect The Stock Market

Effect Of Raising Interest Rates Economics Help

How Do Interest Rates Affect The Stock Market

4 Ways To Write A Letter To Reduce Credit Card Interest Rates

How Your Credit Score Affects Your Mortgage Rates Forbes Advisor