A new statistical approach. Capital inflows from emerging markets to developed economies can contribute to the formation of bubbles in asset prices.

Shu-Peng Chen Ling-Yun He.

When would asset bubbles in emerging. Stock and real estate bubbles in 2007 and currently the Canadian and Australian real estate markets. Those bubbles encourage the accumulation of debt and the deleveraging of that debt exacerbates the decline in economic activity when the bubble bursts. A Massive Asset Price Bubble.

Updated November 30 2020 An asset bubble is when assets such as housing stocks or gold dramatically rise in price over a short period that is not supported by the value of the product. Submitted on 24 Oct 2016 Abstract. Amidst the bubbles there are countless assets trading at reasonable prices.

The International Monetary Fund does not see asset bubbles becoming a major risk in emerging economies but there are hot spots that require close monitoring a. The asset price bubbles in emerging financial markets. It would seem that world economic policymakers and academic economists.

Asset bubbles are especially. As advanced Western nations continue to reel under the impact of a major debt crisis the engines of global economic growth have clearly shifted to emerging economies particularly to the so-called BRIC states Brazil Russia India and China. There are few signs of bubbles emerging in commodities despite volatility in minerals used in batteries.

Emerging markets crisisMexican peso crisis. Value stocks are trading at reasonable valuations and have. Many methods which based on the rational expectation have been proposed to detect the bubble.

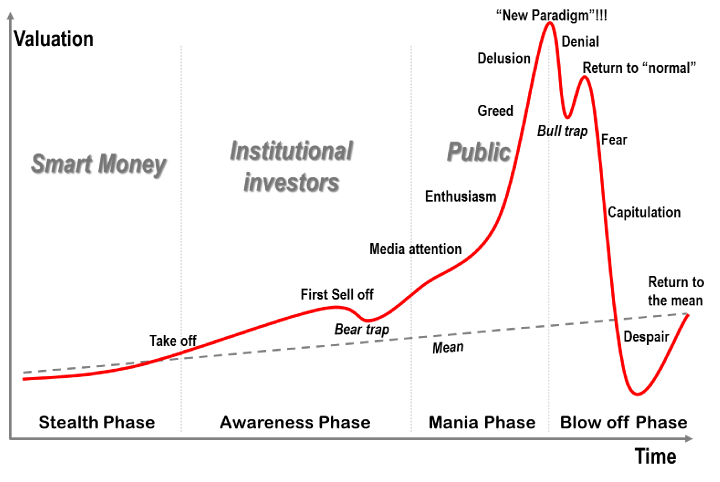

The bubble is a controversial and important issue. And no one is ready. A bubble occurs when the price of a financial asset or commodity rises to levels well above historical norms above its actual value or both.

ASSET SPECULATIVE BUBBLES IN EMERGING MARKETS The Case of Pakistan EHSAN AHMED J. This can happen if buyers are willing to pay a premium for an asset because they expect to. Interest rates in the early-1990s made higher-yielding emerging markets assets more attractive to investors.

International stocks emerging market stocks and US. 31 178 trillion in debt was trading with a negative yield. However for some developing countries epically China the asset markets are so young that for many companies there are no dividends and fundamental value making it difficult if not impossible to measure the bubbles by existing methods.

The risk asset bubbles is No. It also uses ARCH and BDS. From Global Finance in Emerging Market EconomiesKnoop 2013 The Causes and Consequences of Asset Bubbles The term asset bubble.

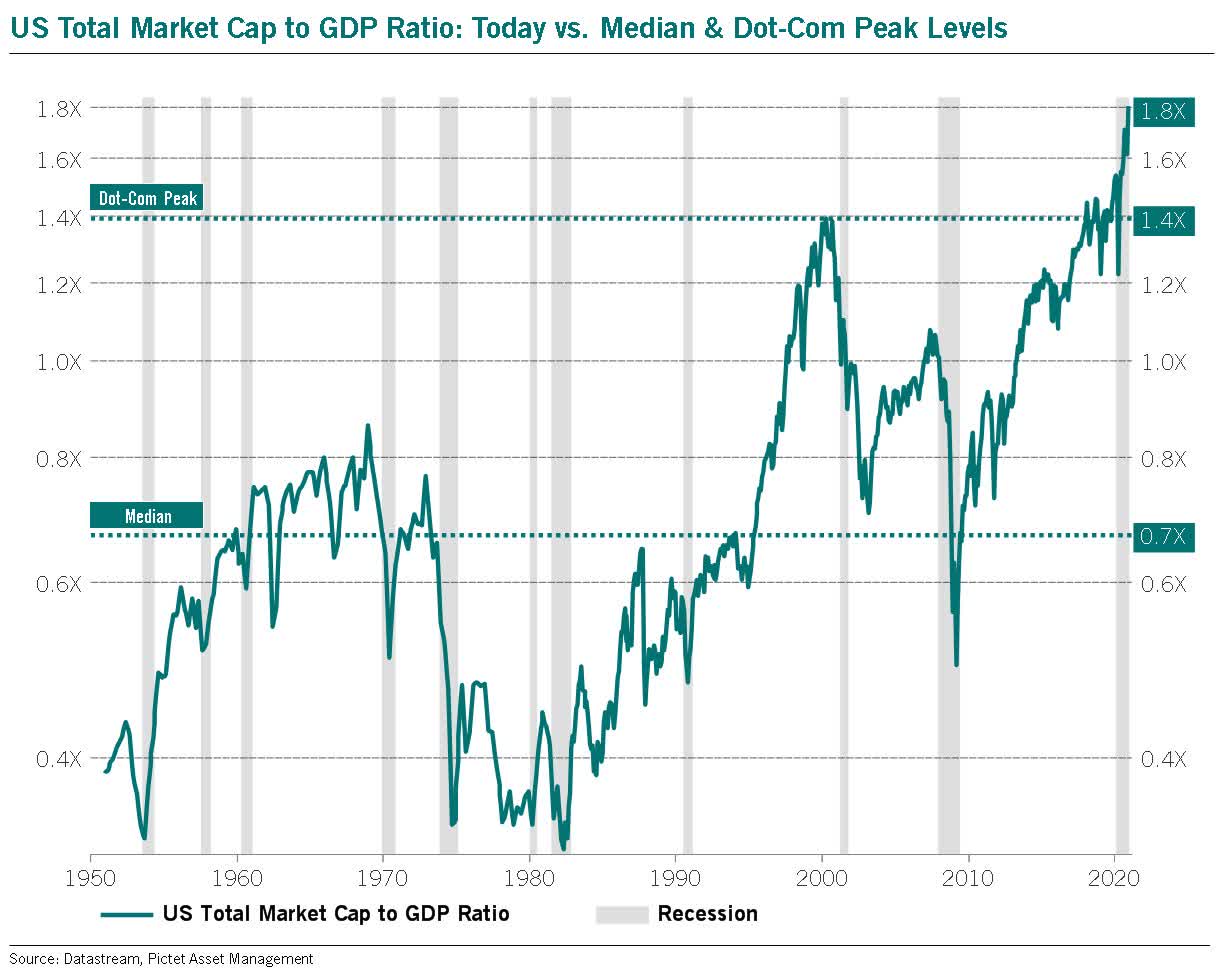

Through its truly massive bond-buying program the Federal Reserve has created and continues to create asset and credit bubbles. Once you do that you know a bubble might appear but the cost of not doing anything is probably even higher As of Dec. 10 in the likelihood column of long term risks.

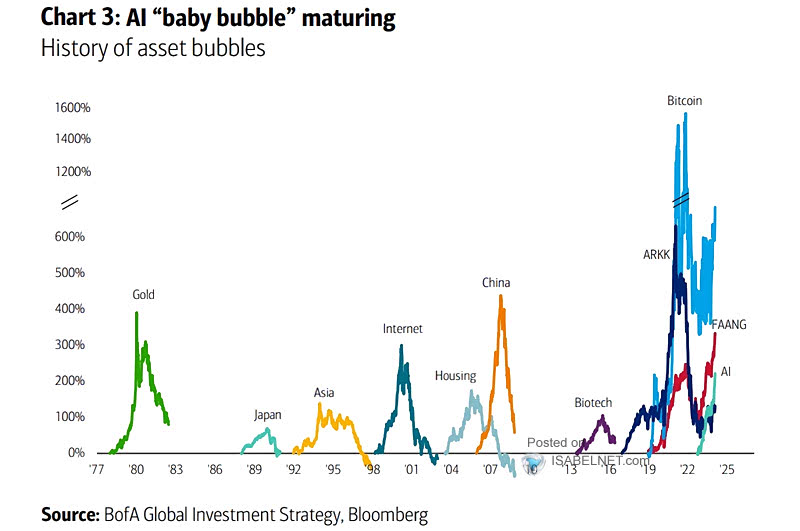

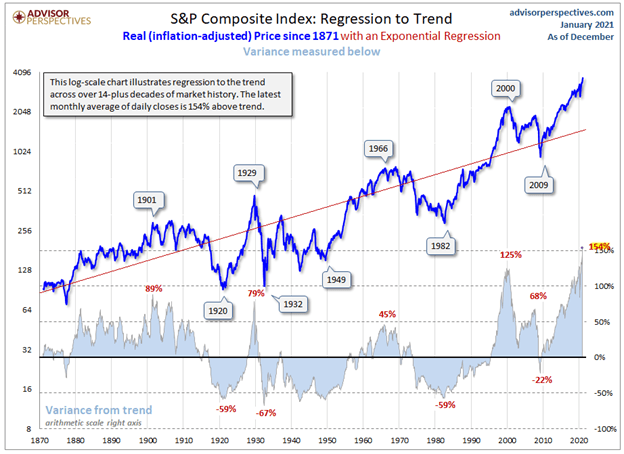

The Global Asset Price Bubble Is Preparing to Burst. The stock market bubble of the 1920s the dot-com bubble of the 1990s and the real estate bubble of the 2000s were asset bubbles followed by sharp economic downturns. In the next recession there will be serious problems for emerging markets PODCAST.

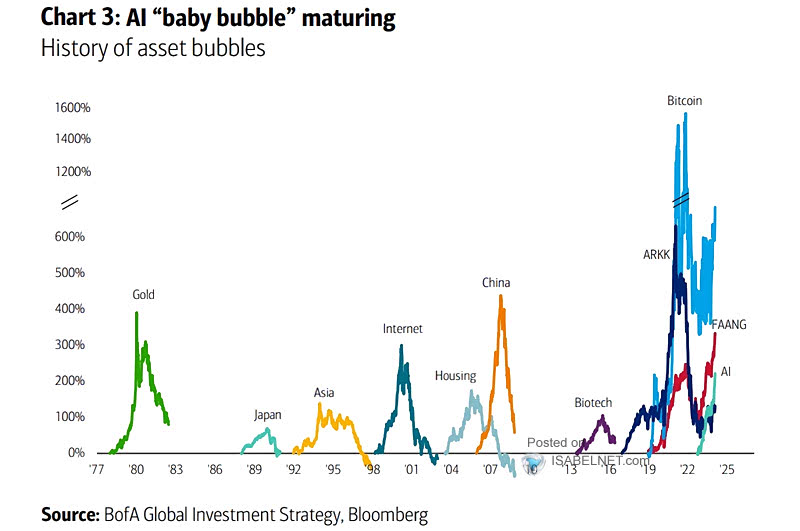

This brief period of 30 years for the asset class coincided with a period during which developed markets have experienced serial financial market bubbles including the Japanese stock and real estate markets 1990 the dot-com bubble 2000 the US. This study of daily stock market data between June 1987 and May 1994 from Pakistan uses the Hamilton switching technique to test the existence of speculative bubbles. The hallmark of a bubble is irrational exuberance a phenomenon when everyone is.

View Notes - Asset Bubbles from ECON 225 at Cornell College. Many methods which based on the rational expectation have been proposed to detect the bubble. This cycles asset bubble is the emerging-market sector Levy said.

In fact it would be wrong to even call many of these countries as emerging for China. However for some developing countries. What caused the housing boom and bust of the early 2000s.

The bubble is a controversial and important issue. Bubbles form when the price of an asset exceeds its fundamental value.

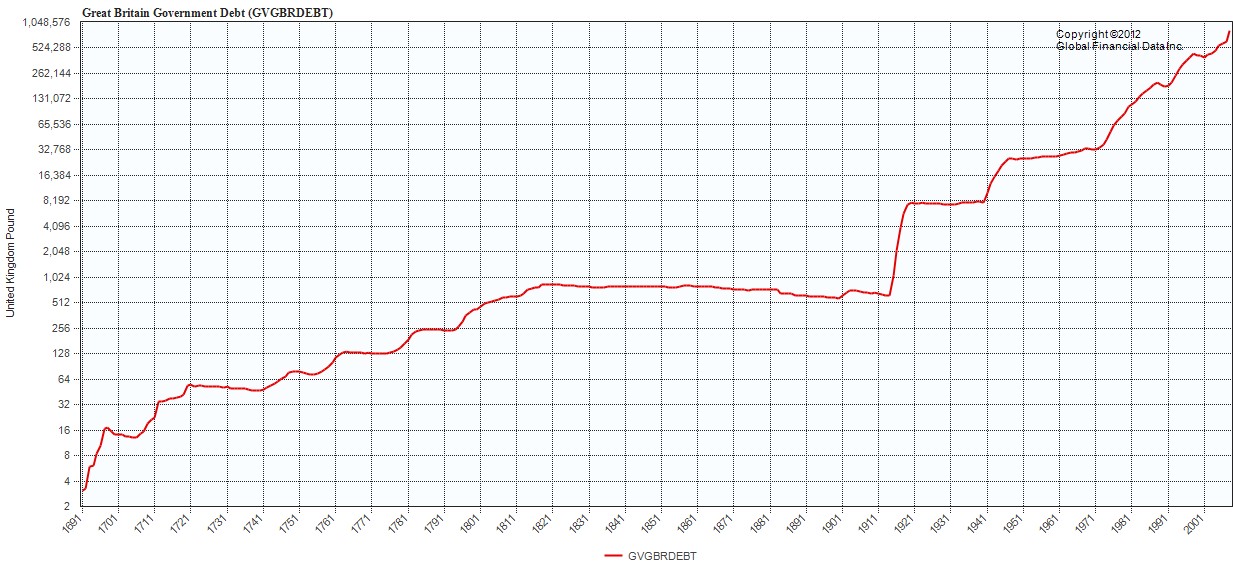

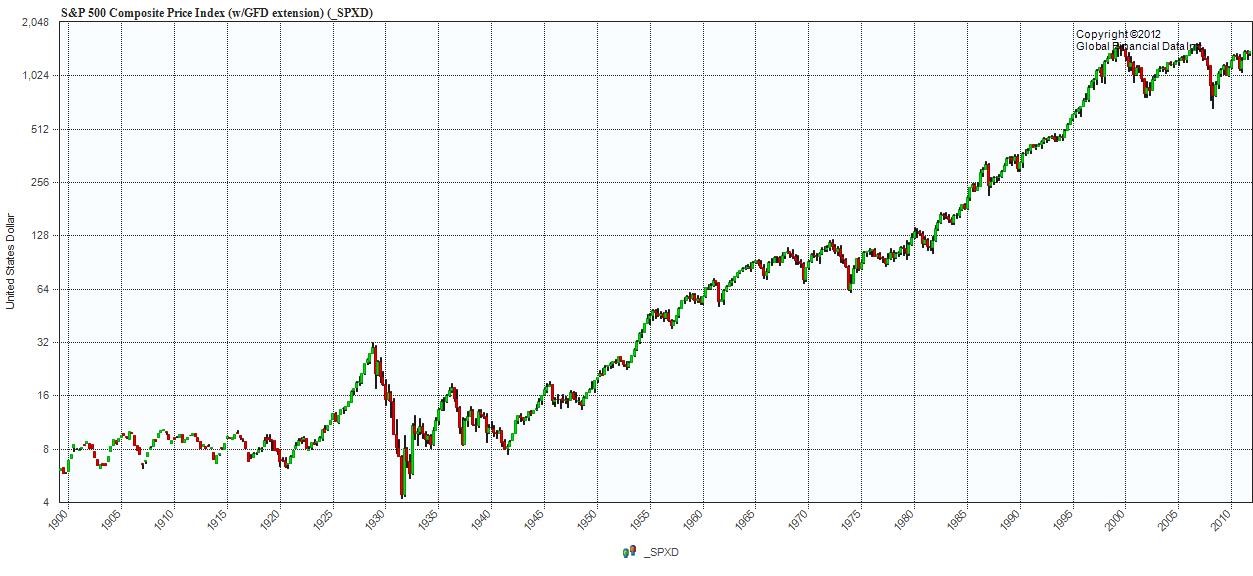

Are You Ready For The Bubble Of The 2020s Global Financial Data

Are You Ready For The Bubble Of The 2020s Global Financial Data

Are You Ready For The Bubble Of The 2020s Global Financial Data

Tv Sentiment For The Next 12 Months The Chart Below Shows The Financial Tv Sentiment For The Economy Stocks Volatility Eme Safe Investments Pensions Economy

Real Estate Bubbles Global City Bubbles Real Estate Prices

Real Estate Bubbles Global Real Estate Global City Real Estate

International Outlook Innovation Isn T Just A U S Story Capital Group Practice Management Business Management Innovation

Rational Bubbles Business Forecasting

Bubbles Are Ubiquitous Bubbles Always Burst Seeking Alpha

Are You Ready For The Bubble Of The 2020s Global Financial Data

History Of Asset Bubbles Past 40 Years Isabelnet

We Are Now Officially In A Stock Market Bubble Seeking Alpha

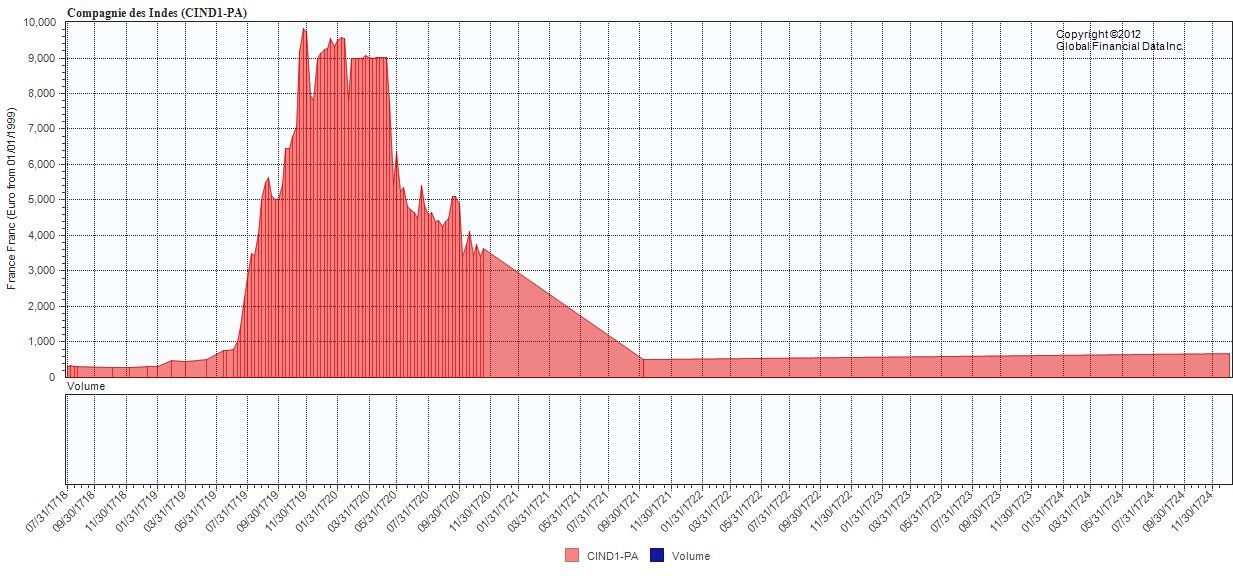

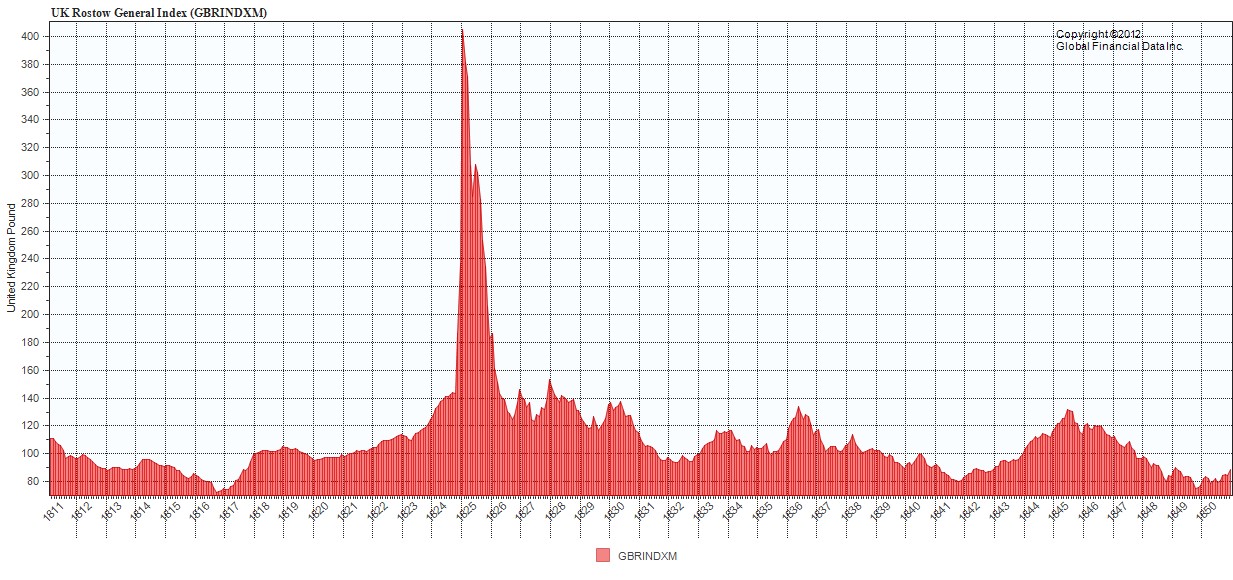

There Is No Doubt That We Are In The Process Of Potentially Creating One Of The Largest Asset Bubbles In History W South Sea Bubble Financial Analyst Bubbles

Image Result For Small Cap Analyst Coverage Images Asset Management Small Caps Analyst