Australias top performing equity managers unveiled Sarah Thompson Anthony Macdonald and Tim Boyd Jun 8 2020 932pm The end of June looms large in diaries of fund managers around the country. They are both high conviction and index agnostic.

Prime Value Building Wealth Together

The Fiducian Australian Shares Fund has returned 9 pa.

Best boutique fund managers australia. Selector Funds Management - The Selector Ex-50 High Conviction Equity Fund excludes the top 50 stocks. KIS Capital Partners is a boutique absolute return fund manager based in Sydney Australia with an Asia ex Japan trading focus. Looking for the best investment opportunities in Australia.

They are usually boutique fund managers who are often unknown by the greater investing community. We dont charge any fixed management fees. These are funds that are largely invested in highly liquid short-term securities such as bank deposits cash and bank bills.

They typically hold 15-30 stocks with cash of 0-20. 2020 5-Star Rated Managed Funds. Boutique Capital partners with talented early stage fund managers to launch and operate successful boutique funds management businesses.

It recently wrote a paper The Boutique Premium. Its always an interesting exercise and were continually impressed by the quality of boutique managers in Australia. Click through to invest in any of our funds below.

Having minimum funds under management FUM of 50m. Given 2018 was a rocky ride compared to the year before it Money Management looked at the performance of boutique managers across 30 November 2017 to 30 November 2018 to see which funds topped the charts. The 5-Star products in each profile are sorted by provider name.

Our partnerships with talented boutique fund managers throughout Australia means we offer investors access to quality investment opportunities in various asset classes. Guest Services Manager Guesthouse Manager new. Save time and capital with our turnkey solutions and focus on what you do best.

Look no further than Boutique Capitals fund manager partners. Extended out over 12 months which includes the March 2020 COVID-19 selloff the top quartile of investment managers. Raising funds and investing them.

We aim to pay monthly distributions. In the institutional space the best performer over one year is Lazard Select Australian Equities with 838 per cent while at the bottom over the same period is the SMI ME Australian Share Fund with -1145 per cent. We aim to invest with the best investment managers in Australia.

We understand that regular income is very important to many investors and target a distribution yield of 5 per annum. Keeping performance and key investment team quality at a constant there are two key behavioural characteristics from a communication Promotion point of view that boutique fund managers can focus on to get cut through but it does require constant effort and a certain personality type to make it happen. The business was founded by Tony Scenna and Corey Vincent.

We provide a fixed-cost solution support and expertise to get you started faster. We believe that an absolute return fund should be risk and performance focused with strong attention to investment differentiation. Here are the managed funds that received a 5-Star Rating this year.

The same cannot be said for boutique funds management company. Again the largest fund managers who are focused on asset gathering can easily do this whereas boutique providers - which tend to have specialist strategies with higher conviction - are far. In what was a strong quarter for global equity markets Mercer said the median manager generated higher returns than the SPASX 300 Index.

They have a maximum holding size of 5 at cost. With Q1 FY21 in the books Mercer has released its quarterly performance update for the best and worst Australian fund managers. Harding who previously worked at Colonial First State and started Wavestone nearly three years ago with former CFS staffers Graeme Burke and Catherine Allfrey said his group saw last year as the best way to stress test their investment process.

60000 - 69999 a year. Its also surprising how often we see the same factors at play in managers we like the reasons why the best fund managers outperform. Here are the key things that we believe time and time again separate the brilliant Australian fund managers from the rest.

They say the greatest value lies in the smaller less researched businesses. One of the top performing boutiques was Lincoln Australian Growth which rose to the top quartile in that time period from the third across three years. Peter Cooper from Cooper Investors is one of.

To track cost and report inventory supplies for accommodation and ensure these are billed out and funds retrieved In room supplies will be its own profit centre. Atlas Funds Management We are a boutique investment management firm that builds on decades of experience in the financial markets along with a conservative approach to investing with the goal of generating regular income. Wavestone Capital principal Ian Harding believes 2008 was the year of testing for the process and character of boutique fund managers.

Do Boutique Investment Managers Create Value looking at more than 1200 funds management firms. Absolute return funds should not be asset gatherers. Single asset class funds.

Dont let a lack of resources keep you from getting ahead. Those figures make the active funds managers some of the highest-paid executives across the Australian business sector.

Quaystreet Good Returns Fund Manager Of Year Awards 2020 Winners

The Top 10 Boutique Fund Managers Across All Asset Classes Citywire

Comparing Managed Funds Here S Why Boutique Fund Managers Beat The Institutions Lincoln Indicators

The Top 10 Boutique Fund Managers Across All Asset Classes Citywire

Comparing Managed Funds Here S Why Boutique Fund Managers Beat The Institutions Lincoln Indicators

Prime Value Building Wealth Together

Tribeca Vanda Asia Credit Fund Tribeca Investment Partners Australia Based Boutique Fund Manager

Best Investment Funds Managers Australia Affluence Funds Management

The Top 10 Boutique Fund Managers Across All Asset Classes Citywire

The Top 10 Boutique Fund Managers Across All Asset Classes Citywire

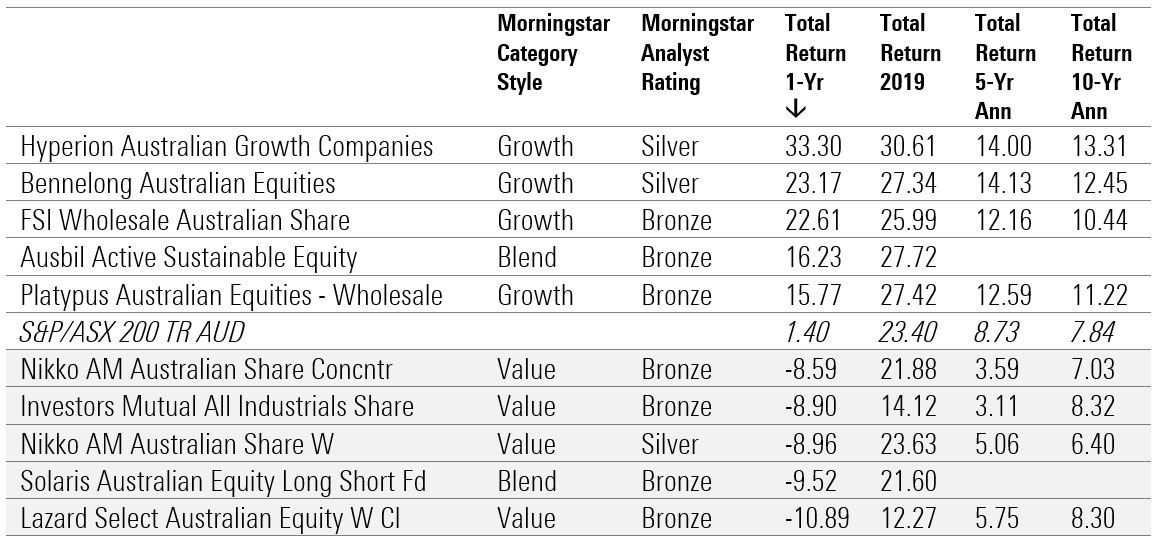

Best And Worst Performing Equity Funds Of 2020 Morningstar Com Au

The 10 Fund Managers Who Made 300m Profits This Year

Fidante Partners Launches New Emerging Market Boutique Fund Manager Ox Capital Management Financial Corporate Relations

Fortlake Asset Management Experienced Fixed Income Manager

Quaystreet Good Returns Fund Manager Of Year Awards 2020 Winners

Equity Australia Asia Pacific Equities Fund Fund Manager League Table Citywire

How An Invite Only Asset Manager From Australia Keeps Beating The Market

The Top 10 Boutique Fund Managers Across All Asset Classes Citywire