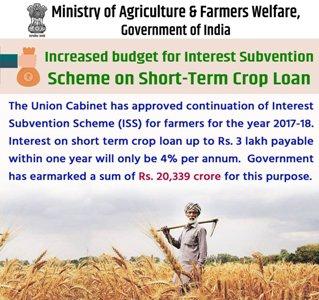

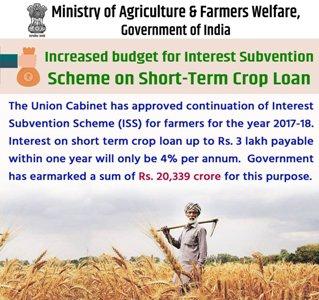

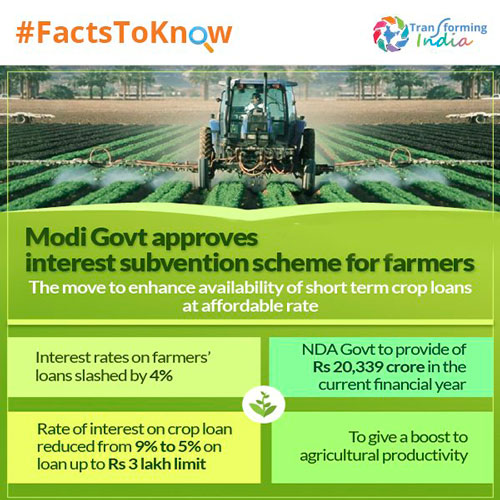

Interest subvention for short term crop loans. Under this scheme farmers can avail loans upto 3 lakhs at subsidized interest rate of 7 which could go down to 4 on prompt repayment.

Interest Subvention Scheme Subsidy Indiafilings

In a letter sent to the heads of all public sector banks PSBs and chairman of the National Bank for Agriculture and Rural Development the ministry said.

Interest subvention scheme for farmers rbi. The Centre has already approved the scheme. Ministry of MSME MoMSME has decided that a new scheme viz. Salient Features of the Scheme.

The Central Government provides to all farmers for short term crop loan upto one year for loan upto Rs. The Reserve Bank of India RBI Thursday notified the norms for banks with regards to two per cent interest subvention or subsidy for short-term crop loans during 2018-19 and 2019-20. In this regard it is advised that Government of India has now issued the operational guidelines of the Interest Subvention Scheme for Kisan Credit Card facility to fisheries and animal husbandry farmers a period of two for syearie.

To ensure hasslefree benefits to farmers under- Interest Subvention Scheme banks are advised to make Aadhar linkage mandatory for availing short-term crop loans in 2018-19 and 2019-20. To ensure hassle-free benefits to farmers under Interest Subvention Scheme the banks are advised to make Aadhar linkage mandatory for availing short-term crop loans in 2017-18. In order to provide short-term crop loans up to Rs 3 lakh to farmers at an interest rate of 7 per cent per annum the government offers interest subvention of 2 per cent per annum to banks.

The farmers repaying promptly as above would get short term loans 4 per annum after an additional interest subvention of 3 per annum during the years 2018-19 and 2019-20. Following Imp Interest Subvention Scheme for Farmers. Reserve Bank of India RBI will implement Interest Subvention Scheme 2018-19 for Short Term Crop Loans.

28 August 2019 Current AffairsThe Reserve Bank of IndiaRBI issued guidelines on Interest Subvention Scheme ISSfor Kisan Credit Card KCC to Fisheries and Animal Husbandry farmers during the year 2018-19 and 2019-20RBI directed the Central Government to operate the interest subvention guidelines. Accordingly to ensure that farmers do not have to pay penal interest and at the same time continue getting the benefits of interest subvention scheme Government has decided to continue the availability of 2 IS and 3 PRI to farmers for the extended period of repayment upto 31052020 or date of repayment whichever is earlier for short term. In this regard it is advised that Government of India has now issued the operational guidelines of the Interest Subvention Scheme for Kisan Credit Card facility to fisheries and animal husbandry farmers for a period of two years ie.

Subsidy on Short Term Agriculture Loans by DBT. RBI Interest Subvention Scheme ISS 2018-19. Interest subvention of 2 to banks and 3 to farmers towards Prompt Repayment incentive is extended on short-term loans up to Rs2 lakh to animal husbandry and fisheries farmers apart.

The interest subsidy scheme is applicable for loans taken during 2018-19 and 2019-20. Interest Subvention Scheme for Kisan Credit Card KCC to Fisheries and Animal Husbandry farmers during the years 2018-19 and 2019-20 RBI extending KCC facility to animal husbandry farmers and fisheries for their working capital requirements and. The Central Government provides to all farmers for short term crop loan upto one year for loan upto Rs.

Farmers paying the loans promptly will be eligible for another three per cent discount on the interest rate. 2018-19 and 2019-20 with the following stipulations. RESERVE BANK OF INDIA.

With this interest subvention such farmers will get short-term loan of up to Rs 2 lakh at a concessional rate of 7 per cent. The Interest Subvention Scheme is being implemented by NABARD and RBI. The Interest Subvention Scheme is being implemented by NABARD and RBI.

Under this scheme the farmers can avail concessional crop loans of upto Rs3 lakh at 7 per cent. In order to provide short-term. The Finance Ministry has asked all banks to take branchlevel measures to extend the interest subvention scheme and prompt repayment initiative PRI for all short-term crop loans taken by farmers in 2018-19 and 2019-20.

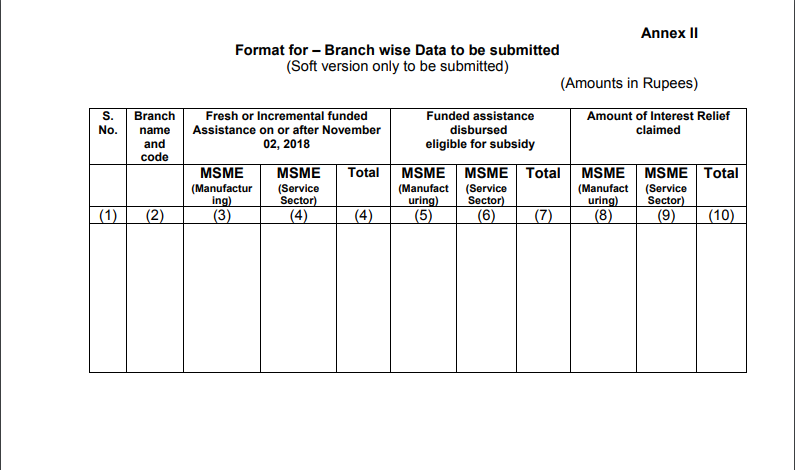

The GoI has extended the Interest subvention Scheme on KCC issued to crop loan farmers to the KCC issued to Animal Husbandry and Fisheries farmers from 2018-19. Interest Subvention Scheme for Incremental credit to MSMEs 2018 will be implemented over 2018-19 and 2019-20. As part of access to credit Prime Minister announced 2 interest subvention for all GST registered MSMEs on fresh or incremental loans.

An additional 3 per cent interest subvention is provided to farmers who pay their loans promptly. Further from 201-19 the I8 nterest Subvention Scheme is being put on DBT. Interest subvention is to be provided on a maximum limit of Rs 2 lakh short term loan to farmers involved in animal husbandry and fisheries.

Under the scheme an additional 2 per cent interest subvention is provided to farmers repaying loans promptly. Interest subvention for short term crop loans. 2018-19 and 2019-20 with the following stipulations.

3 lakhs borrowed by them. As regards the Scheme for the year 2017-18 Ministry of Agriculture Farmers Welfare Government of India GoI has. 3 lakhs borrowed by them.

For such farmers the effective interest rate is 4 per cent. The farmers involved in activities related to Animal Husbandry and. No 905020012016-17 dated August 4 2016 on Interest Subvention Scheme for Short-term Crop Loans 2016-17 wherein we had advised the continuation and implementation of the Interest Subvention Scheme for the year 2016-17.

All lending banks are requested to send to us the eligible pending audited claims of 2015-16 latest by August 31 2017 as already advised vide our email dated August. RBI said that the farmers do not have to pay penal interest and at the same time they will continue getting the benefits of the interest subvention scheme.

From Aadhaar Linkage To Farm Loans Upto Rs 3 Lakh Here S What Interest Subvention Scheme 2017 18 Is About Zee Business

Interest Subvention Scheme For Msmes 2019 Indiafilings

Cabinet Approves Interest Subvention On Short Term Crop Loans Here S Are Its Features Zee Business

Interest Subvention Subsidy Scheme For Msme 2021 Pm Jan Dhan Yojana

How Interest Subvention Schemes In Real Estate Work Businesstoday

Bank Exams Interest Subvention Scheme Part 1 Offered By Unacademy

Interest Subvention Scheme How Can Smes In India Benefit From It

Exporters Hope For Interest Subvention Scheme To Help Msmes Counter Coronavirus Crisis

Fact Checking Government Claims On Affordable Credit To Farmers

Government Approves Interest Subvention Scheme For Farmers

Msme Ministry Issues Norms For Implementing Interest Subvention Scheme Interest Relief To Be Calculated At 2 Points Per Annum

Interest Subvention Scheme Agri Exam Agriculture Scheme

Parshottam Rupala Interest Subvention Scheme For Short Term Crop Loans Of Rs 3 Lakh

India Announces Interest Subvention Scheme For Farmers

Rbi Extends Interest Subvention Scheme For Msmes Till 31st March 2021

Govt Introduces New Scheme Of 2 Interest Subvention On Working Capital Loans For Dairy Sector

Interest Subvention Scheme For Farmers Journalsofindia

Editorial Notes Why All Crop Loans Should Be Routed Through Kisan Credit Cards