Individual Relief Types Amount RM 1. Tax relief means that you either.

How The Tcja Tax Law Affects Your Personal Finances

Notably the child need not be a Singapore citizen permanent resident or staying in Singapore for this relief claims.

Personal income tax child relief. 20400 - NSman Wife Relief 750 - WMCR on 1st child. Individual and dependent relatives. Personal Reliefs - Earned Income Relief.

1000 - CPF Relief. Moreover the spouses can share the relief based on the apportionment agreed by both parties. 24000 15 x 160000 - WMCR on 2nd child.

Each unmarried child of 18 years and above that. And Malaysia is a blessed place to live a place where no earthquake and volcano. Although we once hit by tsunami but it brings minimal effect to us.

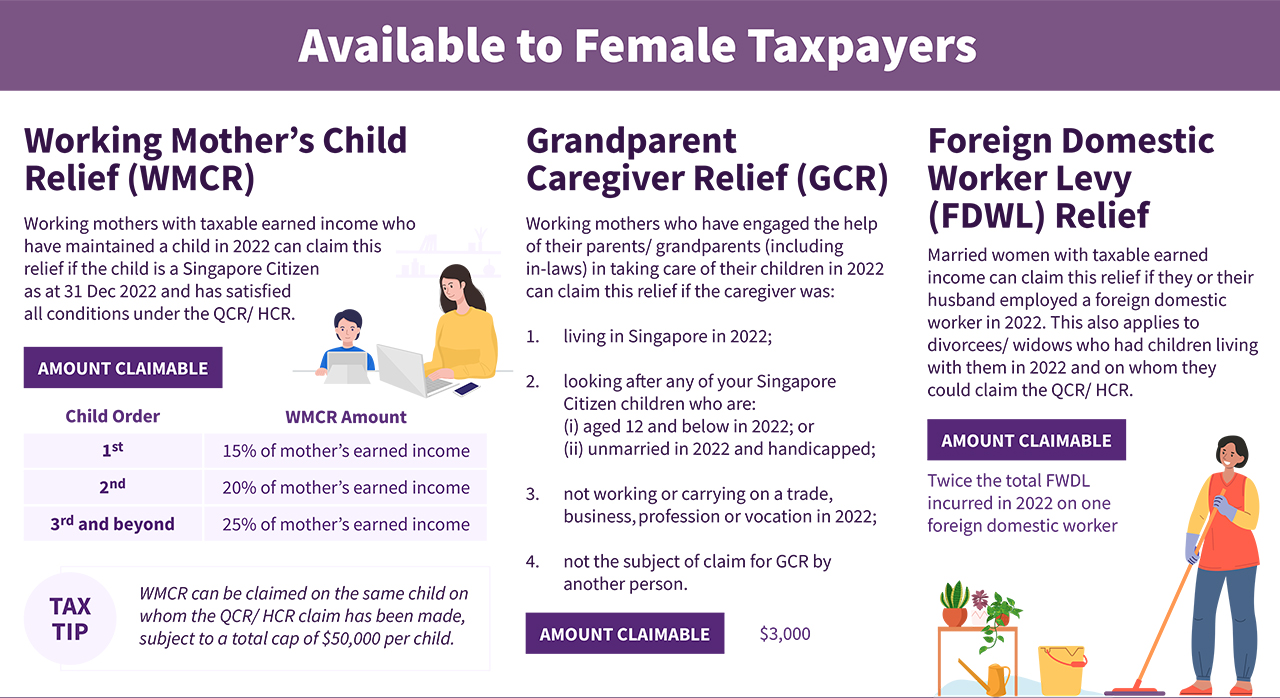

The amount of WMCR that a working mother can claim for each child is based on the child order. Generally parents can claim tax relief of RM1000 per unmarried child per year until he or she turns 18. Pay less tax to take account of money youve spent on specific things like business expenses if youre self-employed get tax back or get it repaid in.

It replaced the One-Parent Family Credit from 1 January 2014. However this is not applicable when you file this year as it only applies to the Year of Assessment 2020 and 2021. How to Claim e-Filing Login with your SingPass or IRAS Unique Account IUA at myTax Portal.

The purpose of this paper is to examine the personal tax reliefs for resident individuals under the Income Tax Act 2015 Act 896 as amended. The WMCR for the first child. Each unmarried child of 18 years and above who is receiving full-time education A-Level certificate matriculation or preparatory courses.

Each unmarried child of. Ordinary child relief A deduction is allowed for every child who is unmarried and who is below the age of 18 years at any time during the year of assessment. For the second child 20 of earned income is eligible for tax relief.

Child Relief When we are having children its a gift from God. Can claim for either qualifying child relief QCR or the handicapped child relief HCR. Personal Income Tax.

Under the PENJANA recovery plan there will also be an increase in income tax relief for parents on childcare services expenses from RM2000 to RM3000. 80410 160000 - 79590. For the first child a working mother may claim 15 of the total income earned.

The paper starts by explaining assessable income chargeable income resident individual and proceeds to analyse six 6 personal tax relief situations. 32000 20 x 160000 - Foreign Domestic Worker Levy Relief. And Malaysia is a blessed place to live a place where no earthquake and volcano.

Chargeable Income of Mrs Ang. RM2000 per child Child relief for child 18 in full-time education. Go to Individuals File Income Tax Return.

Child Relief When we are having children its a gift from God. 26 Zeilen Amount RM 1. 28 Zeilen Tax Relief Year 2020.

An unmarried child who is over 18 and continuing full-time education at a secondary school he or she entitles the parent to a RM1000 tax relief. For claim of QCR the child must. Housing tax credits and reliefs It is possible to claim tax relief on certain housing expenses.

Self and DependentSpecial relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Select Edit My Tax Form. The percentage of tax rebate can also be added up to a.

23 Zeilen Each unmarried child and under the age of 18 years old. This relief is applicable for Year Assessment 2013 only. Deductions Reliefs and Parenthood Tax Rebate.

Although we once hit by tsunami but it brings minimal effect to us. Amount RM Self and. For the third and subsequent children 25 of earned income is eligible for tax relief.

Personal Income Tax. 1440 Total Personal Reliefs 79590. Click Update and enter your claim.

There are 15 personal income tax reliefs. The Single Person Child Carer Credit SPCCC is a tax credit for people who are caring for children on their own. Medical expenses for parents.

Income Tax 2020 Everything You Should Claim As Income Tax Relief News Rojak Daily

Lhdn Irb Personal Income Tax Relief 2020

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Child Tax Credit Enhancements Under The American Rescue Plan Itep

The Tax Break Down Child Tax Credit Committee For A Responsible Federal Budget

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Child Tax Credit Calculator How Much Will I Get

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Reduce Your Tax Payments In 2021 With These Tips Dbs Singapore

Covid 19 Relief Bill Here S How Much You Could Get In Stimulus Checks Child Tax Breaks Ktla

Irs Releases Child Tax Credit Payment Dates Here S When Families Can Expect Relief

Covid Relief Bill Update How Much Are Child Earned Income Tax Credits And Who Is Eligible

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Child Tax Credit 2021 Are You Eligible For The Extra Cash 3 Ways To Check Cnet

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Ultimate Tax Relief Guide For Malaysians Infographic Tax Guide Tax Debt Relief Relief