We found that homeowners need more help and less hype to get the tax relief. B 15 years for capital investment above RM500 million.

Tax Incentives Mines Wellness City

Even said so for those of you already filed for your 2013 personal income recently do you realized that there is this Special Relie f.

Ya2013 special tax relief. The RM2500 special tax relief for purchasing mobile phones computers and tablets which expired on Dec 31 2020 will be extended for another year until the end of 2021 says Prime Minister Tan Sri Muhyiddin Yassin. 1 Any person who seeks to remove tax exempted and VAT zero rated goods valued in aggregate in excess of 500 from the SERZ to locations inside. This may sound too late for you but Im sure there are many of you out there are last-minute taxpayers.

Its also the only utility payment you can get a tax relief. Example to show the. And DollarsAndSensesg wants you to be adequately prepared you may refer to a comprehensive checklist that we have provided for YA2013 for an introduction to Singapore Income Tax.

You can get up to RM2500 worth of tax relief for lifestyle expenses under this category. Colin is entitled to tax relief under the special rules for the full cost of the return journeys for the first 4 visits. The withholding agent shall file BIR Form 1601-F and BIR Form 1604-CF and shall pay the withholding taxes due in accordance with their relevant tax obligations in the Philippines.

Instead they can claim tax relief for sports equipment as well as gym memberships under a broad category of lifestyle purchases. YA2013 Special Tax Relief. At present Malaysia does not have a dedicated tax relief incentive intended for sports-related expenses.

Individual personal tax relief is only available for individuals who are considered tax resident in Malaysia. Buying reading materials a personal computer smartphone or tablet or sports equipment and gym memberships for yourself spouse or child allows you to claim for tax relief. First of all you have to determine if you are a tax resident or non-resident for income tax purposes.

You can also claim for your monthly home Internet subscription. Annual income tax rebate of up to RM20000 for the first 3 Years of Assessments YA will be given to an SME established and in operation between 1 July 2020 and 31 December 2021. I know I know.

A 10 years for capital investment between RM300 million to RM500 million. Legislation will be introduced in Finance Bill 2021 to amend Part 2 CAA 2001 to bring in the super-deduction an enhanced temporary 130 first-year allowance for. Tax relief is administered and communicated so that homeowners and other taxpayers can evaluate the performance of their government and the promises it made to them.

This category also allows you to claim for an assortment of other purchases including reading materials personal computers and devices as well as home. The normal remedy for this situation would be a claim under para 3 claim for relief for overpaid tax but that is only possible within a four-year limit. There are some other rules a person can be qualified as tax resident in Malaysia.

Non-Residents claiming tax treaty relief on dividends interest and royalties shall submit a completed CORTT Form to the payor or withholding agent in the Philippines. Conditions for tax relief on goods. Many translated example sentences containing special tax relief Spanish-English dictionary and search engine for Spanish translations.

Even said so for those of you already filed for your 2013 personal income recently do you realized that there is this Special Relie f. Yes you get tax relief for just paying your monthly Internet bills from Unifi Streamyx and so on. For example if by end of this year you topped up 5000 in cash to your own CPF Special Account and you topped up 10000 in cash to your mothers CPF Retirement Account.

Once again it is the time of the year when the taxman comes calling. More Malaysian Income Tax Relief guides here. Example to show the stated Special Relief under tax summary page.

Procedure for Availing of Tax Treaty Relief. Am I entitle for it. April 29 2014 I know I know.

The maximum CPF Cash Top-up relief per Year of Assessment YA is 14000 maximum 7000 for self and maximum 7000 for family members. No tax relief is available for non-tax residents. Special relief see TMA 1970 Sch 1AB para 3A is a claim of last resort for the taxpayer who has failed to comply with their tax obligations on time and has had a determination issued by HMRC but can show that the amount determined was excessive.

Muchos ejemplos de oraciones traducidas contienen special tax relief Diccionario espaol-ingls y buscador de traducciones en espaol. De trs nombreux exemples de phrases traduites contenant special tax relief Dictionnaire franais-anglais et moteur de recherche de traductions franaises. YA2013 Special Tax Relief.

Generally rule is a person is a Malaysia tax resident if heshe stays more than 180 days in Malaysia. This may sound too late for you but Im sure there are many of you out there are last-minute taxpayers.

Finance Malaysia Blogspot Personal Tax Relief For Ya2014

Guidelines On Tax Treatment Related To The Implementation Of Mfrs 121 Or Other Similar Standards Pdf Free Download

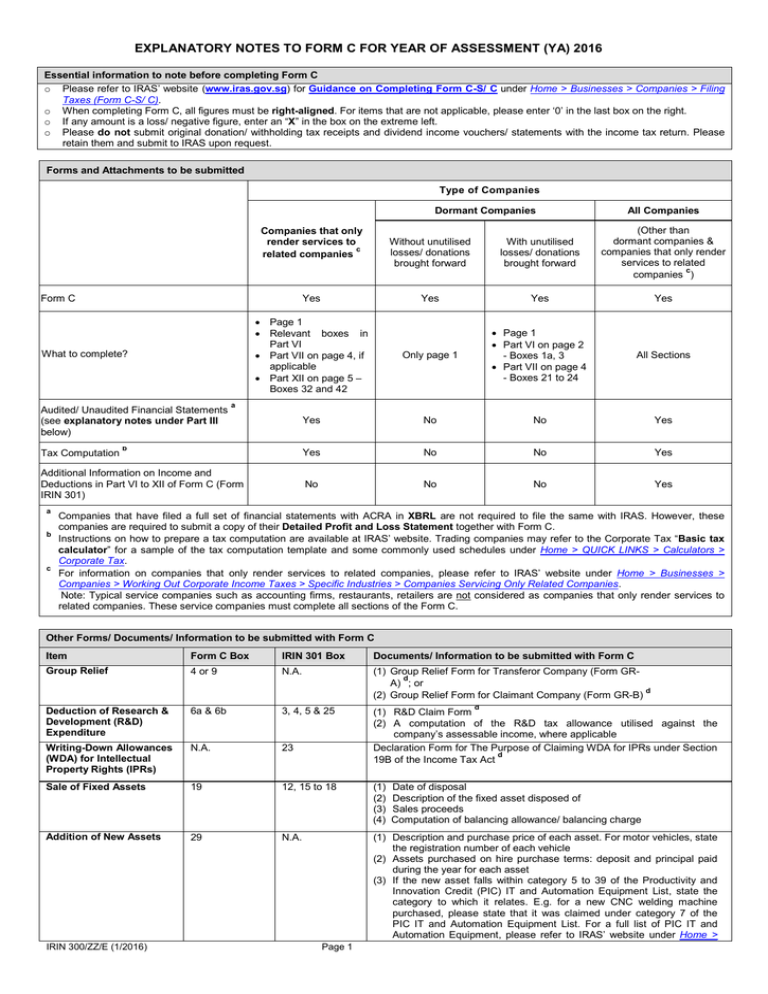

Explanatory Notes To Form C For Year Of Assessment Ya 2016

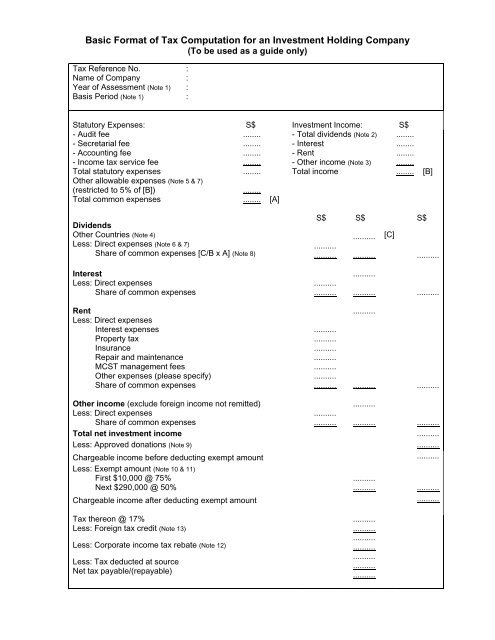

Basic Format Of Tax Computation For An Investment Holding Iras

Annex B 2 Research And Development R D Tax Measures Pdf Free Download

Enhancing The Double Tax Deduction For Internationalisation Scheme 1 April March 2016 1 Background Pdf Free Download

5 April 2012 Dear Sir Mdm Simplified Income Tax Filing For Small

Common Mistakes On Claims For S14q Deduction Tax Deduction Expense

Do You Know That You Get A 30 Corporate Tax Rebate For 3 Years From Ya 2013 To Ya 2015 Learn More Here H Singapore Business Corporate Tax Rate Tax Rebates

Https Www Mayerbrown Com Media Files Perspectives Events Publications 2015 07 Asia Tax Bulletin Files Asi Taxbulletin Summer2015 Fileattachment Asi Taxbulletin Summer2015 Pdf

Capital Allowances Write Off Interest

Https Www Iras Gov Sg Irashome Uploadedfiles Irashome Businesses Foreign 20tax 20credit Worked 20example Pdf

Https Www Iras Gov Sg Irashome Uploadedfiles Irashome Schemes Pic 20illustration 20 20training Pdf

Productivity And Innovation Credit Scheme In Singapore This Infographic Will Help You Understand How Your Company Can Enjoy U Innovation Singapore Infographic

Singapore Does Not Need To Emulate Nordic Type Welfare

Irb Guidelines For Income Tax Treatment Of Mfrs 5 Pages 1 7 Flip Pdf Download Fliphtml5

Year Of Assessment 2013 Guide On Filing Of Form B Iras